- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT) Valuation: How AI Expansion and Cloud Investments Are Shaping the Future

Reviewed by Simply Wall St

User interest in Microsoft (MSFT) is climbing as the company doubles down on AI and cloud initiatives. The company has unveiled the MAI Superintelligence Team and is committing billions to expand data center infrastructure for future growth.

See our latest analysis for Microsoft.

Microsoft has been on a headline-making run with fresh earnings beats, splashy AI partnerships, and ambitious global investments, but the share price has eased off recent highs, slipping 2.7% over the past month and down 4.8% for the quarter. Although some investors are wary of the company’s record capital spending, Microsoft’s one-year total shareholder return stands at a robust 18.5%, and the company’s five-year total return is up a staggering 139%. The recent dip seems more like a pause for breath after an extended rally, not a sign of fading momentum, especially as demand for cloud and AI solutions keeps swelling.

If Microsoft’s AI breakthroughs have you thinking bigger, it could be the right moment to explore other leading tech and AI innovators. Check out See the full list for free..

The question now is whether Microsoft's recent pullback and significant investments present a rare window for investors to buy into the future of AI and cloud, or if the market has already priced in much of the anticipated growth.

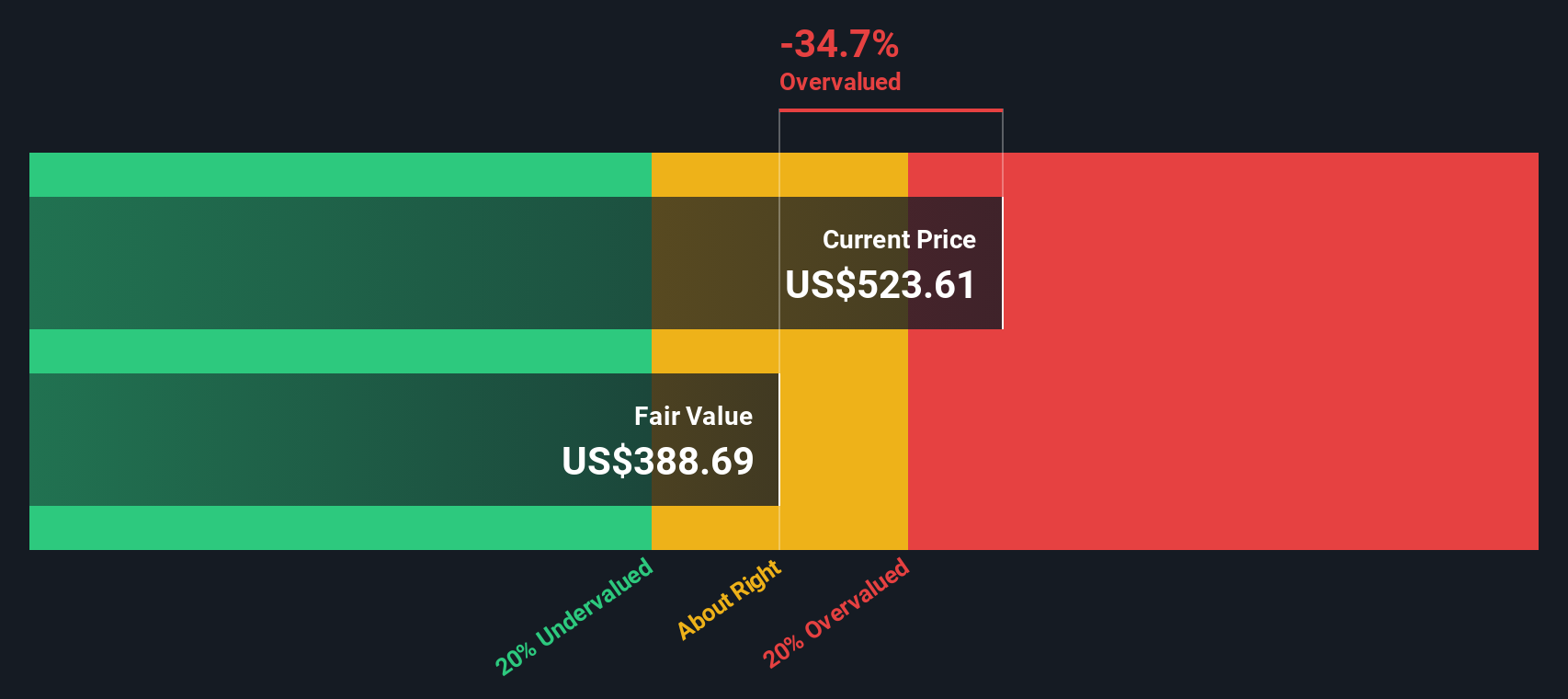

Most Popular Narrative: 38% Overvalued

The most popular narrative suggests that Microsoft’s current share price of $496.82 sits well above the fair value estimated by the narrative, signaling a stock trading at a significant premium driven by future growth hopes. The marker for this story is not a consensus analyst view. It is based on the detailed projections outlined by Broke_Joe, whose evaluation centers on Microsoft’s unique position in the AI and cloud revolution.

The key growth driver is the monetization of AI, especially through Copilot, which is being deeply embedded across core platforms such as Office, GitHub, and Dynamics. Azure continues to benefit from the rising demand for cloud and AI workloads. The Activision acquisition strengthens Microsoft’s position in gaming, and strategic pricing power across the SaaS suite offers additional upside.

Curious which aggressive revenue leaps and margin plays anchor this bold projection? The most watched narrative hinges on future profitability rarely seen outside the hottest tech disruptors. Think you know which key drivers are boosting this massive valuation gap? Dive in to uncover the surprising math and market bets fueling the story.

Result: Fair Value of $360.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed AI monetization or mounting regulatory pressure could challenge Microsoft's pace. This could potentially trigger a reassessment of the current bullish outlook.

Find out about the key risks to this Microsoft narrative.

Another View: Discounted Cash Flow Signals Undervaluation

While the most popular narrative argues the stock is overvalued compared to its long-term growth prospects, our DCF model presents a different perspective. According to this method, Microsoft's share price of $496.82 is approximately 17.6% below our fair value estimate of $602.75. This indicates there may be untapped upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Microsoft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Microsoft Narrative

If you like to challenge the prevailing view or want to dig into the metrics yourself, you can craft your own narrative in under three minutes: Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your advantage by taking action now with Simply Wall Street's powerful screener tools. Miss these ideas today, and you could miss the next top performer tomorrow.

- Jump on proven cash flow opportunities by evaluating these 876 undervalued stocks based on cash flows, which trade below their intrinsic value.

- Capture the next wave of medical breakthroughs by targeting these 32 healthcare AI stocks, combining innovation with real sector growth potential.

- Grow your income streams by selecting these 16 dividend stocks with yields > 3%, boasting reliable yields that thrive even when markets get bumpy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives