- United States

- /

- IT

- /

- NasdaqGS:KC

Optimistic Investors Push Kingsoft Cloud Holdings Limited (NASDAQ:KC) Shares Up 52% But Growth Is Lacking

Kingsoft Cloud Holdings Limited (NASDAQ:KC) shares have continued their recent momentum with a 52% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 93% in the last year.

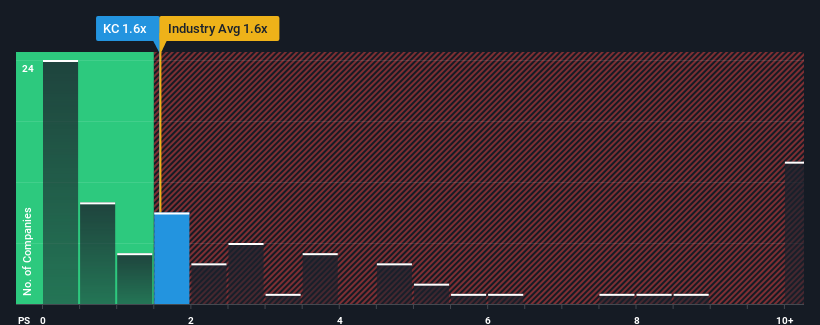

In spite of the firm bounce in price, it's still not a stretch to say that Kingsoft Cloud Holdings' price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the IT industry in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Kingsoft Cloud Holdings

What Does Kingsoft Cloud Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Kingsoft Cloud Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying to much for the stock.

Keen to find out how analysts think Kingsoft Cloud Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Kingsoft Cloud Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.7%. Even so, admirably revenue has lifted 107% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 9.2% each year as estimated by the ten analysts watching the company. That's shaping up to be materially lower than the 14% per year growth forecast for the broader industry.

With this information, we find it interesting that Kingsoft Cloud Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Kingsoft Cloud Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Kingsoft Cloud Holdings' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Plus, you should also learn about these 2 warning signs we've spotted with Kingsoft Cloud Holdings.

If these risks are making you reconsider your opinion on Kingsoft Cloud Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Undervalued with imperfect balance sheet.

Market Insights

Community Narratives