- United States

- /

- Diversified Financial

- /

- NasdaqCM:IMXI

International Money Express (NASDAQ:IMXI) Has A Rock Solid Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, International Money Express, Inc. (NASDAQ:IMXI) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for International Money Express

What Is International Money Express's Net Debt?

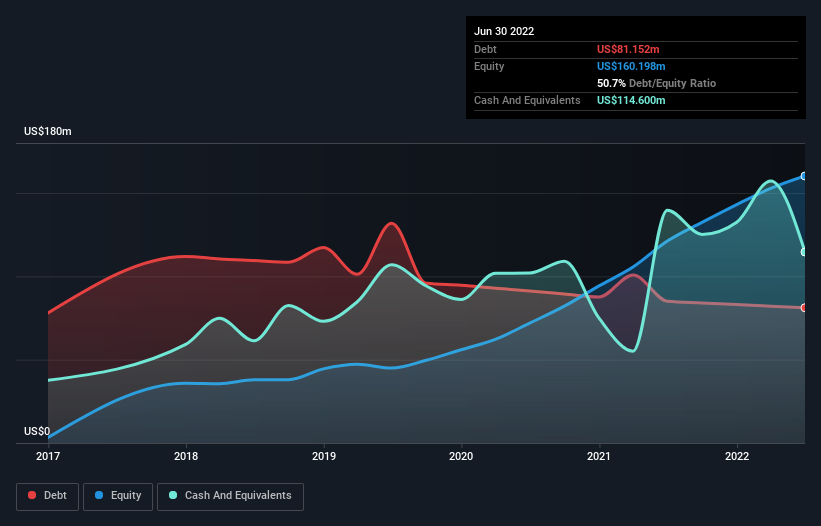

The image below, which you can click on for greater detail, shows that International Money Express had debt of US$81.2m at the end of June 2022, a reduction from US$85.0m over a year. However, its balance sheet shows it holds US$114.6m in cash, so it actually has US$33.4m net cash.

A Look At International Money Express' Liabilities

The latest balance sheet data shows that International Money Express had liabilities of US$116.9m due within a year, and liabilities of US$81.5m falling due after that. Offsetting this, it had US$114.6m in cash and US$97.2m in receivables that were due within 12 months. So it actually has US$13.3m more liquid assets than total liabilities.

This state of affairs indicates that International Money Express' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$1.00b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that International Money Express has more cash than debt is arguably a good indication that it can manage its debt safely.

Another good sign is that International Money Express has been able to increase its EBIT by 26% in twelve months, making it easier to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine International Money Express's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While International Money Express has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, International Money Express actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that International Money Express has net cash of US$33.4m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of US$131m, being 112% of its EBIT. So is International Money Express's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for International Money Express that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMXI

International Money Express

Operates as an omnichannel money remittance services company in the United States, Latin America, Mexico, Central and South America, the Caribbean, Africa, and Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives