- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (NasdaqGS:MSFT) Boosts Healthcare AI with New Azure Innovations and Strategic Alliances

Reviewed by Simply Wall St

Dive into the specifics of Microsoft here with our thorough analysis report.

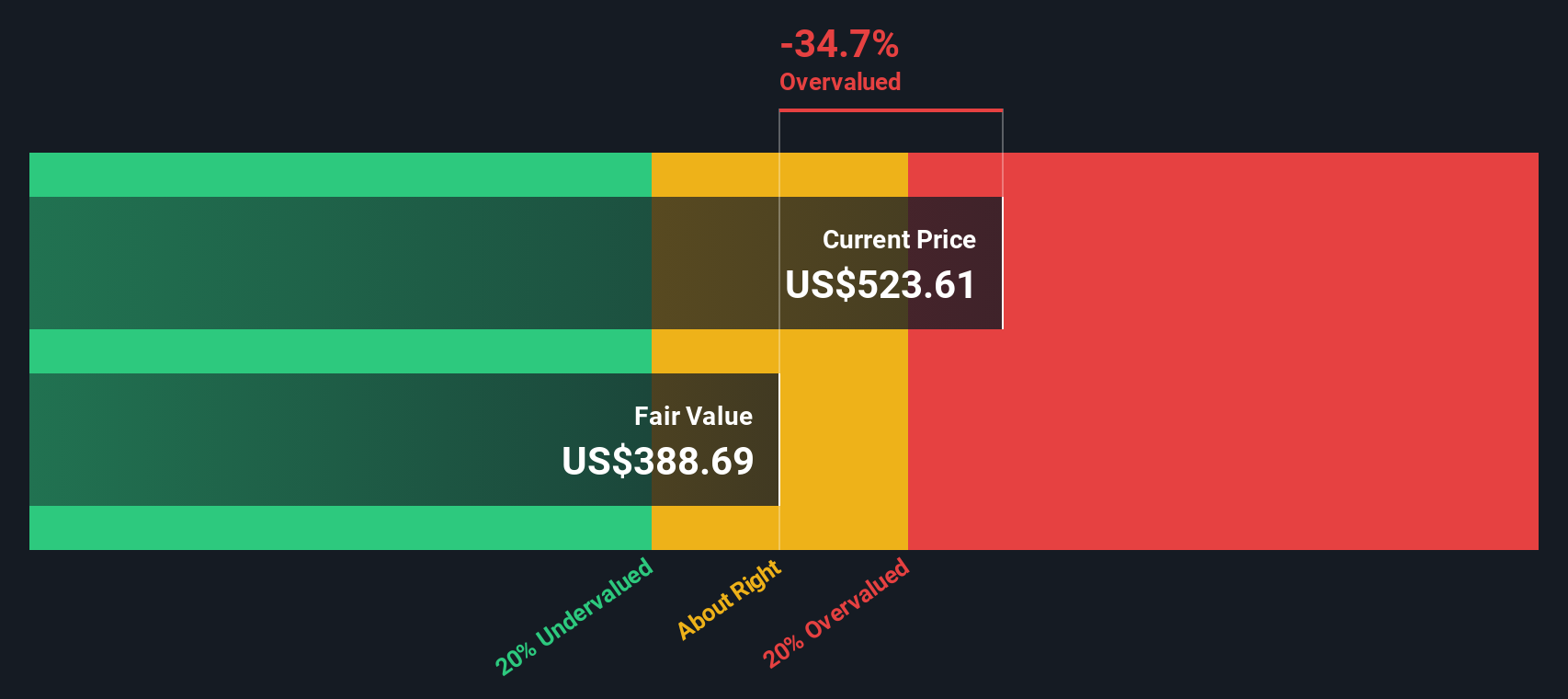

Innovative Factors Supporting Microsoft

Microsoft's financial health is underscored by its impressive cash flow from operations, which surpassed $100 billion for the first time, reaching $119 billion. This financial strength is further complemented by a 10% increase in quarterly dividends, reflecting a commitment to returning value to shareholders. The company's leadership, led by Satya Nadella, has been pivotal in driving revenue growth, with annual revenue exceeding $245 billion, marking a 15% year-over-year increase. Strategic alliances, such as those with Enbridge and Infosys, enhance Microsoft's market position by leveraging AI and cloud technologies for operational excellence and customer engagement. Despite being considered expensive based on its Price-To-Earnings Ratio of 35.3x compared to peers, Microsoft is trading below its estimated fair value of $573.39, currently priced at $419.14, indicating potential for future appreciation.

Internal Limitations Hindering Microsoft's Growth

Challenges persist with margin pressures, as the Microsoft Cloud gross margin percentage decreased by approximately 2 points year-over-year to 69%. Operating expenses have surged by 13%, partly due to the Activision acquisition, highlighting cost management issues. While Microsoft's earnings have grown by 15% annually over the past five years, its earnings growth of 21.8% in the last year lagged behind the software industry average of 23.3%. Furthermore, Microsoft's earnings are forecast to grow at 12.4% per year, slower than the US market's 15.9% growth rate. These factors, coupled with a Price-To-Earnings Ratio higher than the peer average, suggest that Microsoft faces significant financial challenges despite its strong market position.

Future Prospects for Microsoft in the Market

Microsoft is poised to capitalize on emerging opportunities through its strategic focus on AI and cloud expansion. The launch of new healthcare AI models in Azure AI Studio and innovations in Microsoft Fabric highlight the company's commitment to enhancing healthcare solutions. Additionally, the introduction of Copilot+ PCs and the expansion of LinkedIn's member growth and engagement further diversify Microsoft's product offerings. Strategic alliances, such as the partnership with KT Corporation, are expected to drive AI and ICT transformation, opening new avenues for growth. These initiatives, combined with Microsoft's seasoned management team, position the company to leverage market trends and maintain its competitive edge.

Regulatory Challenges Facing Microsoft

Microsoft faces several external threats, including intense competition from other tech giants like SAP and Oracle in the hyperscale cloud market. Economic factors, such as lower-than-expected growth in certain European regions, pose additional challenges. Capacity constraints in AI and a higher-than-anticipated effective tax rate due to retroactive state tax laws further complicate Microsoft's growth trajectory. Additionally, significant insider selling over the past three months raises concerns about internal confidence in the company's future prospects. These threats underscore the need for Microsoft to navigate regulatory and market dynamics carefully to sustain its growth momentum.

To gain deeper insights into Microsoft's historical performance, explore our detailed analysis of past performance.To dive deeper into how Microsoft's valuation metrics are shaping its market position, check out our detailed analysis of Microsoft's Valuation.Conclusion

Microsoft's financial prowess, evidenced by its substantial cash flow and increased dividends, positions it well for long-term shareholder value, even as its Price-To-Earnings Ratio of 35.3x suggests a premium compared to peers. However, its current market price of $419.14, below the estimated fair value of $573.39, indicates potential for price appreciation. While internal challenges such as declining cloud margins and rising expenses could temper growth, Microsoft's strategic focus on AI and cloud innovations, alongside key partnerships, offers promising avenues for expansion. Nevertheless, the company must adeptly navigate competitive pressures and regulatory hurdles to sustain its growth trajectory and capitalize on its market opportunities.

Next Steps

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.