- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP): Evaluating Valuation After Major AI Upgrade and Expanding Retail Momentum

Reviewed by Simply Wall St

Shopify (NasdaqGS:SHOP) made headlines after partnering with Liquid AI to integrate advanced foundation models. These models promise to deliver much faster and smarter search and recommendations for its merchants and customers. This technology update could be meaningful for Shopify's ongoing growth story.

See our latest analysis for Shopify.

The excitement around Shopify’s deepening investment in AI comes as its shares have maintained a strong upward trend, notching a 37.5% year-to-date share price return and a remarkable 288.6% total return for investors over three years. While recent innovations have fueled momentum, the last month saw a modest pullback even as the long-term growth story remains intact.

If you’re interested in what’s driving tech and AI stocks right now, you’ll want to check out See the full list for free..

But with so much excitement around Shopify’s latest AI initiatives and retail expansion, investors are left wondering if the stock’s strong run still leaves room for upside or if the market already anticipates its future gains.

Most Popular Narrative: 15.6% Undervalued

The most widely followed narrative suggests Shopify's fair value is notably above its recent closing price, pointing to a bullish outlook and ongoing optimism from market watchers.

Shopify is expanding rapidly in international markets, with 42% YoY GMV growth internationally (especially in Europe, but also in Asia Pacific). As digital commerce adoption increases globally, this drives a larger addressable market and will support outperformance in revenue growth and GMV. The company is aggressively integrating AI-driven capabilities (for example, Sidekick, AI store builder, conversational commerce integrations with large language models), enabling merchants to launch, manage, and scale stores with less friction and more efficiency. This is likely to accelerate merchant acquisition, improve retention, and drive higher margins through automation and new high-value features.

Want to know what’s behind this high price target? The key is aggressive growth strategies matched with daring profit assumptions and a valuation multiple rarely seen outside hyper-growth companies. Intrigued by the quantitative leaps backing this confidence? Uncover the narrative’s bold projections and see if the numbers support the hype.

Result: Fair Value of $175.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from major e-commerce players and rising regulatory scrutiny could quickly challenge Shopify’s impressive growth trajectory and current investor optimism.

Find out about the key risks to this Shopify narrative.

Another View: How Do Valuation Multiples Stack Up?

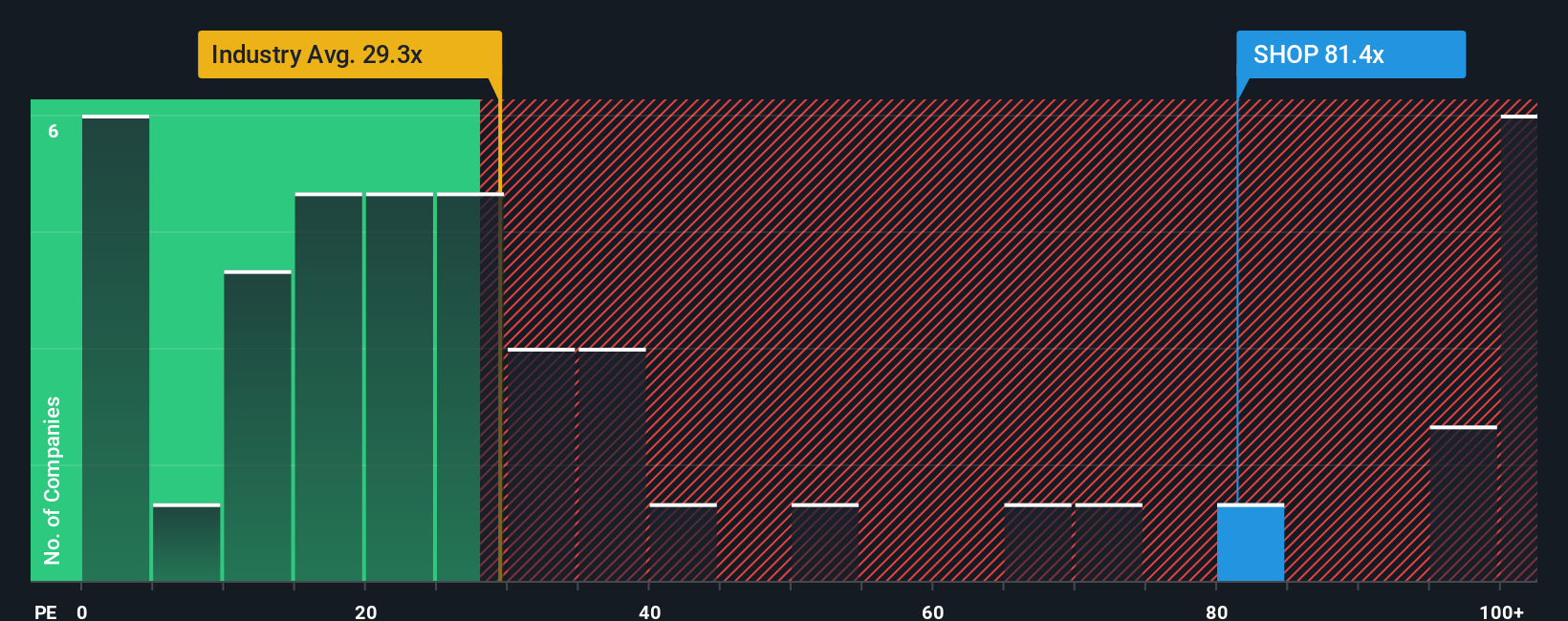

Taking a closer look at valuation, Shopify currently trades at a price-to-earnings ratio of 108x, which is significantly above both the US IT industry average of 27.8x and the peer group average of 39.3x. It is also well above the fair ratio of 51.4x, suggesting the market is pricing in steep future growth. This kind of premium often reflects big expectations. However, is such optimism sustainable, or does it leave little room for error if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If you see things differently or want to dig into the data for yourself, you can craft your own Shopify story in just a few minutes. Do it your way.

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by, especially with market trends moving fast. Find fresh investment angles tailored for today’s smartest investors.

- Target steady income and long-term reliability by checking out these 15 dividend stocks with yields > 3%, which has proven to offer yields above industry averages and consistent payouts.

- Capitalize on cutting-edge healthcare innovation and growth by exploring these 30 healthcare AI stocks, a selection reshaping diagnostics, treatment, and patient outcomes with AI-driven solutions.

- Seize the buzz around artificial intelligence and get ahead with these 26 AI penny stocks, featuring companies that are setting the pace in automation and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives