- United States

- /

- Software

- /

- NasdaqGS:VRNS

Varonis Systems (VRNS): Assessing Valuation After Q3 Results, 2025 Guidance Raise, and New $150M Buyback

Reviewed by Simply Wall St

Varonis Systems (VRNS) just delivered a flurry of updates, reporting third quarter results, sharing refreshed revenue guidance for the year ahead, and rolling out a $150 million share buyback program all on the same day.

See our latest analysis for Varonis Systems.

Varonis Systems’ third-quarter earnings, 2025 revenue guidance hike, and fresh $150 million buyback gave investors lots to digest, but the news arrived during a rough patch. Its share price is still down 44% over the last month, and the 1-year total shareholder return stands at -34%. Longer-term holders will have noted the stock’s momentum faded after a strong three-year run, with the current pullback overshadowing those prior gains.

If you’re rethinking your tech portfolio after a move like this, it’s the perfect time to check out See the full list for free..

With shares trading significantly below recent analyst targets and improved revenue guidance on the table, investors are left asking whether the current weakness offers a compelling entry or if the market is correctly anticipating what comes next.

Most Popular Narrative: 34.6% Undervalued

According to the most followed narrative, Varonis Systems' fair value sits well above its latest closing price, suggesting the market is missing something big. The narrative highlights several competitive strengths and bold assumptions driving this gap. See what’s behind the valuation below.

“SaaS transition, R&D investments, and platform enhancements are boosting recurring revenue, customer retention, and competitive advantage, strengthening long-term earnings and profitability. The shift to SaaS is pressuring revenue, margins, and profits, heightening dilution and competitive risks, while growth depends on sustained customer expansion amid industry consolidation.”

The projected fair value comes from some bold financial assumptions, including revenue and earnings growth, ramped-up margins, and a future valuation multiple rarely seen outside of the tech elite. Wonder if these underlying projections hold up? Click through to see which forecasts are powering this high-stakes scenario.

Result: Fair Value of $52.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, near-term challenges such as on-premise renewal weakness and margin compression could slow earnings momentum. This could make the bullish narrative harder to realize.

Find out about the key risks to this Varonis Systems narrative.

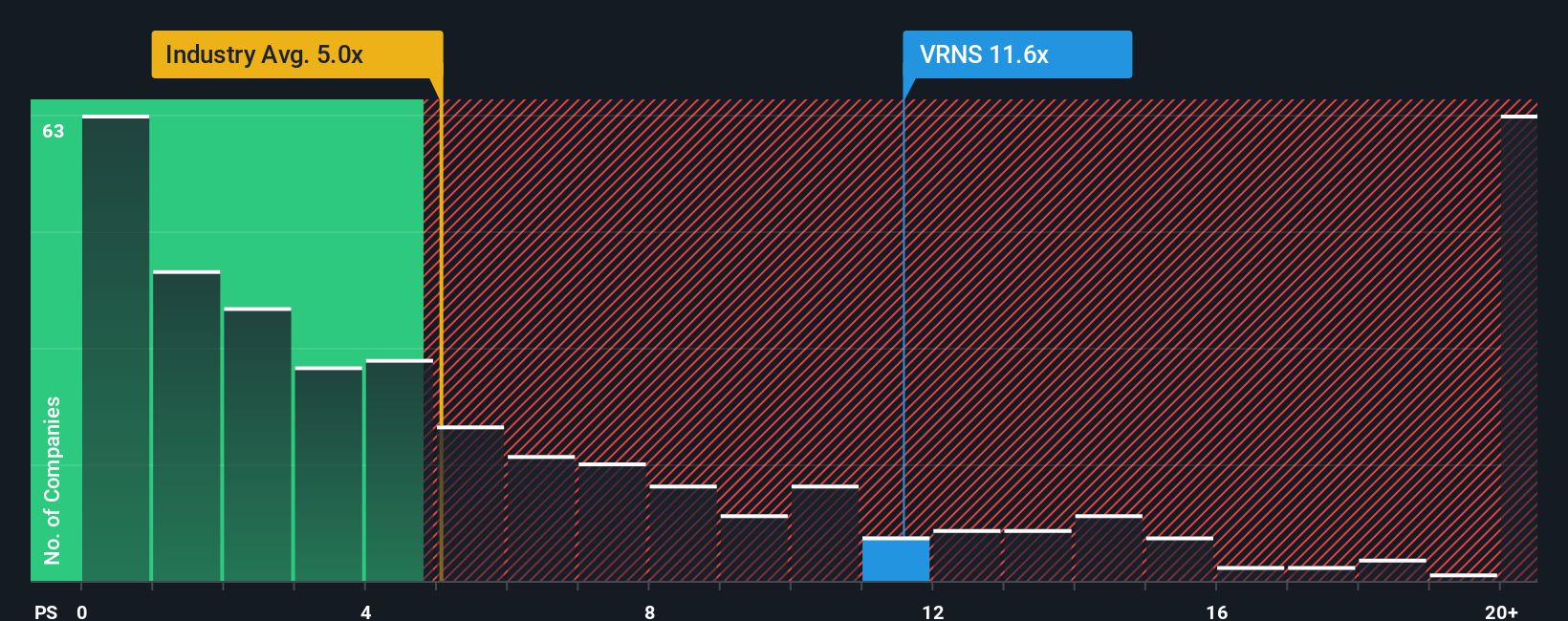

Another View: Comparing Market Multiples

While our earlier analysis suggests Varonis Systems is trading well below fair value, a different picture emerges when we look at the price-to-sales ratio. VRNS trades at 6.7x, which is more expensive than both its industry average of 4.8x and a fair ratio of 6.6x. This higher multiple could signal a valuation risk if the company cannot deliver on growth expectations. Will the market reward this premium, or is a pullback waiting in the wings?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Varonis Systems Narrative

If you see things differently or want to dive into the details yourself, you can shape your own Varonis Systems story in just a few minutes: Do it your way.

A great starting point for your Varonis Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by exploring fresh opportunities beyond the headlines. Don’t miss your chance—these screens surface the stocks everyone will soon be talking about.

- Uncover high-potential opportunities trading below value and power up your portfolio with these 865 undervalued stocks based on cash flows.

- Capture steady income streams and strong yields by tapping into these 16 dividend stocks with yields > 3% for reliable dividend performers.

- Be an early mover in artificial intelligence by spotting breakthrough companies setting the pace using these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives