- United States

- /

- Software

- /

- NasdaqGS:MANH

A Look at Manhattan Associates's Valuation Following New FedRAMP Authorization for Federal Cloud Solutions

Reviewed by Simply Wall St

Manhattan Associates (MANH) has just hit a new milestone, securing FEMA authorization for its Warehouse Management System under the FedRAMP program. This certification could open up more opportunity among federal agencies and contractors seeking secure and compliant cloud solutions.

See our latest analysis for Manhattan Associates.

While Manhattan Associates’ FedRAMP milestone sets the stage for new federal partnerships, investors have reason to watch the stock closely. The share price has come under pressure, down almost 34% year-to-date, with momentum clearly fading after a 1-year total shareholder return of minus 37%. However, the longer-term track record remains strong, posting a total shareholder return of 91% over five years.

If you’re interested in discovering other software companies showing strong momentum and insider conviction, it’s a great time to check out fast growing stocks with high insider ownership.

With the stock trading at a significant discount to analyst targets after recent declines, the question is whether this represents a compelling entry point as future growth prospects improve, or if the market has already factored in the next chapter.

Price-to-Earnings of 49.5x: Is it justified?

Manhattan Associates trades at a price-to-earnings (P/E) ratio of 49.5 times, which is a notable premium over both peer and industry averages, even after the recent slide in its share price.

The P/E ratio measures how much investors are willing to pay for each dollar of the company's earnings. For software firms, a higher P/E can sometimes be justified by exceptional profitability or future growth potential, but it also raises the bar for performance expectations.

Compared to the US Software industry average of 33.5x and a peer group average of 39.4x, Manhattan Associates looks distinctly expensive. Even relative to the fair P/E ratio estimate of 32.1x, the stock commands a much higher multiple. Unless future earnings growth strongly accelerates, this valuation leaves little room for error.

Explore the SWS fair ratio for Manhattan Associates

Result: Price-to-Earnings of 49.5x (OVERVALUED)

However, slower revenue growth or disappointing earnings could quickly challenge the market’s optimism and have an impact on Manhattan Associates’ premium valuation.

Find out about the key risks to this Manhattan Associates narrative.

Another View: What Does the SWS DCF Model Suggest?

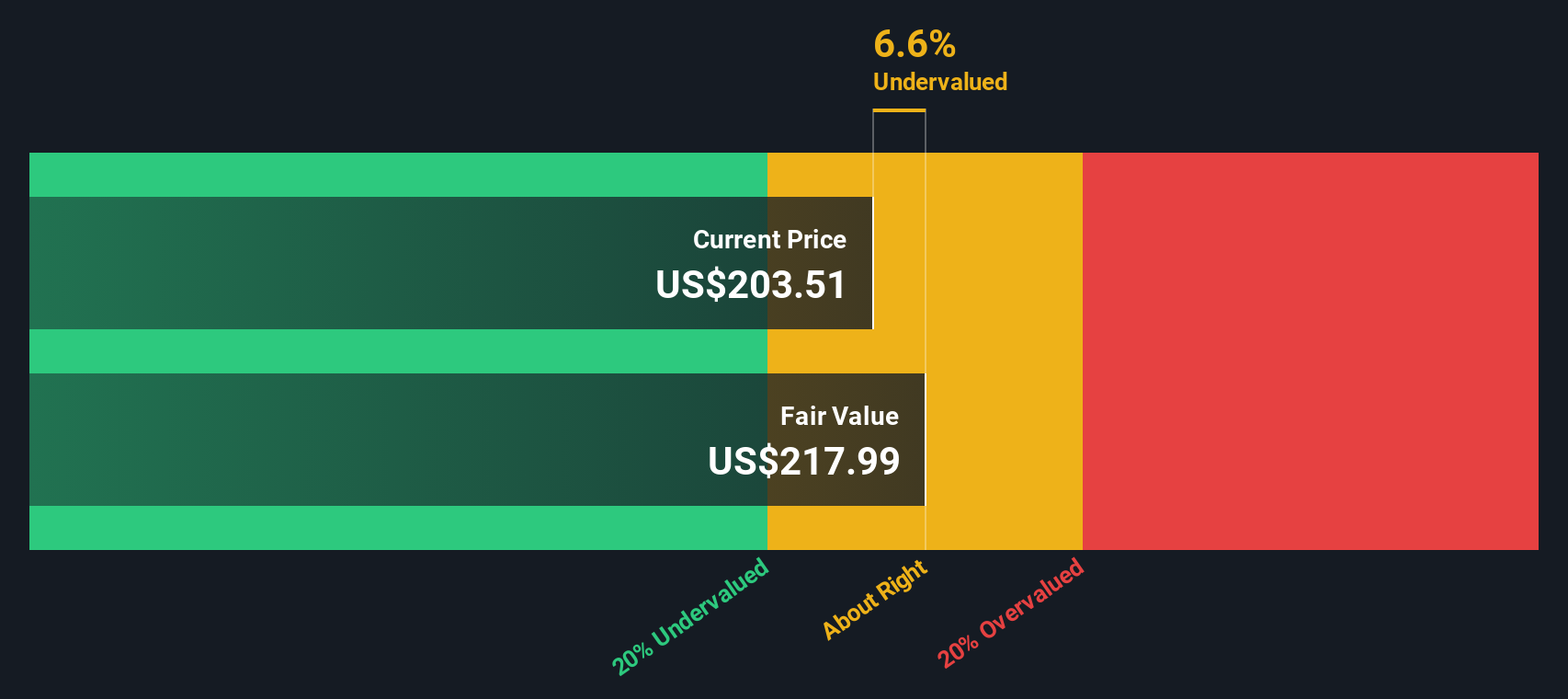

Shifting from multiples to our SWS DCF model, Manhattan Associates appears undervalued at current levels. The stock trades about 20.8% below our estimate of fair value, using future cash flows as the anchor. This raises the question of whether the market is being overly pessimistic or overlooking new risks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Manhattan Associates for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Manhattan Associates Narrative

Whether you have a different perspective or want to dive deeper into the numbers, you can easily craft your own investment thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Manhattan Associates.

Looking for more investment ideas?

Smart investors stand out by always knowing where momentum is building and which trends hold real potential. Don’t miss your chance to grab the next opportunity. Let the Simply Wall Street Screener show you what’s possible today.

- Find companies outpacing the competition with explosive value potential by checking out these 876 undervalued stocks based on cash flows.

- Capture the future of healthcare advancements by exploring breakthroughs through these 32 healthcare AI stocks.

- Supercharge your portfolio with high-yielding income. Start with these 16 dividend stocks with yields > 3% and see which stocks are delivering the best returns right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MANH

Manhattan Associates

Develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives