- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (MARA) Eyes West Texas Energy Integration Will AI Ambitions Redefine Its Core Business?

Reviewed by Sasha Jovanovic

- In the past week, MPLX LP and MARA Holdings, Inc. jointly announced the signing of a letter of intent for MPLX to supply natural gas to MARA’s upcoming integrated power generation facilities and data center campuses in West Texas, starting with 400 MW and potentially scaling to 1.5 GW. MARA Holdings will own and operate these facilities, signaling a shift from pure bitcoin mining toward providing scalable computing power and energy solutions for both digital and industrial clients.

- This marks an important step in MARA’s evolution, as the company expands into energy-integrated AI and high-performance computing infrastructure while leveraging West Texas’s natural gas resources to power advanced data centers.

- We'll assess how MARA's move to vertically integrate power generation with AI and data center growth could reshape its investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MARA Holdings Investment Narrative Recap

For shareholders of MARA Holdings, the core belief centers on the company's ability to evolve from a bitcoin mining pure play into a vertically integrated provider of power and compute solutions for AI and digital industries. The new MPLX partnership adds visibility to this shift, but in the near term, the biggest driver remains bitcoin price volatility, while the main risk continues to be heavy dependence on mining economics; this announcement does not fundamentally change either.

Of all recent news, the Q3 2025 earnings release stands out, with MARA reporting a record US$252.41 million in quarterly sales and a swing to US$123.13 million net income. These results highlight the company's operating leverage and reinforce why short-term progress in diversifying beyond bitcoin remains closely tied to the performance and stability of its mining operations.

Yet, investors should be aware that despite these growth signals, the company’s exposure to bitcoin prices still means...

Read the full narrative on MARA Holdings (it's free!)

MARA Holdings' outlook anticipates $1.1 billion in revenue and $31.5 million in earnings by 2028. This implies an annual revenue growth rate of 12.4%, but a sharp decrease in earnings of $647.3 million from the current $678.8 million.

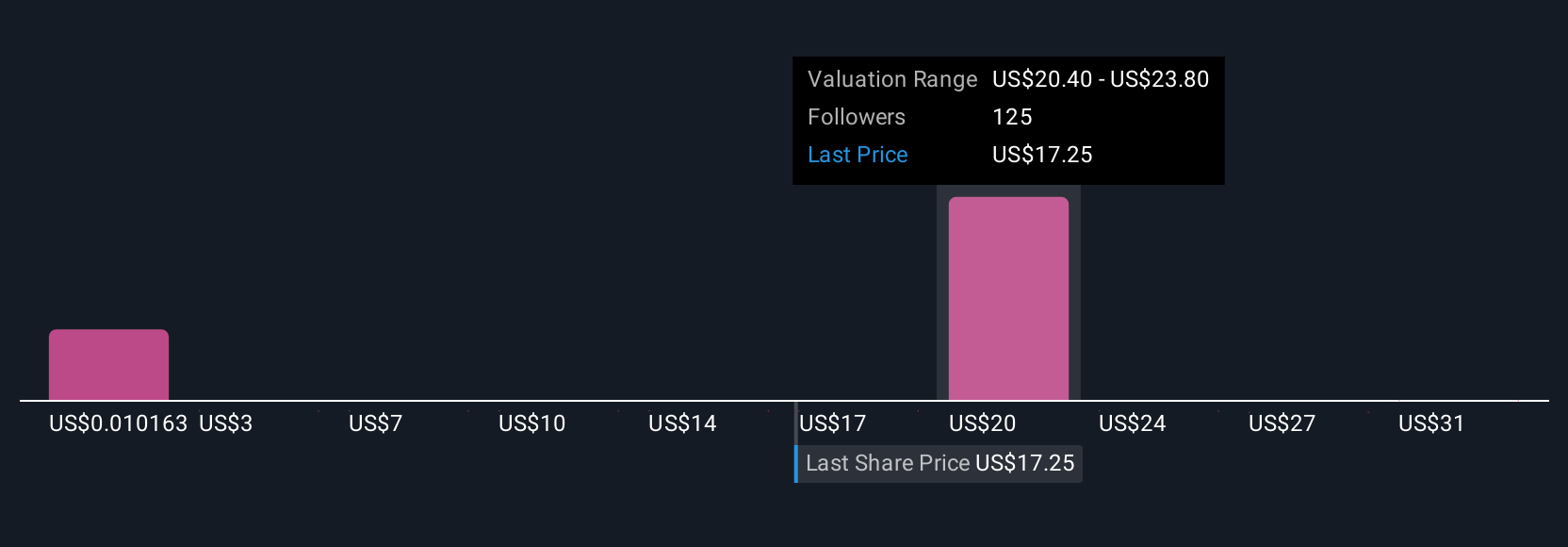

Uncover how MARA Holdings' forecasts yield a $24.14 fair value, a 52% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate MARA Holdings’ fair value anywhere from US$18 to US$28 per share, with 9 diverse viewpoints represented. The company’s ongoing reliance on bitcoin mining for revenue reminds us that future earnings may remain unpredictable as market forces shift.

Explore 9 other fair value estimates on MARA Holdings - why the stock might be worth just $18.00!

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MARA Holdings' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives