- United States

- /

- Trade Distributors

- /

- NYSE:ZKH

3 Growth Companies With High Insider Ownership And Earnings Growth Up To 122%

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight uptick following a break in its five-session winning streak, investors are paying close attention to sectors like technology and cryptocurrency, which have shown notable rebounds. In this environment, growth companies with high insider ownership can present intriguing opportunities due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

We'll examine a selection from our screener results.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd., along with its subsidiaries, develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of $7.73 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, generating $1.17 billion.

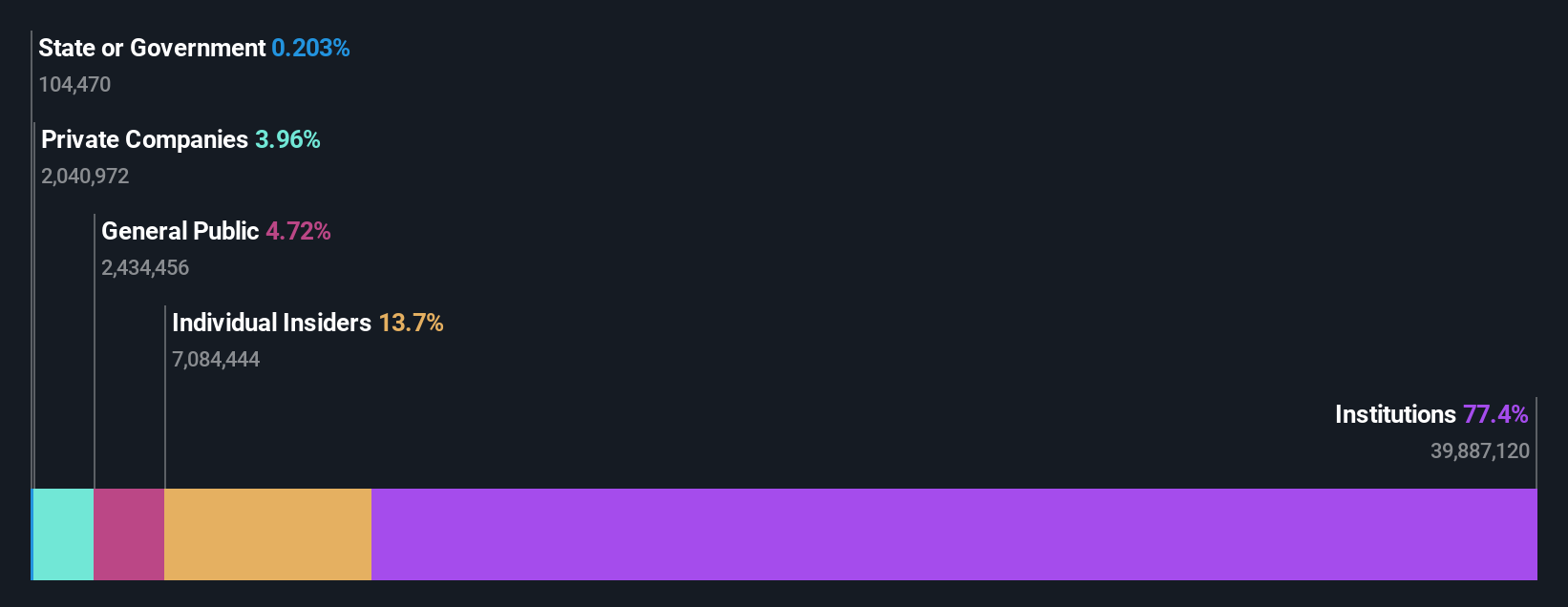

Insider Ownership: 13.7%

Earnings Growth Forecast: 32.4% p.a.

monday.com is experiencing significant growth, with earnings projected to rise substantially above the market average. Despite trading below its estimated fair value, the company's revenue growth is expected to outpace the broader US market. Recent partnerships with high-profile teams like Bonds Flying Roos underscore its strategic expansion efforts. Noteworthy product innovations and a substantial share repurchase program further highlight monday.com's commitment to enhancing shareholder value and operational efficiency in a competitive tech landscape.

- Get an in-depth perspective on monday.com's performance by reading our analyst estimates report here.

- Our valuation report here indicates monday.com may be undervalued.

New Fortress Energy (NFE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: New Fortress Energy Inc. is an integrated gas-to-power energy infrastructure company offering energy and development services globally, with a market cap of $372.76 million.

Operations: The company generates revenue from its Ships segment, contributing $145.03 million, and its Terminals and Infrastructure segment, which brings in $1.53 billion.

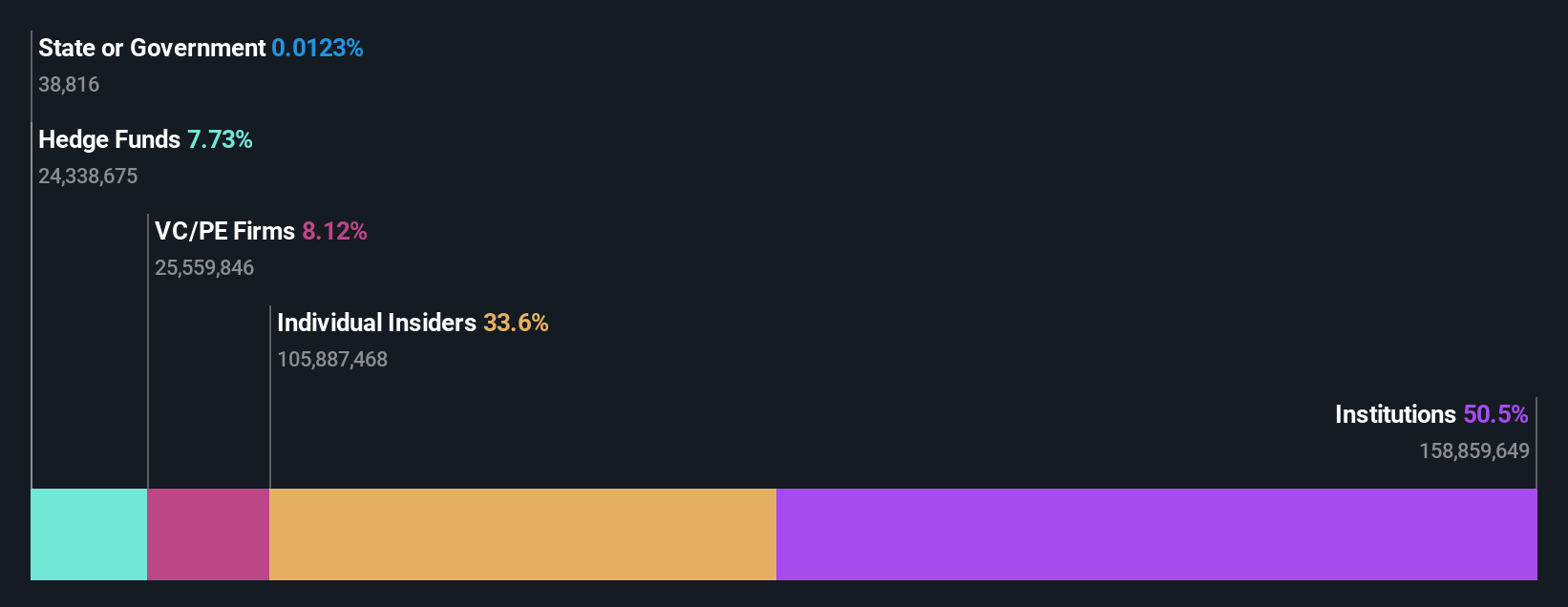

Insider Ownership: 36.9%

Earnings Growth Forecast: 97.1% p.a.

New Fortress Energy faces financial challenges, with a significant net loss reported for recent quarters and ongoing debt restructuring efforts. Despite these hurdles, the company is positioned for substantial growth, with revenue forecasted to grow at 24.7% annually—outpacing the US market. Recent operational milestones in Brazil and a long-term LNG supply agreement in Puerto Rico highlight strategic expansions. However, its volatile share price and delayed SEC filings underscore potential risks amidst its growth trajectory.

- Take a closer look at New Fortress Energy's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that New Fortress Energy is priced lower than what may be justified by its financials.

ZKH Group (ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for maintenance, repair, and operating (MRO) products in China, offering items like spare parts and office supplies, with a market cap of $535.38 million.

Operations: The company's revenue is primarily derived from its Business-To-Business Trading and Services of Industrial Products segment, which generated CN¥8.80 billion.

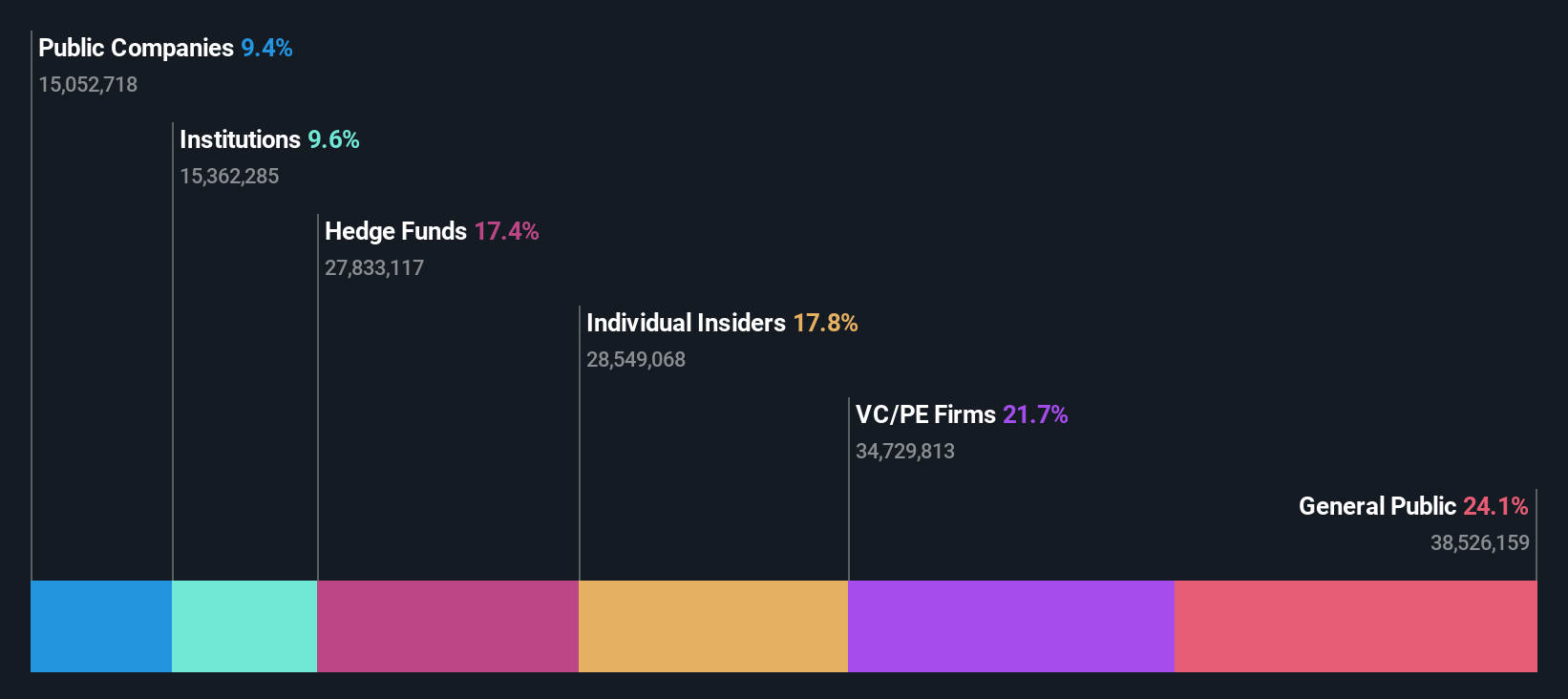

Insider Ownership: 17.8%

Earnings Growth Forecast: 122.1% p.a.

ZKH Group's revenue for Q3 2025 increased to CNY 2.33 billion, with a reduced net loss of CNY 24.31 million, indicating improved financial performance. The company is expected to become profitable in three years and shows strong earnings growth potential at over 122% annually, outperforming the US market average. Trading significantly below its estimated fair value and with no recent insider trading activity, ZKH presents a compelling investment case despite slower revenue growth projections.

- Navigate through the intricacies of ZKH Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility ZKH Group's shares may be trading at a discount.

Key Takeaways

- Investigate our full lineup of 200 Fast Growing US Companies With High Insider Ownership right here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if ZKH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZKH

ZKH Group

Develops and operates a maintenance, repair, and operating (MRO) products trading and service platform that offers spare parts, chemicals, manufacturing parts, general consumables, and office supplies in the People’s Republic of China.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026