- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (ZS): Evaluating Valuation After Fresh Upgrades to Digital Experience Platform

Reviewed by Simply Wall St

Zscaler (ZS) just rolled out fresh enhancements to its Zscaler Digital Experience platform, with a clear focus on tackling digital downtime and network performance headaches. The new features are designed to improve real-time monitoring and streamline issue detection across complex enterprise environments.

See our latest analysis for Zscaler.

It’s been an eventful year for Zscaler, with momentum clearly on the rise. After some recent product-driven buzz, the company’s share price has climbed 76.2% year-to-date. Its impressive long-term total shareholder return of 125% over three years underscores growing confidence in Zscaler’s role as a leader in network security and digital experience solutions.

If Zscaler’s recent surge has you looking for more tech innovators stepping up their game, explore the latest opportunities in our curated list: See the full list for free.

But with shares already up sharply this year and trading close to analyst price targets, investors are left to wonder: is there still room for upside, or has the market already priced in Zscaler’s future growth?

Most Popular Narrative: 1.4% Undervalued

Zscaler’s last close at $320.01 sits just below the most widely followed fair value estimate of $324.66. The gap is narrow, hinting at high expectations and lively debate among analysts about what is being priced into the stock.

Accelerating customer adoption of Zero Trust Everywhere and Data Security Everywhere solutions, particularly among Global 2000 and Fortune 500 firms, is fueling large upsell deals and higher ARR per customer. This is expected to drive sustained double-digit revenue growth and improve net retention rates.

Curious what’s fueling this valuation? The narrative relies on an aggressive blueprint: rapid platform adoption, lasting revenue acceleration, and ambitious improvements to margins. But what are the real quantitative drivers and which bullish assumptions move the target price? Dive in, the details are more eye-opening than you might expect.

Result: Fair Value of $324.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from major cloud providers and the high costs of attracting cybersecurity talent could quickly challenge Zscaler’s growth assumptions.

Find out about the key risks to this Zscaler narrative.

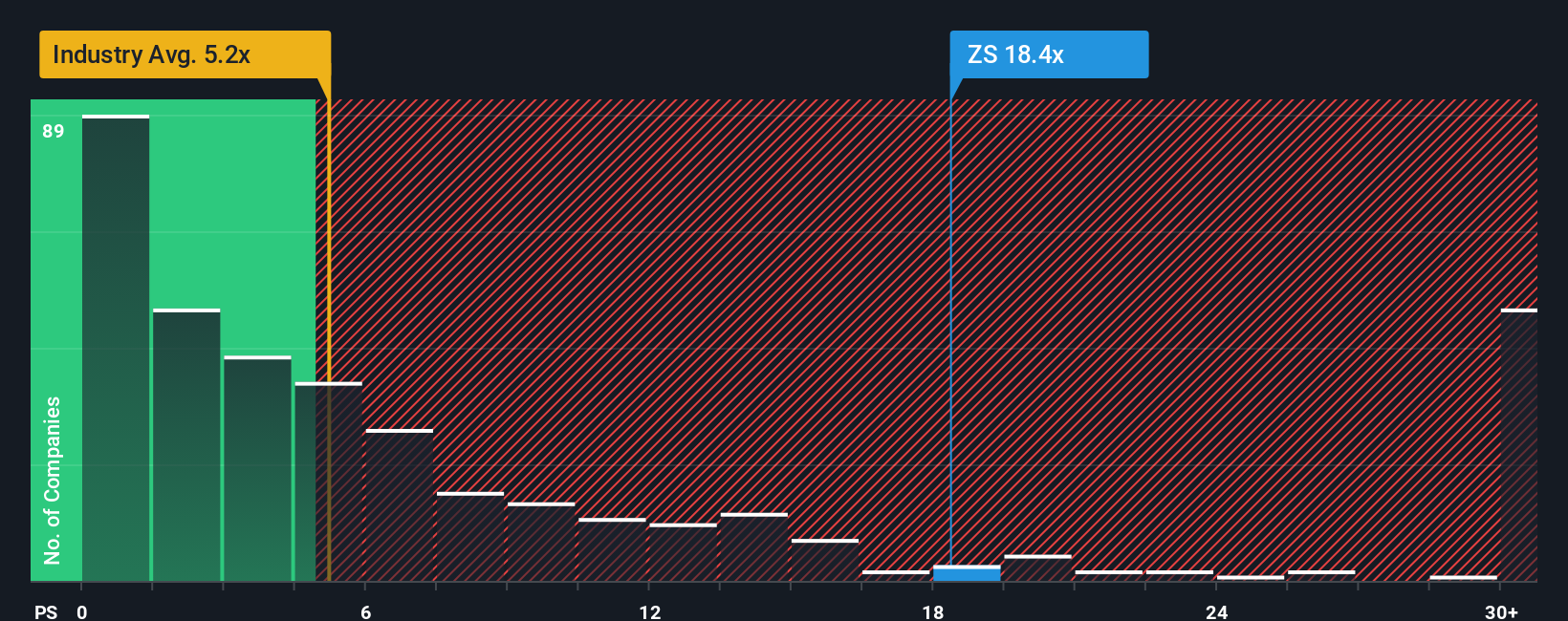

Another View: Market Multiples Flash a Warning

While analyst forecasts lean on future earnings growth and optimism around AI-driven platform expansion, Zscaler’s share price is 19 times its annual revenue. This compares to the US Software industry average of just 4.8 times. The fair ratio for Zscaler may be closer to 13, so investors could be paying a significant premium. Does this premium reflect sustainable growth, or could valuation risk be building beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zscaler for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zscaler Narrative

If you have your own take or want to put the numbers to the test, you can build a personal investment narrative in just a few minutes. Do it your way.

A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities slip by. Confidently expand your research and put the odds in your favor by checking out these tailored stock lists:

- Zero in on untapped value with these 875 undervalued stocks based on cash flows, where promising companies are trading below their intrinsic worth.

- Tap into the surge of artificial intelligence by finding forward-thinking businesses changing the game through these 24 AI penny stocks.

- Secure dependable payouts for your portfolio and start building income streams with these 16 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives