Stock Analysis

- United States

- /

- Software

- /

- NasdaqGS:PLTR

High Growth Tech Stocks To Watch This December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but over the past 12 months, it has risen by an impressive 28%, with earnings forecasted to grow by 15% annually. In this context of robust growth and steady performance, identifying high growth tech stocks that align with these trends can be key for investors looking to capitalize on innovation-driven opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.61% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CrowdStrike Holdings (NasdaqGS:CRWD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions both in the United States and internationally, with a market capitalization of approximately $89.40 billion.

Operations: CrowdStrike Holdings generates revenue primarily through its Security Software & Services segment, which accounts for $3.74 billion. The company's focus on cybersecurity solutions positions it as a key player in the industry.

CrowdStrike Holdings has demonstrated robust growth with a projected annual revenue increase of 17.8%, outpacing the US market's average of 9.1%. This growth is supported by strategic alliances, such as the recent collaboration with SonicWall to launch a Managed Detection and Response offering for SMBs, enhancing their security capabilities against sophisticated threats. Furthermore, CrowdStrike's R&D focus remains strong with significant investments aimed at advancing their AI-native cybersecurity solutions. In fiscal year 2024, R&D expenses constituted a substantial portion of their revenue, underscoring their commitment to innovation in an evolving threat landscape. These factors collectively highlight CrowdStrike's potential in maintaining competitive edge and expanding its market share in cybersecurity solutions.

- Delve into the full analysis health report here for a deeper understanding of CrowdStrike Holdings.

Explore historical data to track CrowdStrike Holdings' performance over time in our Past section.

Intuit (NasdaqGS:INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. is a company that offers financial management, compliance, and marketing products and services in the United States, with a market capitalization of approximately $187.78 billion.

Operations: Intuit generates revenue primarily from its Global Business Solutions and Consumer segments, contributing $9.73 billion and $4.43 billion respectively. The company also benefits from its Credit Karma segment with $1.83 billion in revenue and Pro-Tax services at $596 million.

Intuit's recent strategic partnerships, notably with Amazon and the Professional Women’s Hockey League in Canada, underscore its commitment to expanding its influence across diverse business ecosystems. By integrating AI-driven financial management solutions into Amazon Seller Central, Intuit is poised to enhance operational efficiency for millions of sellers by providing critical insights into profitability and cash flow. This move not only broadens Intuit's market reach but also solidifies its role as a pivotal player in leveraging technology to empower small to mid-sized businesses. Additionally, the company's R&D expenditure remains robust, aligning with its strategy to innovate continually; this year alone, R&D expenses were significant at $1.2 billion, representing 11.3% of revenue—a clear indicator of Intuit’s dedication to advancing their technological capabilities in a competitive landscape where annual earnings are expected to surge by 17.3%.

- Get an in-depth perspective on Intuit's performance by reading our health report here.

Gain insights into Intuit's historical performance by reviewing our past performance report.

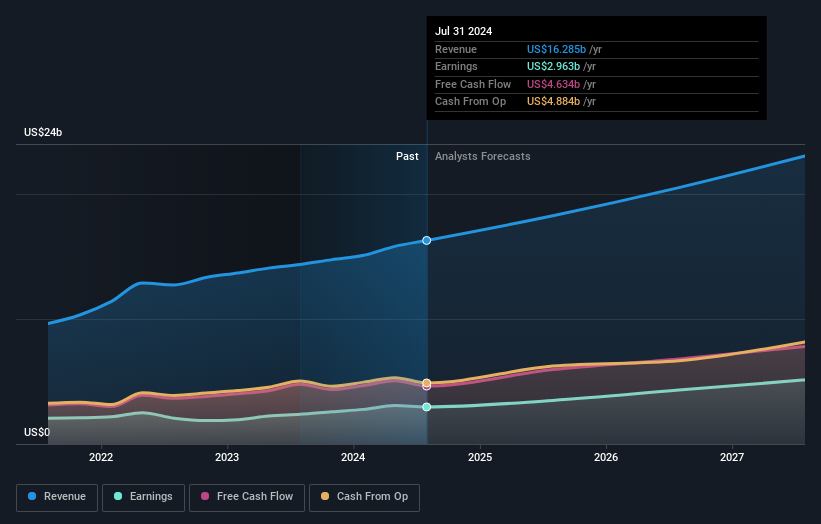

Palantir Technologies (NasdaqGS:PLTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. develops software platforms for intelligence and counterterrorism operations globally, with a market cap of $165.18 billion.

Operations: Palantir Technologies generates revenue primarily from two segments: Government, contributing $1.44 billion, and Commercial, with $1.21 billion. The company focuses on providing software solutions for intelligence and counterterrorism operations across various international markets.

Palantir Technologies stands out in the high-growth tech landscape, particularly with its recent strategic alliances and government contracts that underscore its robust integration into national security and defense sectors. The company's expanded contract with USSOCOM, valued at $36.8 million, not only cements its role as a primary software integrator but also leverages its AI capabilities across broader military operations. This move aligns with Palantir’s significant investment in R&D, which has been pivotal in developing advanced technologies for real-time data processing and analysis crucial for defense applications. Moreover, the company's partnership with Anduril to form a consortium aims to transform U.S. leadership in AI-driven national security, addressing critical challenges like data readiness and secure AI deployment at scale. These initiatives reflect Palantir’s strategic focus on enhancing operational efficiencies through high-tech solutions while fostering substantial growth prospects within the tech industry.

- Navigate through the intricacies of Palantir Technologies with our comprehensive health report here.

Key Takeaways

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 237 more companies for you to explore.Click here to unveil our expertly curated list of 240 US High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.