- United States

- /

- Software

- /

- NasdaqGS:SNPS

Synopsys (SNPS) Margin Compression to 18.1% Tests Bullish High-Growth Valuation Narrative

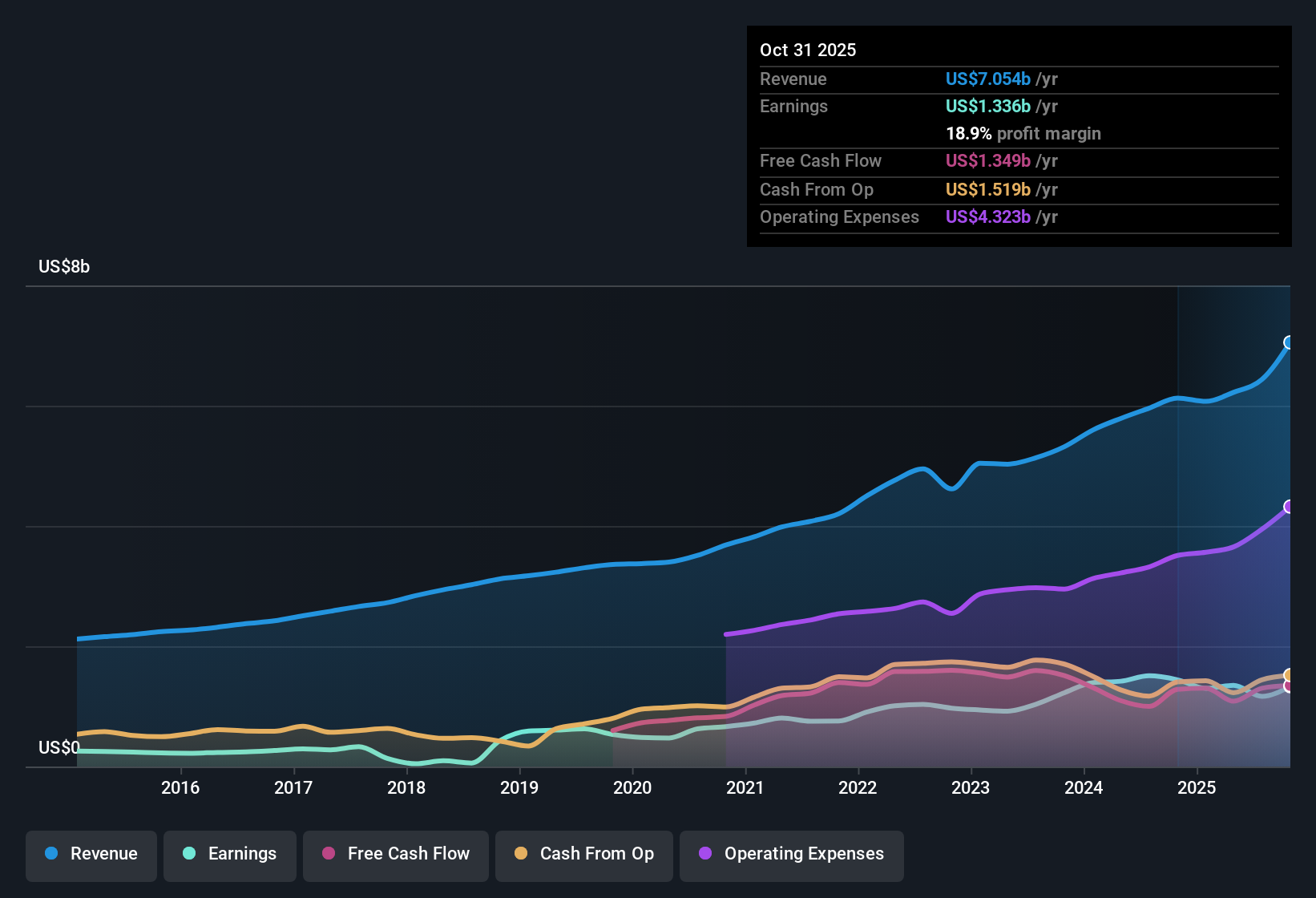

Synopsys (SNPS) just wrapped up FY 2025 with fourth quarter revenue of about $2.3 billion and basic EPS of $2.42, capping a year in which trailing 12 month revenue reached roughly $7.1 billion and EPS came in at $8.15. The company has seen quarterly revenue move from about $1.6 billion in the fourth quarter of FY 2024 to $2.3 billion in the latest quarter, while basic EPS shifted from $1.81 to $2.42 over the same period. This sets up a story in which investors will be weighing headline growth against how sustainable those margins look.

See our full analysis for Synopsys.With the numbers on the table, the next step is to see how this latest run of results lines up with the prevailing narratives around Synopsys, and where those stories might need a reset.

See what the community is saying about Synopsys

Trailing Profit Margin Slides to 18.1%

- Over the last 12 months, Synopsys generated about $7.1 billion of revenue with net profit of roughly $1.3 billion, which works out to an 18.1 percent net margin versus 25.3 percent a year earlier.

- Bears focus on this margin pressure, arguing that integration costs and business transitions could weigh on profitability even if revenue grows.

- The drop from 25.3 percent to 18.1 percent margins lines up with concerns that higher development spending and restructuring, including a 10 percent headcount reduction, may be biting into near term profitability.

- At the same time, analysts still expect margins to edge up from 21.7 percent to 22.3 percent over the next three years, which challenges the bearish view that margin compression must be permanent.

Forecast Revenue Growth of 16.2% Supports Bull Case

- Analysts expect Synopsys revenue to grow about 16.2 percent per year, ahead of the broader US market forecast of 10.7 percent a year, with earnings projected to rise roughly 19.1 percent annually after growing 15.4 percent per year over the last five years.

- Supporters of the bullish view see these growth rates as evidence that Synopsys expansion into AI heavy chip design, advanced IP, and Ansys powered simulation can drive long term upside.

- The Ansys combination expands Synopsys reach from silicon into broader engineering software, supporting the idea that a mid teens revenue growth outlook is realistic on a roughly $7.1 billion trailing revenue base.

- The forecast that earnings could reach about $2.7 billion by around 2028, up from roughly $1.4 billion today, is consistent with the company pivoting toward higher margin SaaS, cloud, and integrated IP offerings.

Premium Valuation at 77.7x P/E

- Synopsys trades on a trailing price to earnings ratio of 77.7 times, above both peer levels around 63.9 times and the US software industry at 31.9 times, and above a DCF fair value of about 458.33 dollars per share compared with the current share price of 477.26 dollars.

- Critics warn that paying this kind of multiple leaves less room for error, especially with debt coverage by operating cash flow flagged as a major risk and some shareholder dilution over the past year.

- The gap between the current price of 477.26 dollars and the DCF fair value of 458.33 dollars suggests the market is already factoring in a lot of the expected growth.

- When you pair that premium P E with a step down in net margins from 25.3 percent to 18.1 percent, it reinforces the bearish argument that investors are relying heavily on the long term growth story to support this valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Synopsys on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something different in the results? Use that angle to quickly shape your own long term view in just a few minutes, Do it your way.

A great starting point for your Synopsys research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Synopsys pairs shrinking profit margins with a stretched valuation, leaving investors heavily exposed if the ambitious growth and integration plans slip.

If you want potential upside without paying such a rich multiple, use our these 908 undervalued stocks based on cash flows today to quickly pinpoint candidates with more attractive price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides design IP solutions in the semiconductor and electronics industries.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.