Stock Analysis

- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Three High Growth Tech Stocks To Watch In The United States

Reviewed by Simply Wall St

The market has been flat over the last week but is up 22% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks can be crucial for investors looking to capitalize on potential future gains.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

| Iris Energy | 65.01% | 111.98% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI-powered technology to serve financial institutions and investors across the United States, Israel, the Cayman Islands, and internationally, with a market cap of $937.91 million.

Operations: Pagaya Technologies Ltd. generates revenue primarily through its software and programming segment, which brought in $925.42 million. The company leverages data science and AI technology to provide solutions for financial institutions and investors globally.

Pagaya Technologies, leveraging its AI-driven lending technology, reported a 28% year-over-year revenue increase to $250.34 million in Q2 2024. Despite a net loss of $74.79 million for the same period, the company anticipates annual revenue growth of 15%, outpacing the US market's 8.8%. Strategic partnerships with Castlelake and OneMain Financial highlight Pagaya’s expanding funding capacity and client base, enhancing its competitive edge in consumer credit technology solutions.

Cognex (NasdaqGS:CGNX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cognex Corporation offers machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks globally, with a market cap of $6.65 billion.

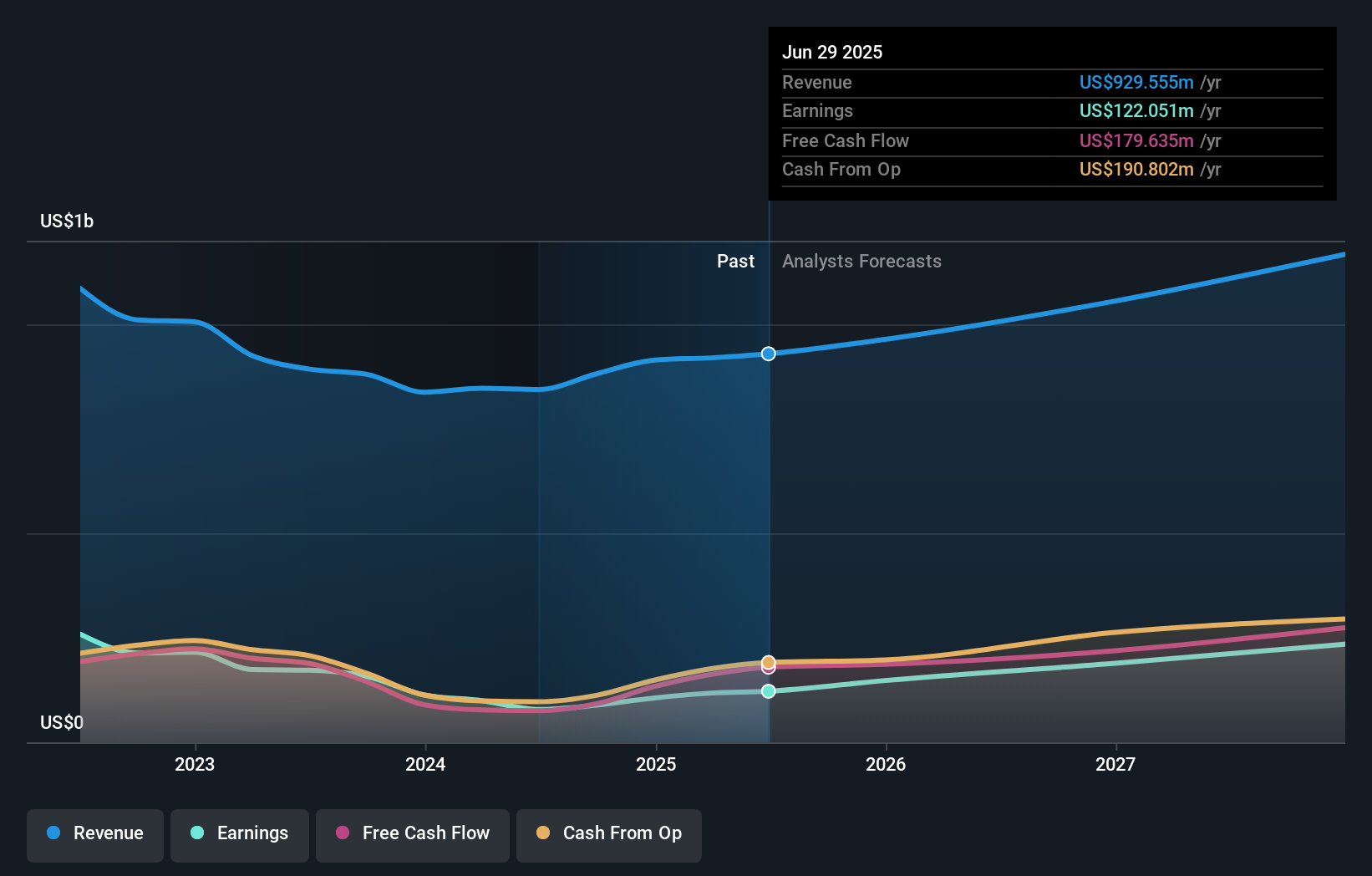

Operations: Cognex generates revenue primarily from its machine vision technology, amounting to $844 million. The company focuses on automating manufacturing and distribution processes through advanced visual information analysis.

Cognex Corporation's innovative AI-enabled In-Sight SnAPP™ vision sensor significantly enhances manufacturing efficiency by automating complex counting tasks, reducing errors, and ensuring quality control across diverse industries like automotive and pharmaceuticals. Recent earnings show $239.29 million in Q2 2024 sales with a net income of $36.21 million, reflecting a 54.5% decline from the previous year. The company repurchased 3.88 million shares for $187.01 million since March 2022, indicating strong capital management strategies amidst a forecasted revenue growth of 12.2% annually and projected earnings growth of 31.2%.

- Delve into the full analysis health report here for a deeper understanding of Cognex.

Assess Cognex's past performance with our detailed historical performance reports.

Clear Secure (NYSE:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clear Secure, Inc. operates a secure identity platform under the CLEAR brand name primarily in the United States and has a market cap of $4.01 billion.

Operations: Clear Secure generates revenue primarily from its Secure Biometric Identity Verification segment, amounting to $697.15 million. The company focuses on providing secure identity solutions in the United States.

Clear Secure's recent earnings report showcases robust growth with Q2 2024 sales hitting $186.75 million, a significant rise from $149.87 million the previous year. The company's strategic focus on expanding its TSA PreCheck enrollment locations and integrating CLEAR identity verification technology into various platforms highlights its commitment to enhancing security and user experience across industries. Notably, Clear Secure has repurchased 15.33 million shares for $300.04 million since May 2022, reflecting strong capital management strategies amidst forecasted revenue growth of 11.4% annually and projected earnings growth of 25.5%.

- Click to explore a detailed breakdown of our findings in Clear Secure's health report.

Evaluate Clear Secure's historical performance by accessing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 249 companies within our US High Growth Tech and AI Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.