- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN): Valuation in Focus as New Physical AI Orchestrator Expands Industrial AI Offerings

Reviewed by Simply Wall St

Accenture (NYSE:ACN) just introduced its new Physical AI Orchestrator, a cloud-based platform developed with NVIDIA technology that helps manufacturers create digital twins of their factories. This launch comes at a time of expanded collaborations in AI-powered workplace and industrial safety solutions.

See our latest analysis for Accenture.

Accenture’s recent product launches and AI partnerships have grabbed headlines, but the market hasn’t rewarded shareholders just yet. Its share price has slid 28.3% year-to-date, and the total shareholder return over the past year is down 26.1%. While longer-term results remain positive, momentum has faded lately as investors weigh the pace and impact of these innovative bets.

If you want to see which other fast-evolving tech and AI leaders are drawing investor interest, it may be a smart move to check out See the full list for free.

With Accenture shares trading at a notable discount to analyst targets, but amid uncertainties around demand, is this recent dip an opportunity for investors to buy into future AI growth? Or is the market already factoring in what lies ahead?

Most Popular Narrative: 23.6% Overvalued

Accenture’s narrative fair value comes in at $202.38, well below its most recent close of $250.10, raising eyebrows about the company's premium. With investor focus intensifying, it is worth examining the major factors that shape this sharp difference in valuation.

"After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name. EPS growth and margin expansion are intact; execution is visible despite a more selective demand environment."

Wondering what’s behind that bold valuation stance? This narrative zeroes in on growth engines that Wall Street cannot ignore and profit margins that defy sector norms. Uncover what is fueling these ambitious projections, and see why the numbers could shift how you view Accenture’s future.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in bookings or delayed client spending decisions could quickly challenge expectations and significantly reshape Accenture’s near-term outlook.

Find out about the key risks to this Accenture narrative.

Another View: DCF Paints a Different Picture

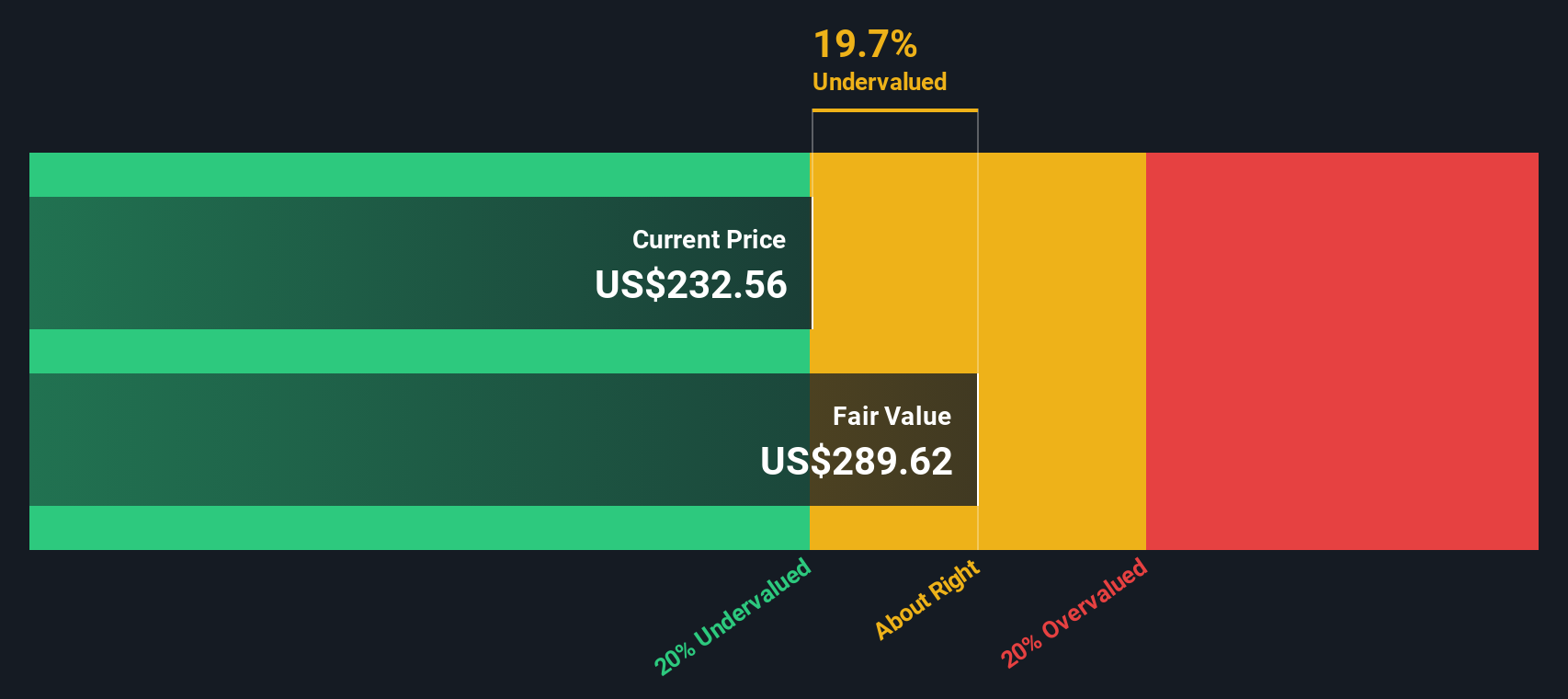

While the narrative analysis suggests Accenture is 23.6% overvalued, our SWS DCF model signals a different scenario. According to this cash flow-based approach, Accenture, at $250.10, actually trades below its estimated fair value of $274.25. This hints at potential undervaluation. Which valuation method captures the real opportunity or risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accenture Narrative

If you want to bring your own perspective to Accenture’s story, dive into the numbers and shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Ready to Unlock Even More Opportunities?

You’ll gain a real edge by broadening your search beyond just Accenture. Take action now and uncover stocks reshaping industries and rewarding forward-thinking investors.

- Supercharge your portfolio by tapping into these 832 undervalued stocks based on cash flows that the market may have overlooked. These opportunities may offer strong growth potential at compelling prices.

- Boost your income strategy by targeting these 22 dividend stocks with yields > 3%, which delivers consistent yields above 3% for reliable returns even in uncertain markets.

- Ride the momentum of groundbreaking innovation with these 26 AI penny stocks, companies at the forefront of artificial intelligence changing the way we live and invest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives