- United States

- /

- Software

- /

- NasdaqGS:MSFT

Is Microsoft’s Valuation Justified After Recent AI Partnership Headlines?

Reviewed by Bailey Pemberton

- Wondering if Microsoft is still a good deal or if recent highs are painting an overvalued picture? Let's cut through the noise and get straight to the numbers that matter.

- Despite climbing an impressive 18.5% over the past year and delivering a stellar 139.3% return over five years, Microsoft's stock has recently dipped 4.1% in the last week and 5.3% over the past month, hinting at shifting sentiment or new risks in play.

- Several headlines have stirred the waters lately, including Microsoft's expanding push into AI partnerships and cloud acquisitions. These developments reflect both innovation and increased competition in the tech space. They have kept investors on their toes, searching for clues about Microsoft's next phase of growth.

- When we distill it down to valuation, Microsoft scores 4 out of 6 on our valuation checks, suggesting it is undervalued in more areas than not. We'll break down what that score really means using a range of valuation methods and, at the end, reveal a fresh perspective that can help you make even more confident decisions.

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to today’s value. The goal is to estimate what the business is really worth in the present, rather than what it trades for in the market. This approach is widely used to determine whether a stock is undervalued or overvalued based on its real earning power over time.

For Microsoft, analysts estimate current Free Cash Flow at $89.4 billion. Looking forward, projections see substantial growth, with Microsoft’s annual Free Cash Flow expected to reach $206.2 billion by 2030. While analyst coverage typically stops at five years, further projections are extrapolated and provide a glimpse into Microsoft’s long-term cash generation potential.

Using these inputs, the DCF calculation from Simply Wall St arrives at an intrinsic value of $602.60 per share. With Microsoft currently trading around 17.6% below this estimated fair value, the DCF suggests the stock is undervalued relative to the company’s future cash-generating abilities.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Microsoft is undervalued by 17.6%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Microsoft Price vs Earnings (P/E)

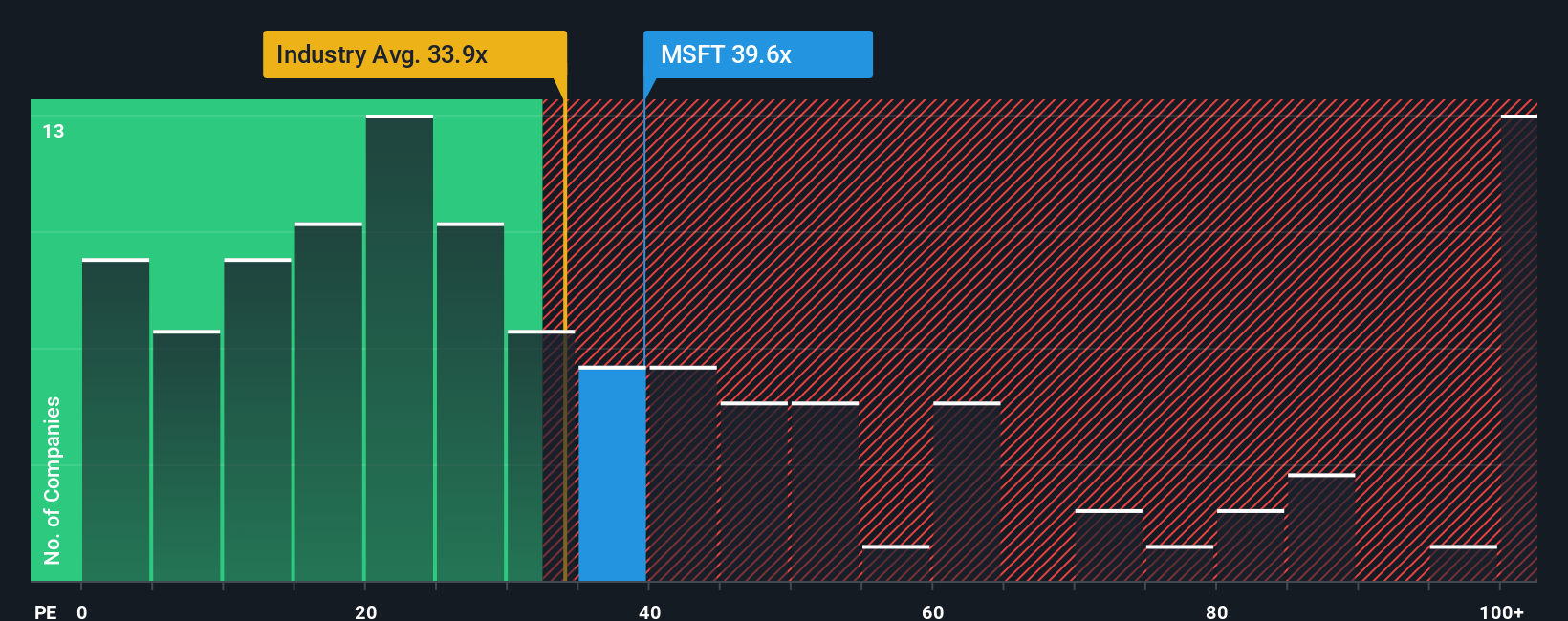

The Price-to-Earnings (P/E) ratio is one of the most popular tools for valuing a profitable company like Microsoft because it connects a company’s share price to its actual earnings. For established businesses generating consistent profits, investors often rely on the P/E as a quick way to check if a stock is priced reasonably compared to its earning power.

It's important to note that a “normal” or “fair” P/E ratio isn’t one-size-fits-all. Higher growth prospects, superior profit margins, or lower risk can justify a higher multiple, while slower growth or additional risks should pull the benchmark down. Industry averages and peer ratios offer some context, but they do not always capture a company’s unique strengths or challenges.

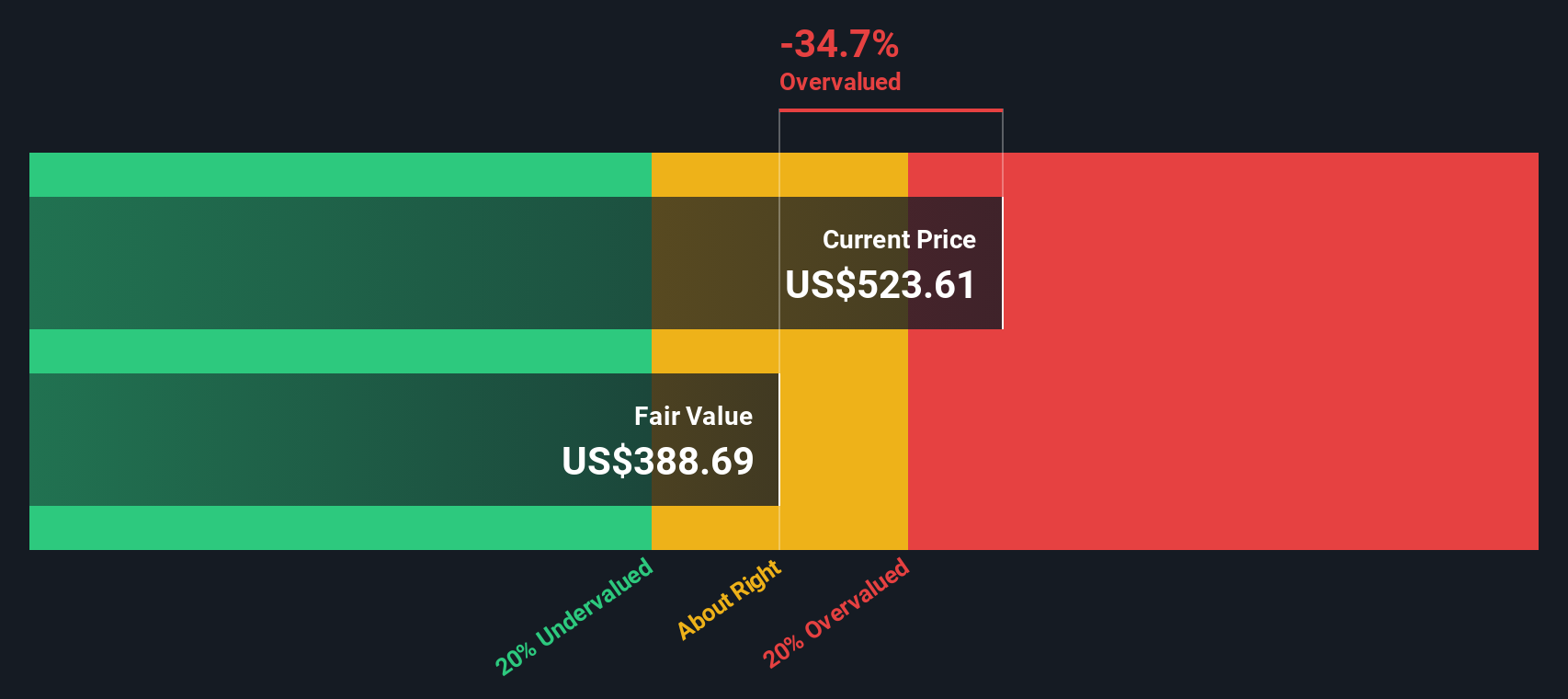

Currently, Microsoft trades at a P/E of 35.2x, which is very close to its peer group average of 36.0x and a little above the software industry average of 34.3x. However, Simply Wall St’s Fair Ratio, a proprietary measure that factors in Microsoft’s earnings growth, margin strength, market capitalization, industry, and risk profile, suggests a fair value closer to 57.4x. This Fair Ratio is a more nuanced benchmark than peer or industry averages because it directly considers Microsoft’s growth outlook and quality relative to the market.

With Microsoft’s current P/E multiple significantly below its Fair Ratio, the numbers indicate the stock is undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microsoft Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic approach used by millions of investors on Simply Wall St’s Community page.

A Narrative is essentially the story you believe about a company, your perspective on Microsoft’s business model, future prospects, and risks, paired with your own assumptions for its fair value, future revenue, earnings, and margins.

This means you connect the bigger story of where you think Microsoft is heading with a detailed financial forecast, creating a fair value that reflects your own expectations rather than just relying on market sentiment or “one size fits all” metrics.

Narratives make investment decisions clearer and more actionable by letting you easily compare your Fair Value with the current market Price, helping you decide if it’s the right time to buy, hold, or sell.

Even better, Narratives update automatically as new news, earnings, or events emerge, so your investment view always stays fresh and relevant.

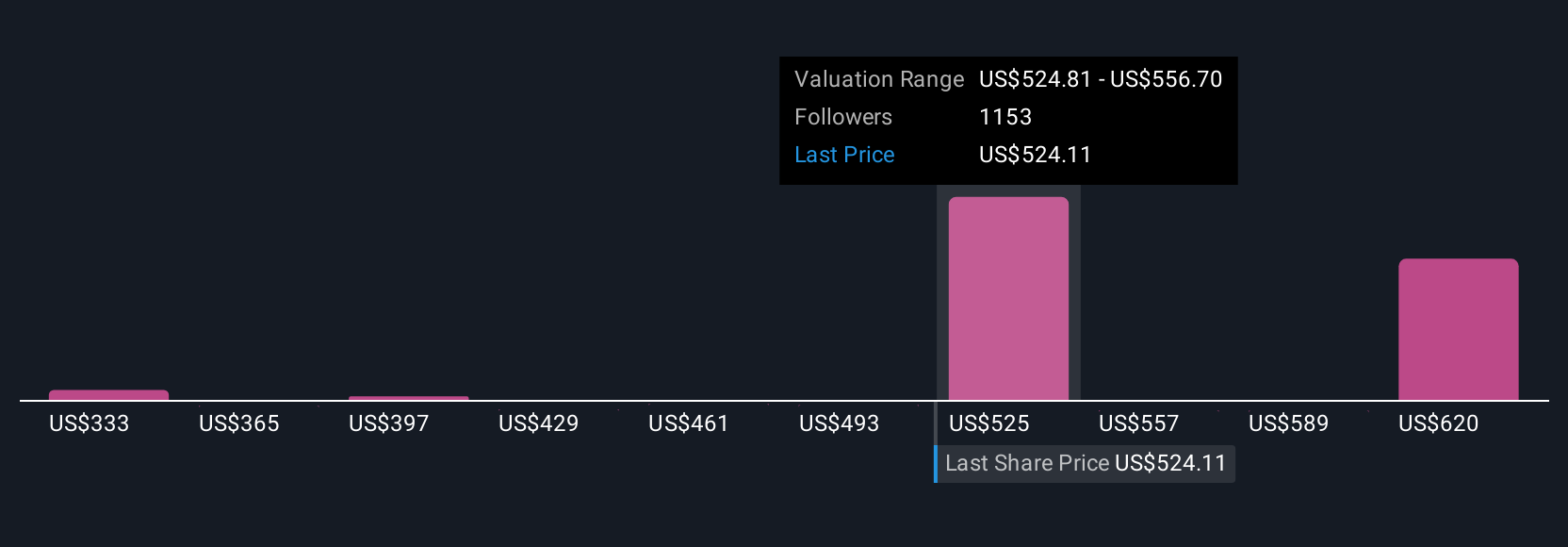

For example, some investors believe Microsoft’s fair value is as low as $333 per share, citing headwinds and margin risks, while others see potential for $626 or more based on AI and cloud growth. Narratives let you see, compare, and track these different views, all in one place.

For Microsoft, we'll make it really easy for you with previews of two leading Microsoft Narratives:

Fair Value: $500.00

Undervalued by about 0.6%

Projected Revenue Growth Rate: 6.75%

- Questions the sustainability of Microsoft’s recent AI-driven valuation jumps. Highlights potential headwinds including a shrinking PC market, weak gaming division, and risks within its AI strategy.

- Points out that massive investments in datacenters for AI, ongoing layoffs, and a slide in employee morale could hamper future growth and innovation.

- Adopts a cautious tone. Suggests Microsoft’s competitive position faces a series of mounting business, financial, and organizational challenges that could pressure future returns.

Fair Value: $333.48

Overvalued by about 49%

Projected Revenue Growth Rate: 9.5%

- Remains bullish on Microsoft's future, driven by expansion of cloud and productivity suites, continued integration of AI, and leveraging SaaS leadership in enterprise software.

- Estimates strong long-term growth in Teams, LinkedIn, and Azure. Projects revenue of $365.6B by 2028 with profit margins improving to 38% and robust buybacks increasing shareholder value.

- Acknowledges risks, including cloud market maturation, competitive innovation, possible antitrust scrutiny, and challenges growing from an already high profit base. Ultimately expects Microsoft to grow into its current premium valuation as AI opportunities materialize.

Do you think there's more to the story for Microsoft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives