- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (CRM): Evaluating Current Valuation After Recent Steady Trading

Reviewed by Simply Wall St

Salesforce (CRM) stock slipped about 1% after a quiet trading session, catching the attention of investors interested in its recent performance. Shares have moved within a narrow range recently, even as discussions about software sector trends continue.

See our latest analysis for Salesforce.

Salesforce’s share price has taken a breather after a choppy first half of the year, with the stock down nearly 24% since January. While this week’s trading was largely uneventful, momentum has clearly faded after last year's strong three-year total shareholder return of 69% and a more modest five-year gain. Investors seem to be weighing long-term growth against a shift in sentiment around software stocks.

The software sector keeps evolving, so if you’re curious about what else could shake up your watchlist, explore See the full list for free.

With Salesforce trading well below analyst price targets but facing slowdowns after a huge multi-year run, the key question is whether today's levels present real value or if the market already reflects future growth prospects.

Most Popular Narrative: 24.9% Undervalued

Compared to Salesforce's last close at $251.46, the most popular narrative sees fair value at $334.68. This sets up a contrast between current sentiment and future potential as calculated by leading analysts.

The extension of SaaS via natively embedded workflow automation, cross-cloud data harmonization, and conversational interfaces (for example, Slack-first ITSM and HR agents) increases customer stickiness, protects against commoditization, and raises switching costs. This forms the basis for sustainable long-term revenue and margin enhancement.

Want to know the secret behind this optimism? It all hinges on bold forecasts for revenue, margins, and the company's ability to boost profit efficiency. Curious what mix of financial levers justifies this premium target? Click through for the full reveal.

Result: Fair Value of $334.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a wave of new competitors and stricter data privacy regulation could erode Salesforce’s pricing power or hinder future revenue and margin growth.

Find out about the key risks to this Salesforce narrative.

Another View: Looking at Earnings Ratios

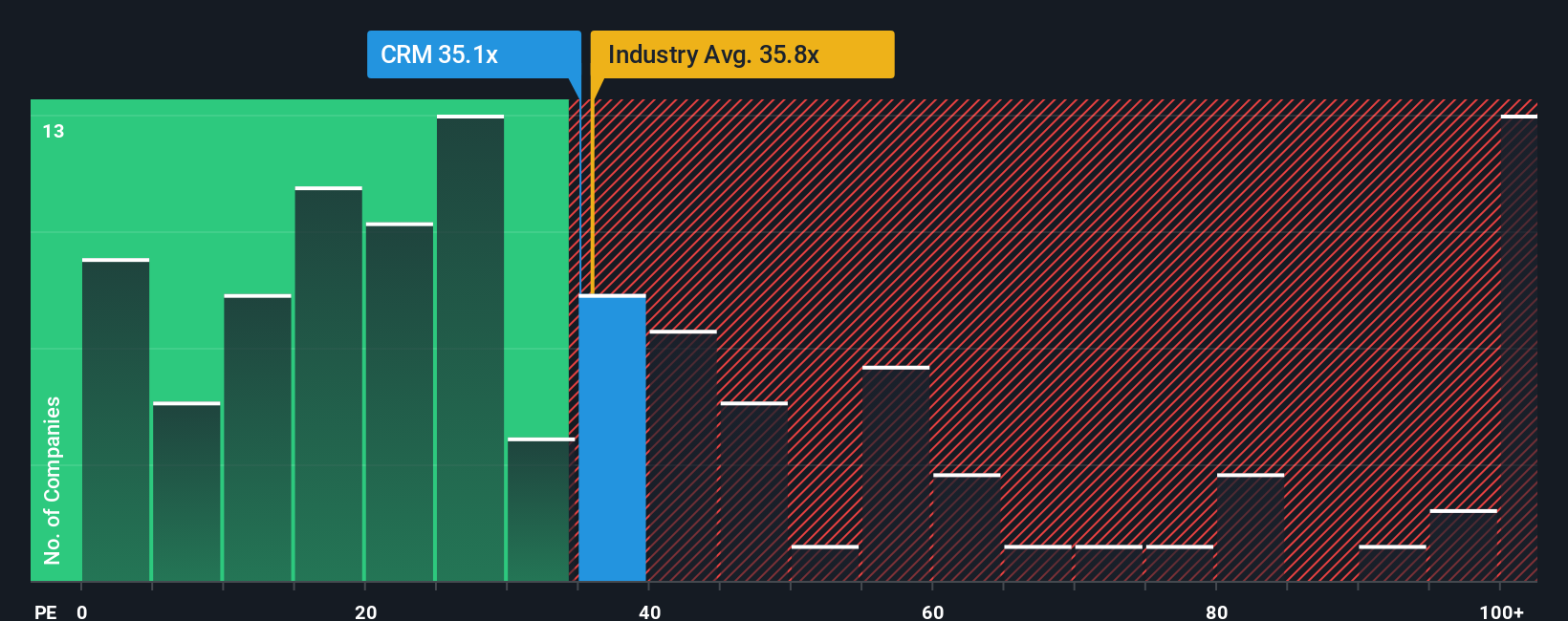

Instead of focusing on discounted cash flow, let’s consider Salesforce’s price-to-earnings ratio. At 35.9x, it is above the US Software industry average of 34.3x, but below the peer average of 60.1x and under the fair ratio of 44.4x. Does this suggest a hidden value, or extra risk if expectations fall?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Salesforce Narrative

If you see the Salesforce story differently or want to dig into your own numbers, you can craft a personalized narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Salesforce.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons with Simply Wall Street’s powerful tools and stay ahead of fast-moving trends that others might overlook.

- Uncover hidden growth stories by checking out these 3579 penny stocks with strong financials with strong financials and compelling upside potential.

- Find steady returns and reliable cash flow as you review these 21 dividend stocks with yields > 3% offering yields greater than 3%.

- Catch the next wave of innovation in medicine by exploring these 34 healthcare AI stocks focused on artificial intelligence and transformative healthcare breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives