- United States

- /

- Software

- /

- NasdaqGS:MANH

Manhattan Associates (MANH): Evaluating Valuation After Strong Q3 Results and Upgraded Full-Year Guidance

Reviewed by Simply Wall St

Manhattan Associates (MANH) shares are getting attention after the company reported stronger sales in the third quarter, supported by steady growth in cloud and services revenue. Management also slightly increased their guidance for the year.

See our latest analysis for Manhattan Associates.

While Manhattan Associates is making headlines for its strong cloud-driven quarter and fresh federal contract wins, the market has been more cautious. After a rocky few months capped by a recent earnings report and executive hire, the 1-year total shareholder return stands at -31.1%, with momentum still subdued compared to the stock's impressive three- and five-year runs. The latest dip in the share price hints at shifting risk perceptions, but long-term holders have still been well rewarded over time.

If you’re weighing where growth and leadership transitions meet, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether recent declines have set up Manhattan Associates for a rebound, or if the company’s long-term prospects are already factored into today’s share price. This could leave little room for upside.

Price-to-Earnings of 50.8x: Is it justified?

Manhattan Associates currently trades at a price-to-earnings multiple of 50.8x, significantly above both the US Software industry average and its own fair value estimate. The latest close was $182.07, compared to a sector that trades on far more modest valuation levels and a fair P/E that is considerably lower.

The price-to-earnings ratio (P/E) gauges how much investors are willing to pay today for each dollar of current earnings. In the dynamic world of software, high multiples often reflect market optimism about future growth potential and profitability, especially for companies enjoying secular demand trends or strong competitive positions.

However, Manhattan Associates stands out as expensive right now. Its 50.8x P/E looks steep versus the US Software industry average of 34.1x and the estimated fair P/E of 31.9x. This could mean that the market expects ongoing growth or margin expansion above typical industry levels. If not, the shares might be at risk of a correction toward more reasonable valuation territory.

Explore the SWS fair ratio for Manhattan Associates

Result: Price-to-Earnings of 50.8x (OVERVALUED)

However, slowing momentum and the high valuation could trigger further volatility if the company’s growth or profitability does not keep pace with expectations.

Find out about the key risks to this Manhattan Associates narrative.

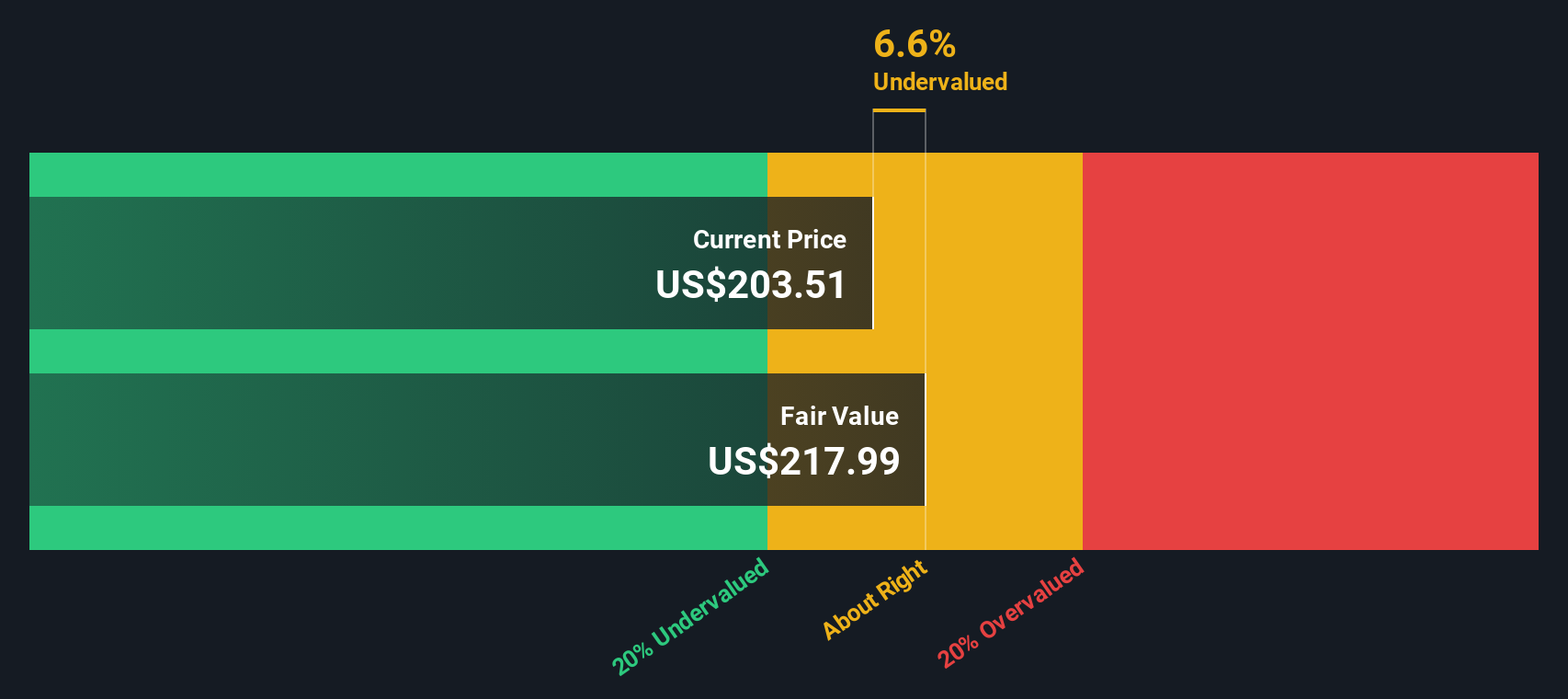

Another View: Discounted Cash Flow Signals Upside

While the market is demanding a steep premium for Manhattan Associates right now, our DCF model suggests a different story. The SWS DCF model estimates fair value at $219.71, roughly 17% higher than the current share price. This hints that despite the high price-to-earnings ratio, there could be overlooked value here. Could the market be overly pessimistic in the short term, or is the DCF too optimistic about future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Manhattan Associates for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Manhattan Associates Narrative

If you have a different view on these figures or want to dig deeper yourself, it takes just a few minutes to craft your own take on Manhattan Associates. So why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Manhattan Associates.

Looking for more investment ideas?

Smart investors know that sticking to one stock can mean missing out on big winners elsewhere. Make your next move with these high-potential investment screens and stay ahead of the curve.

- Unlock potential in artificial intelligence by following companies already making breakthroughs with these 26 AI penny stocks before they hit the mainstream spotlight.

- Tap into regular income by finding top-performing opportunities among these 22 dividend stocks with yields > 3% that reward investors with healthy, reliable yields.

- Seize the moment on quality bargains by targeting these 832 undervalued stocks based on cash flows positioned for future growth based on fundamental cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MANH

Manhattan Associates

Develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives