- United States

- /

- Software

- /

- NasdaqCM:WULF

A Look at TeraWulf (WULF) Valuation Following $9.5B Fluidstack Joint Venture and Strategic AI Partnerships

Reviewed by Simply Wall St

TeraWulf (WULF) shares are drawing fresh attention after the company announced a 25-year, $9.5 billion high-performance computing joint venture with Fluidstack. The venture is supported by a major client commitment and Google’s backing.

See our latest analysis for TeraWulf.

The high-profile Fluidstack partnership adds to a string of growth-driving events for TeraWulf, including upbeat revenue forecasts and strategic financing moves. While the stock has been volatile in the short term, posting a 10% dip over the past week, TeraWulf’s strong 90-day share price return of 177% and a one-year total shareholder return of nearly 69% suggest momentum has been building throughout the year as the business pivots towards AI infrastructure and scales new platforms.

If this kind of rapid transformation has you hunting for other rising stars, broaden your scope and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets even after major gains, investors are left to consider whether TeraWulf’s explosive growth is fully reflected in the stock price or if further upside remains. Is this a genuine buying opportunity, or has the market already priced in years of anticipated expansion?

Most Popular Narrative: 34.5% Undervalued

TeraWulf’s most widely followed narrative points to a fair value that far exceeds the latest closing price, flagging a major disconnect between recent stock movements and the company’s growth-fueled prospects. This section explores one of the most influential drivers shaping the current valuation outlook.

Long-term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital. This directly supports margin expansion and accelerated infrastructure growth.

Curious how analysts justify a value this high? The full story reveals ambitious financial turning points and bold, unconventional assumptions about TeraWulf’s future earnings profile. See which growth projections power the narrative’s fair value target. Some of the numbers might surprise you.

Result: Fair Value of $21.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, as execution delays or unforeseen disruptions in key partnerships could quickly undermine the bullish thesis regarding TeraWulf’s rapid expansion.

Find out about the key risks to this TeraWulf narrative.

Another View: Are Multiples Telling a Different Story?

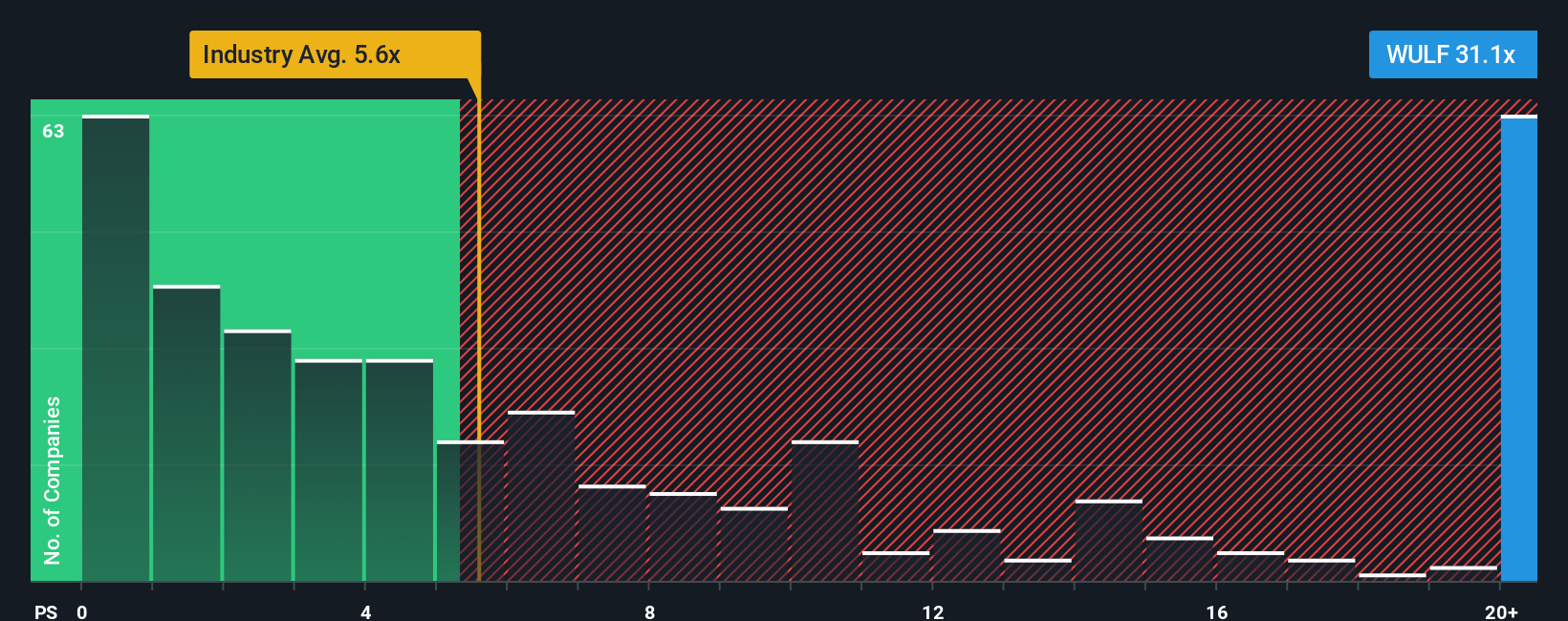

Looking at TeraWulf’s price-to-sales ratio of 39.5x, it stands noticeably higher than both the US Software sector average of 4.8x and the peer average of 23.2x. Even the fair ratio, a level the market could shift toward, is just 19.3x. This significant premium suggests investors are pricing in a lot of future success. However, it also raises the question of whether higher risk is introduced if growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TeraWulf Narrative

If you think the story goes deeper or want to test your own assumptions with the numbers, it only takes a few minutes to build and share your unique perspective. Do it your way

A great starting point for your TeraWulf research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Winning Ideas?

Stay ahead of the curve by hand-picking stocks that fit your unique style. The right screener can help you spot the breakout opportunities others miss.

- Unearth serious income potential and kickstart your search with these 16 dividend stocks with yields > 3% offering steady yields greater than 3% for reliable returns.

- Catch the next wave of industry disruption as you tap into innovation with these 24 AI penny stocks and explore advancements in artificial intelligence.

- Capitalize on market mispricing by acting on these 870 undervalued stocks based on cash flows to find stocks trading below their intrinsic cash flow value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives