Stock Analysis

- United States

- /

- Diversified Financial

- /

- NasdaqGS:IIIV

i3 Verticals (NASDAQ:IIIV) Shareholders Booked A 39% Gain In The Last Year

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. To wit, the i3 Verticals, Inc. (NASDAQ:IIIV) share price is 39% higher than it was a year ago, much better than the market return of around 20% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow i3 Verticals for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for i3 Verticals

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

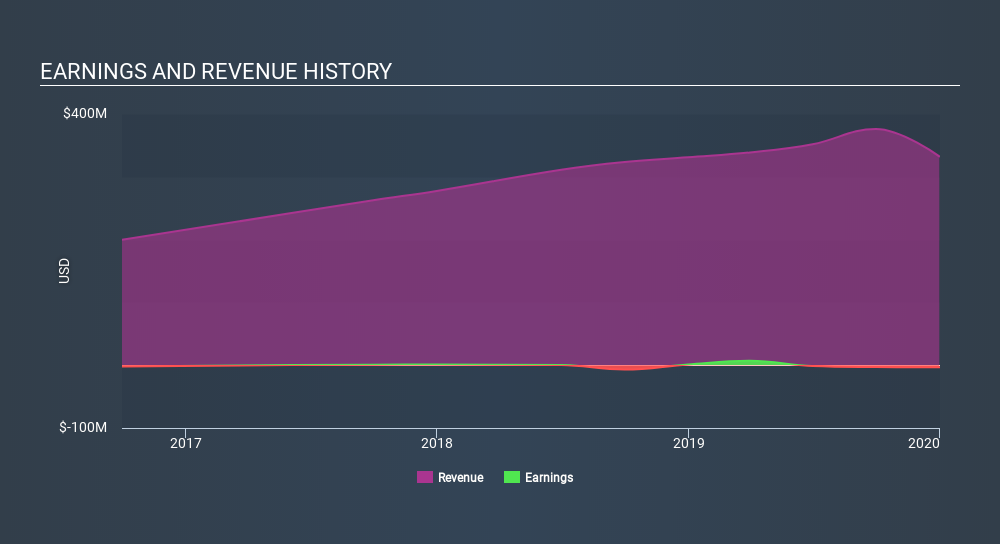

During the last year i3 Verticals saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling i3 Verticals stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that i3 Verticals shareholders have gained 39% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 57% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - i3 Verticals has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:IIIV

i3 Verticals

Provides integrated payment and software solutions primarily to the public sector and healthcare markets in the United States.

Reasonable growth potential and fair value.