- United States

- /

- Software

- /

- NYSE:ASAN

Does AI Hype Fatigue Challenge Asana's (ASAN) Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Earlier this week, Asana was among high-growth technology names affected by a sector-wide pullback, as investors reassessed elevated valuations following an extended AI-driven rally.

- This pause in tech momentum highlights ongoing market caution around sustained AI enthusiasm, reminding investors that sector sentiment can quickly influence even leading software firms.

- We'll look at how investor concern over high valuations could affect Asana's long-term investment outlook and AI-driven growth narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Asana Investment Narrative Recap

To be an Asana shareholder today, you need long-term conviction that its AI-powered work management platform can carve out a differentiated place in an increasingly competitive software market, driving ongoing expansion in enterprise accounts and improved customer retention. The recent tech sector pullback, spurred by valuation concerns, does not appear to materially impact Asana’s main near-term catalyst, which remains its upcoming Q3 2026 results. However, it does highlight the risk that shifting sentiment toward richly valued growth names could put pressure on Asana’s share price, particularly if growth metrics slow.

Of the company’s recent announcements, the upcoming third quarter earnings release on December 2, 2025, stands out given current investor attention on both growth rates and profitability. This results update will be closely watched as a key short-term catalyst, with the potential to directly address concerns raised by profit taking and elevated valuation scrutiny. Consistent revenue growth and narrowing losses may offer some reassurance, but even strong execution will need to be balanced against the market’s current caution toward unprofitable, high-growth software firms.

In contrast, investors should be aware that one of the most important risks now is the potential for declining net retention rates in upcoming...

Read the full narrative on Asana (it's free!)

Asana's narrative projects $966.9 million revenue and $126.6 million earnings by 2028. This requires 9.4% yearly revenue growth and a $358.4 million increase in earnings from the current -$231.8 million.

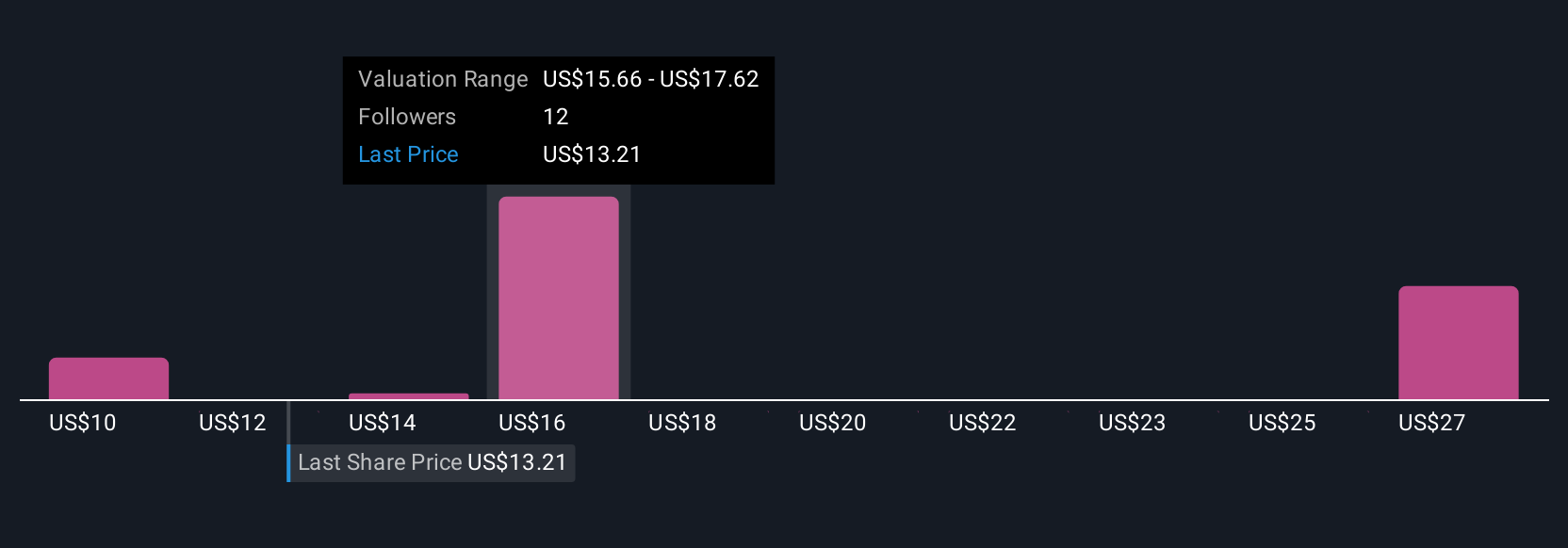

Uncover how Asana's forecasts yield a $16.38 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community have predicted Asana's fair value, with estimates from US$9.79 up to US$30.09. With renewed market caution around high-growth software valuations, it’s clear that your view on retention risk could set you apart from the crowd.

Explore 7 other fair value estimates on Asana - why the stock might be worth 27% less than the current price!

Build Your Own Asana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Asana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asana's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives