- United States

- /

- IT

- /

- NasdaqGS:VNET

Upgraded 2025 Revenue Guidance Might Change The Case For Investing In VNET Group (VNET)

Reviewed by Sasha Jovanovic

- VNET Group, Inc. recently raised its full-year 2025 revenue guidance to between RMB 9.55 billion and RMB 9.87 billion, projecting year-over-year growth of 16% to 19%, following strong third-quarter results driven by a surge in wholesale internet data center (IDC) business revenues and significant wholesale customer orders.

- This uptick in guidance reflects higher-than-expected customer move-ins, operational efficiency gains, and intensified investments to capture ongoing AI-driven demand for high-performance data center solutions.

- We'll examine how VNET Group's upgraded guidance and rapid wholesale business growth could reshape the company's investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

VNET Group Investment Narrative Recap

To be a shareholder in VNET Group, one needs to believe in the thesis that demand for wholesale internet data centers, especially for AI and cloud-related workloads, will grow fast enough to sustain high capacity utilization and margin expansion. The recent upward revenue guidance supports this near-term catalyst, but does not meaningfully reduce the company’s key risk: refinancing a large portion of maturing debt amid high leverage and ongoing capital needs.

Most relevant to this is VNET’s November 2025 launch of a private real estate investment trust (REIT), designed to strengthen its balance sheet and lower its leverage. This action is directly linked to managing the risk associated with heavy upcoming debt maturities, a concern that remains front of mind even as short-term growth drivers accelerate.

However, before assuming these growth drivers will outweigh financial headwinds, investors should be aware of persistent refinancing challenges as over 40% of debt matures by 2027...

Read the full narrative on VNET Group (it's free!)

VNET Group's narrative projects CN¥14.2 billion in revenue and CN¥484.1 million in earnings by 2028. This requires 16.2% yearly revenue growth and a CN¥442 million earnings increase from the current CN¥42.0 million.

Uncover how VNET Group's forecasts yield a $14.09 fair value, a 68% upside to its current price.

Exploring Other Perspectives

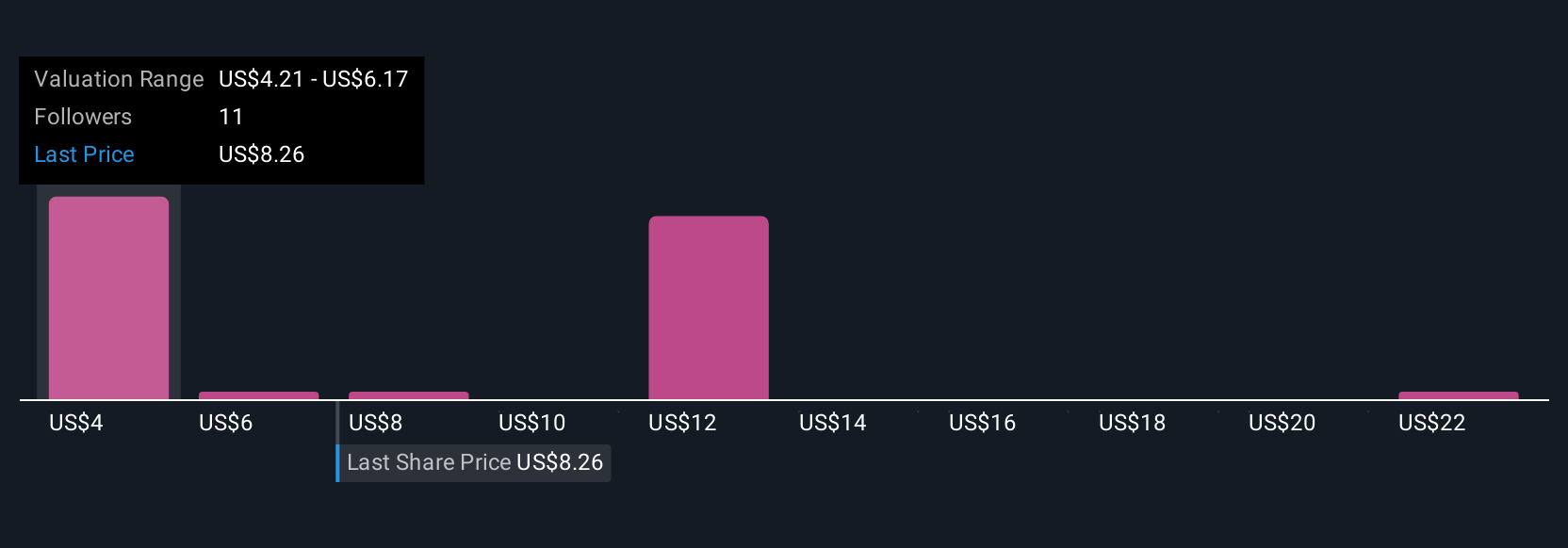

Simply Wall St Community members provided 8 fair value estimates for VNET spanning CNY 5.11 to CNY 23.79 per share. While some expect robust growth fueled by wholesale data center demand, you will find sharply divergent opinions on whether the company’s leverage could disrupt future results, explore their viewpoints to see how the market weighs these risks.

Explore 8 other fair value estimates on VNET Group - why the stock might be worth 39% less than the current price!

Build Your Own VNET Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VNET Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free VNET Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VNET Group's overall financial health at a glance.

No Opportunity In VNET Group?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives