- United States

- /

- IT

- /

- NasdaqGS:KC

Kingsoft Cloud Holdings Limited's (NASDAQ:KC) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Kingsoft Cloud Holdings Limited (NASDAQ:KC) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 295% in the last twelve months.

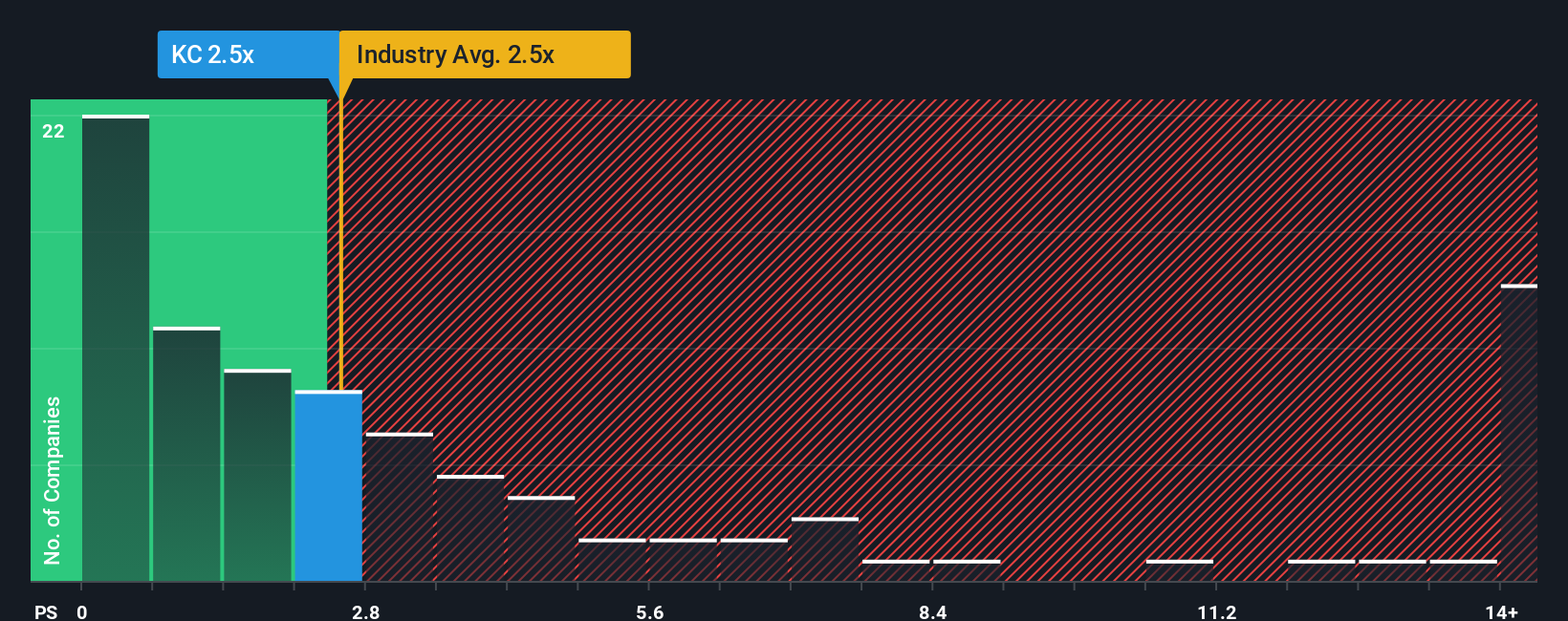

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Kingsoft Cloud Holdings' P/S ratio of 2.5x, since the median price-to-sales (or "P/S") ratio for the IT industry in the United States is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Kingsoft Cloud Holdings

How Kingsoft Cloud Holdings Has Been Performing

Kingsoft Cloud Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Kingsoft Cloud Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Kingsoft Cloud Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 15% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 20% each year during the coming three years according to the twelve analysts following the company. With the industry predicted to deliver 20% growth per year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Kingsoft Cloud Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Kingsoft Cloud Holdings' P/S?

Following Kingsoft Cloud Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Kingsoft Cloud Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the IT industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Having said that, be aware Kingsoft Cloud Holdings is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives