- United States

- /

- Software

- /

- NasdaqGS:PEGA

A Fresh Look at Pegasystems (PEGA) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Pegasystems.

Pegasystems’ share price has not just rebounded over the past month; its 27.1% year-to-date price return and a very strong 36.6% total shareholder return over the past year point to real momentum building. Gains like these suggest that improving sentiment or better fundamentals might be driving renewed investor interest in the stock, especially after a period where longer-term total returns were less inspiring.

If this upswing has you watching what’s next, it could be an ideal moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Pegasystems’ shares climbing higher, investors now face the key question: is the current price a bargain reflecting untapped growth, or has the recent enthusiasm already factored in the company’s upside?

Most Popular Narrative: 19.2% Undervalued

With a narrative fair value of $73.09 versus a last close of $59.09, the most-watched view signals upside potential for Pegasystems, even after its recent rally. The spotlight is now on what could fuel the next move.

Pega's focus on AI and Pega Cloud services is driving revenue growth and client satisfaction, enhancing financial stability and recurring revenue. Shareholder value is expected to increase through share repurchases, debt-free status, and optimized capital allocation improving EPS.

Want to know the bold financial blueprint that is powering this valuation? It all comes down to ambitious margin expansion, steady sales growth, and a profit outlook that rivals sector leaders. Which closely-watched analyst assumptions might send this fair value even higher? See the surprising projections for yourself.

Result: Fair Value of $73.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Pega's competitive environment intensifies or cloud adoption falters, these risks could quickly undermine the current optimism and valuation outlook.

Find out about the key risks to this Pegasystems narrative.

Another View: Market Multiples Tell a Different Story

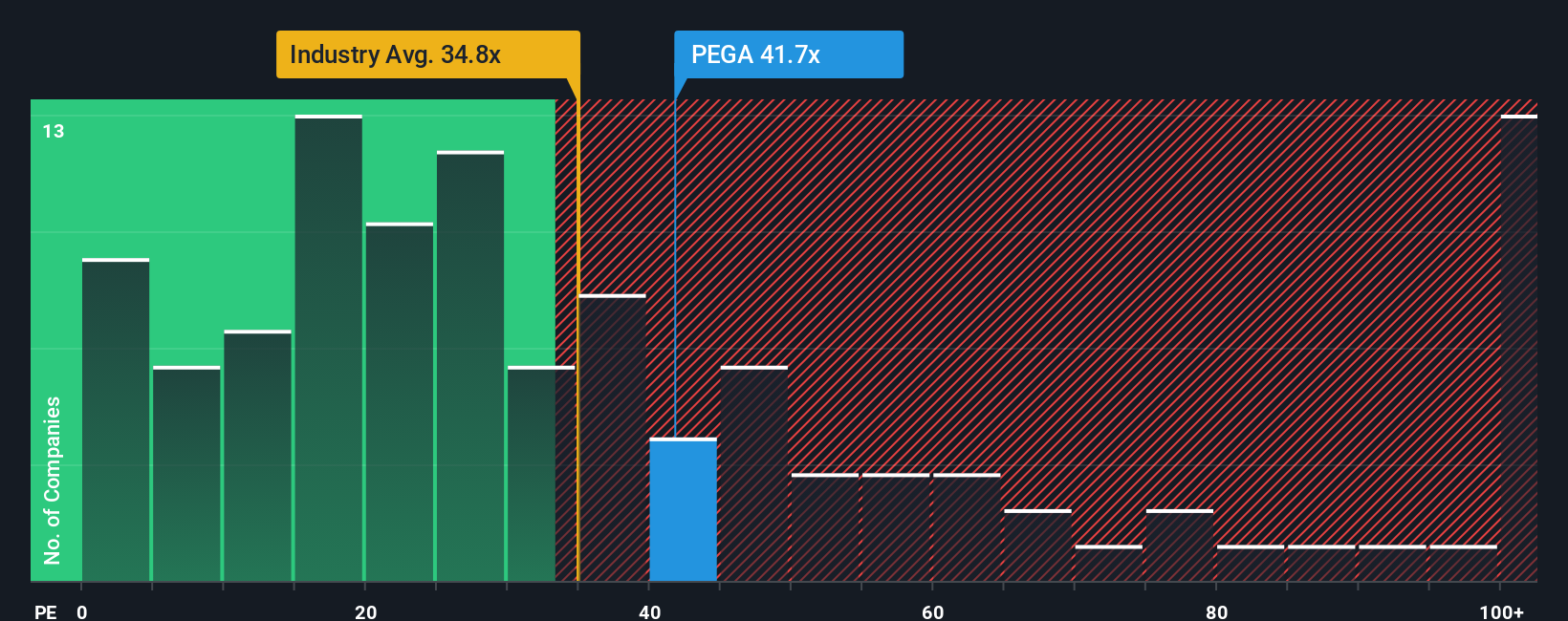

While narrative fair value suggests Pegasystems is undervalued, the market’s favored price-to-earnings ratio paints a less optimistic picture. Pegasystems trades at 36.1x, which is above the industry’s 34.3x and far above its fair ratio of 29.6x. This premium means investors are paying up, raising real questions about value risk if growth expectations slip. Which valuation lens do you trust most?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pegasystems Narrative

If you see Pegasystems differently or want to test your own assumptions against the latest data, you can easily build your narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pegasystems.

Looking for More Investment Ideas?

Your next big opportunity could be just a click away. Use these expert-picked screens to help you spot emerging winners before the crowd.

- Maximize your income by targeting stocks with strong yields. Check out these 16 dividend stocks with yields > 3% featuring returns above 3% and a track record of steady payouts.

- Tap into cutting-edge breakthroughs by seeing which innovators are shaping tomorrow’s medicine and tech with these 32 healthcare AI stocks.

- Energize your search for overlooked bargains with these 875 undervalued stocks based on cash flows to find undervalued gems based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives