- United States

- /

- IT

- /

- NYSE:ASGN

How Flat Sales and Weak Demand at ASGN (ASGN) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, ASGN was identified among three stocks reaching 12-month lows, with analysts projecting flat sales and declining earnings per share amid ongoing weak demand.

- This highlights operational challenges that have impacted investor sentiment, as expectations for a sales recovery remain limited in the near term.

- We’ll look at how recent weak demand and flat sales projections might alter ASGN’s investment narrative and future prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ASGN Investment Narrative Recap

Shareholders in ASGN need to believe in its capacity to recover from persistent demand weakness and operational hurdles, with the investment case centered on the company’s exposure to long-term growth in high-skill IT consulting and federal contracts. However, with analysts projecting flat sales and declining earnings per share in the near term, the latest 12-month low reinforces that ASGN's biggest short-term catalyst, an inflection in demand, remains elusive, and the risk of prolonged headwinds persists. One of the most relevant recent announcements is ASGN’s Q3 2025 earnings guidance, which anticipates revenue between US$992 million and US$1.012 billion. Set against expectations of flat sales, this outlook underscores the current challenge for ASGN: delivering margin improvement while contending with persistent softness in both commercial and staffing demand. Yet, while there’s potential for improvement, investors should also be aware that if the soft demand environment persists and commercial segment revenues do not rebound...

Read the full narrative on ASGN (it's free!)

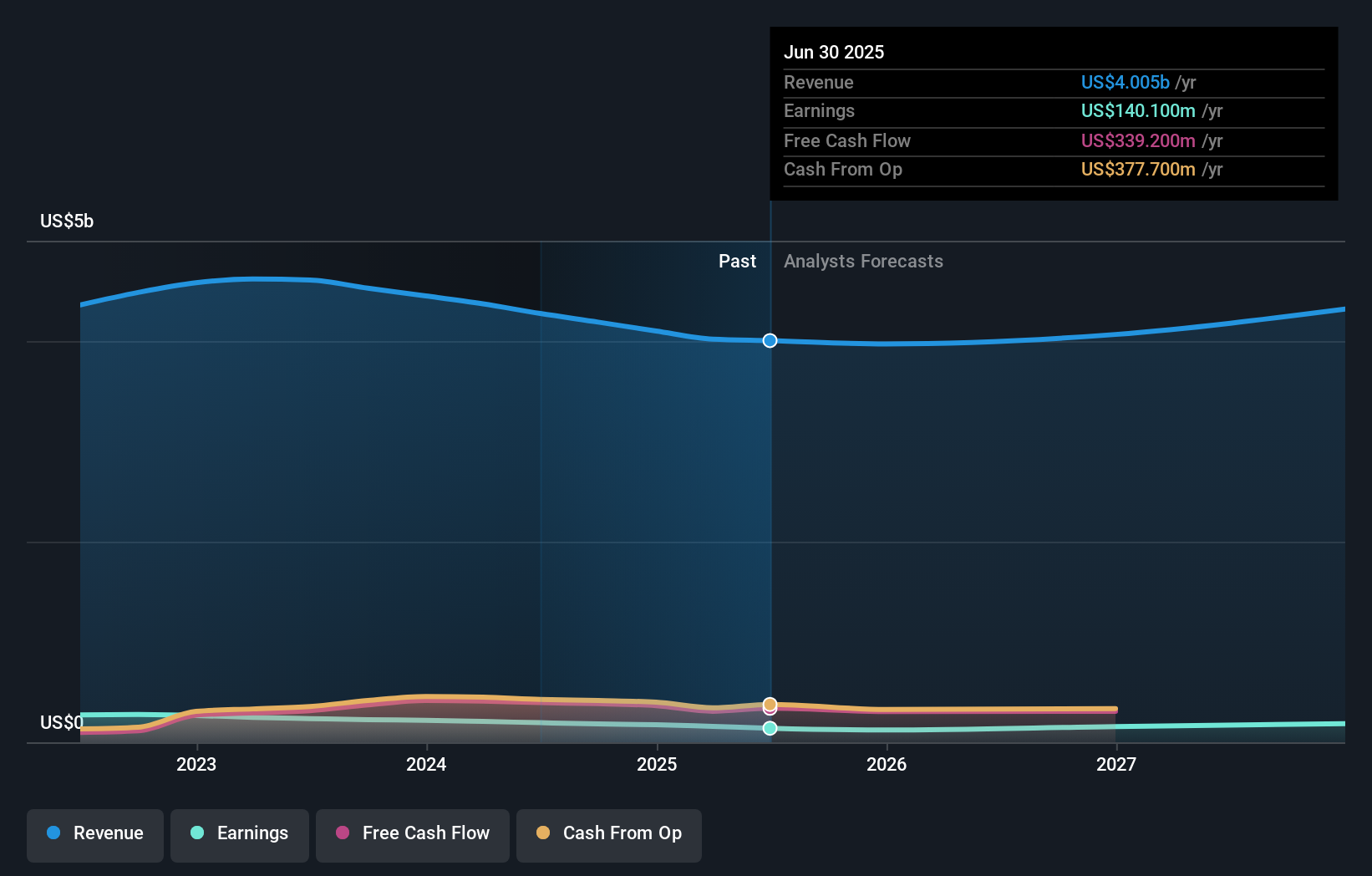

ASGN's outlook anticipates $4.3 billion in revenue and $193.8 million in earnings by 2028. This reflects a 2.5% annual revenue growth rate and a $53.7 million increase in earnings from the current $140.1 million.

Uncover how ASGN's forecasts yield a $54.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have produced three fair value estimates for ASGN, with figures as low as US$30.33 and as high as US$82.33. While some see value far above the current share price, weak demand and declining earnings remain central hurdles for the company’s near term performance, so exploring these different viewpoints can be useful.

Explore 3 other fair value estimates on ASGN - why the stock might be worth as much as 77% more than the current price!

Build Your Own ASGN Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASGN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASGN's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASGN

ASGN

Engages in the provision of information technology (IT) services and solutions in the technology, digital, and creative fields for commercial and government sectors in the United States, Canada, and Europe.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives