- United States

- /

- IT

- /

- NasdaqGM:MDB

AI Cloud Momentum Could Be a Game Changer for MongoDB (MDB)

Reviewed by Sasha Jovanovic

- Earlier this week, MongoDB received renewed attention after being named Investor's Business Daily's Stock of the Day, following ongoing enthusiasm over its Atlas cloud platform's role in supporting AI workloads and positive market sentiment for tech stocks.

- What stands out is how MongoDB's focus on integrating AI features and streamlining data processes within Atlas has positioned the company at the forefront of enterprise cloud adoption, particularly as organizations seek scalable solutions for AI deployment.

- Let's explore how MongoDB's growing traction in AI-enabled cloud infrastructure could shape its broader investment outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MongoDB Investment Narrative Recap

To be a MongoDB shareholder, you need to believe that demand for cloud-native, AI-enabled data infrastructure will drive sustained adoption of Atlas, supporting continued revenue growth and improvement in profitability. While upbeat recent news and share price momentum reflect growing enthusiasm for AI workloads and cloud migration, the primary short-term catalyst remains enterprise uptake of Atlas' new AI features. The biggest risk continues to be rising competition from hyperscalers and open-source alternatives, and the week’s events have not materially changed that outlook.

Of the recent announcements, the launch of MongoDB AMP, an AI-powered application modernization platform, most directly relates to the company’s positioning in the AI infrastructure space. For investors watching near-term catalysts, AMP represents MongoDB’s focus on driving deeper adoption within large enterprises as organizations look to modernize legacy applications for AI deployments, adding to the relevance of its recent Atlas investments.

But on the other hand, investors should also keep in mind the risk that growing traction with major enterprises may eventually slow, especially if existing customers...

Read the full narrative on MongoDB (it's free!)

MongoDB's narrative projects $3.5 billion in revenue and $5.0 million in earnings by 2028. This requires 16.8% yearly revenue growth and an $83.6 million earnings increase from the current earnings of -$78.6 million.

Uncover how MongoDB's forecasts yield a $350.80 fair value, a 8% upside to its current price.

Exploring Other Perspectives

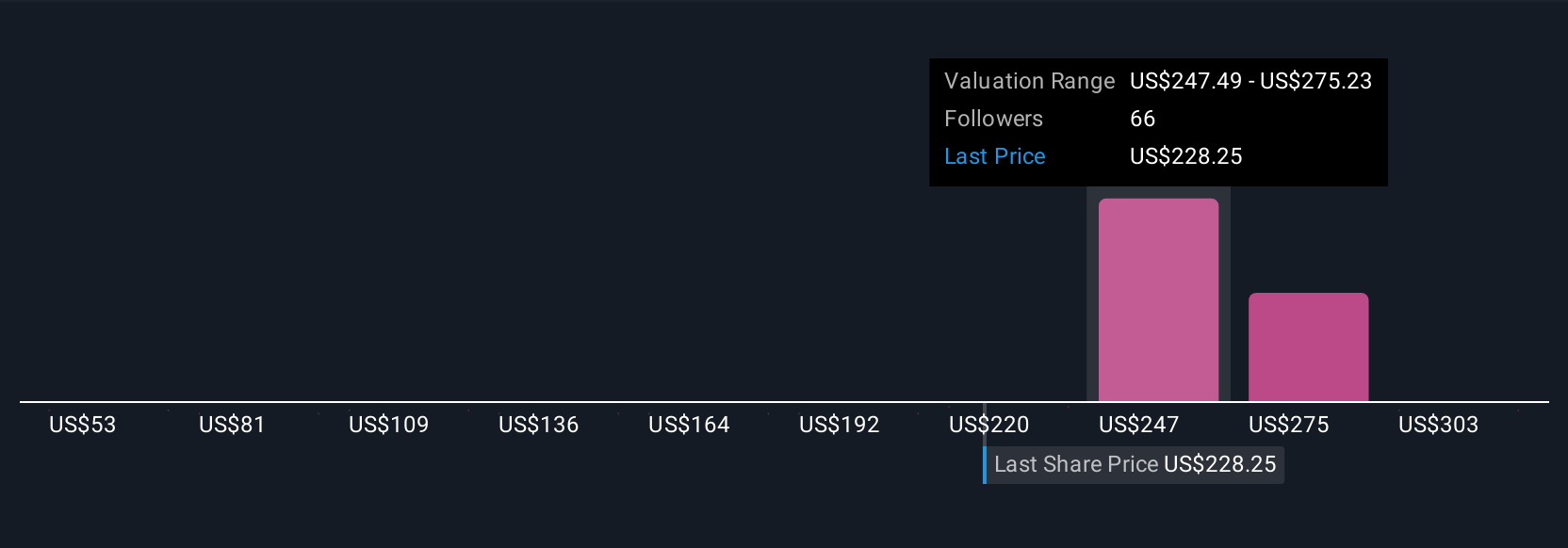

Simply Wall St Community members have set fair value estimates for MongoDB ranging from US$130.20 to US$394.78 across 11 viewpoints. With rising competition from cloud providers and open-source, it is important to compare these diverse assessments and consider how shifts in enterprise workload expansion may affect future opportunities.

Explore 11 other fair value estimates on MongoDB - why the stock might be worth less than half the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives