- United States

- /

- Software

- /

- NasdaqGS:PTC

PTC (PTC) Is Down 7.3% After Raising 2026 Guidance and Reporting Surging Earnings Growth

Reviewed by Sasha Jovanovic

- PTC Inc. recently reported fourth quarter and full-year 2025 results, highlighting significant increases in both revenue and net income compared to the prior year, and issued new financial guidance for fiscal 2026, expecting first quarter revenue between US$600 million and US$660 million and full-year revenue between US$2.65 billion and US$2.92 billion.

- One unique insight is the company’s remarkable year-over-year growth in diluted earnings per share, which nearly tripled for the quarter and doubled for the full year, indicating operational momentum ahead of its new guidance period.

- We’ll examine how PTC’s strong earnings growth and higher guidance could influence its long-term margin and recurring revenue outlook.

Find companies with promising cash flow potential yet trading below their fair value.

PTC Investment Narrative Recap

To be a shareholder in PTC, you need confidence in the company’s ability to keep growing recurring revenue by delivering AI-driven solutions that lock in large manufacturers as customers. The recent surge in quarterly earnings and raised 2026 guidance strengthens the view that AI adoption and digital transformation are acting as meaningful near-term growth catalysts. However, the most important short-term risk remains unpredictable deal timing due to global trade and policy uncertainty; the impact of the latest financial results on this risk is not material.

Among recent announcements, PTC’s launch of AI features for Onshape and Arena stands out as closely tied to its earnings momentum, these innovations are driving customer engagement, which directly informs the stronger topline guidance. Advances in the SaaS and AI strategy, combined with integration initiatives, have the potential to support higher contract values and margin expansion as recurring revenues build. But, unlike the optimism these launches generate, investors should be aware of the variable timing of large enterprise deals, which can quickly...

Read the full narrative on PTC (it's free!)

PTC's narrative projects $3.3 billion revenue and $814.8 million earnings by 2028. This requires 9.6% yearly revenue growth and a $302.1 million earnings increase from $512.7 million today.

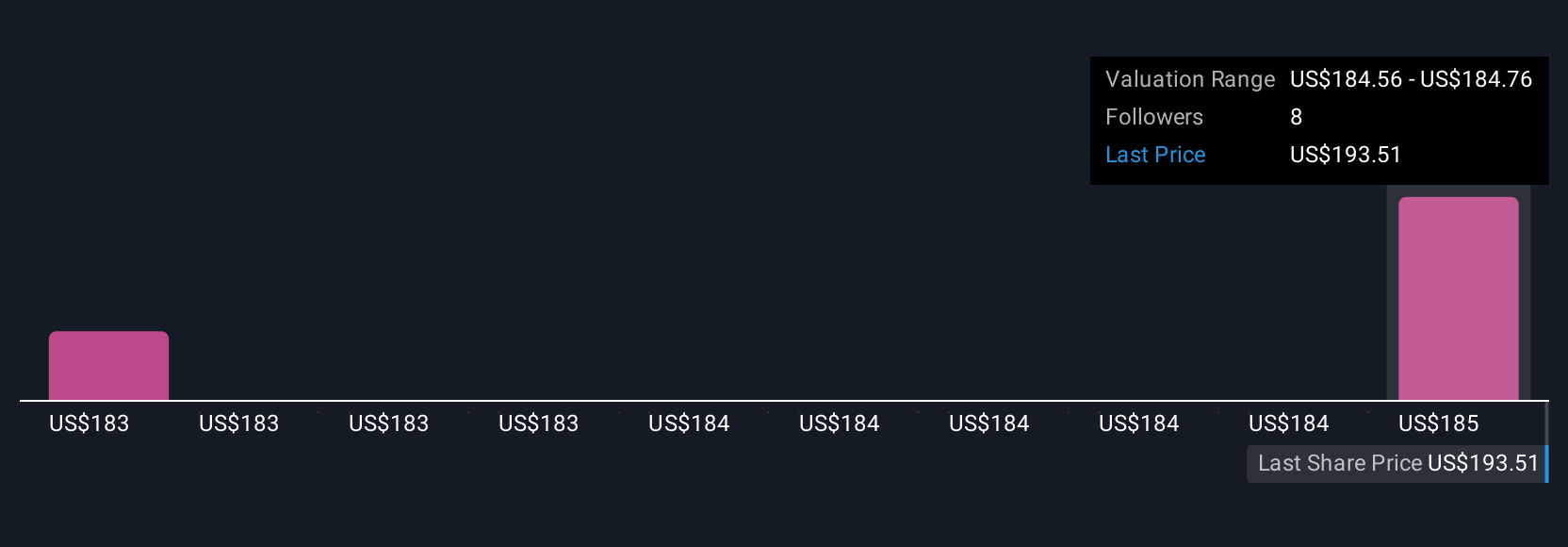

Uncover how PTC's forecasts yield a $220.39 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$160 to over US$230,746 based on five individual forecasts. While some see current earnings momentum fueling further upside, others remain focused on persistent risks that could affect deal closure and future revenue stability, so make sure to weigh different viewpoints before making any decisions.

Explore 5 other fair value estimates on PTC - why the stock might be worth 10% less than the current price!

Build Your Own PTC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free PTC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC's overall financial health at a glance.

No Opportunity In PTC?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTC

PTC

Operates as software company in the Americas, Europe, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives