- United States

- /

- IT

- /

- NasdaqGM:III

Information Services Group (III): Profit Rise Driven by $5.3M One-Off Challenges Quality Narrative

Reviewed by Simply Wall St

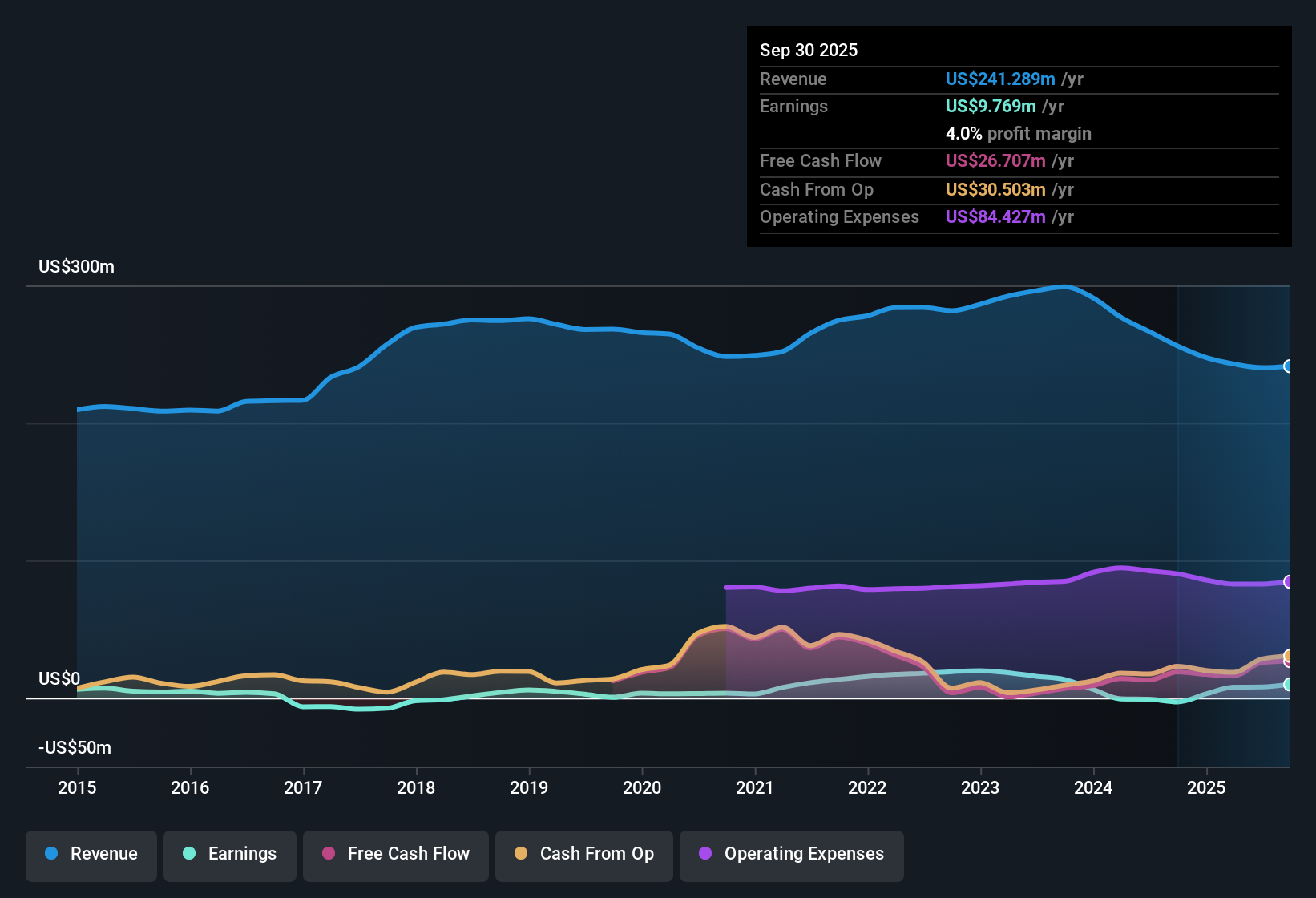

Information Services Group (III) is forecast to grow earnings at 13.26% per year, lagging the projected 16.1% annual growth for the US market. Revenue is expected to rise by 5.1% per year compared to the broader market’s 10.5% forecast. Profitability has just turned positive, but a one-off gain of $5.3 million has made recent margin trends less straightforward. Over the past five years, the company’s earnings have declined by 12.8% per year, painting a complex picture for investors looking for consistent profitability.

See our full analysis for Information Services Group.The real test is how these results compare to the prevailing market narratives. Some views will be reinforced, while others could be up for debate.

See what the community is saying about Information Services Group

Margins Complicated by $5.3 Million One-Off Gain

- The most recent profit figure includes a non-recurring gain of $5.3 million. This makes it difficult to assess ongoing margin trends, as current profitability is higher than what is typical for the core business.

- According to the analysts' consensus view, growing demand for AI and digital transformation services is expected to drive more stable, higher-margin performance in the future.

- Analysts highlight that 45% of total revenue comes from recurring sources, which helps buffer future margins and demonstrates underlying quality despite this year’s one-off impact.

- Consensus also points to planned margin expansion, from 3.3% today to a projected 4.8% within three years, supported by the shift to higher-value digital advisory work.

It is notable that this latest profit boost coincides with consensus expectations that margins will become more stable as recurring digital business grows. However, the jump this year is not expected to repeat and should be viewed with some skepticism.

📊 Read the full Information Services Group Consensus Narrative.

Valuation Discounts Against Peers and DCF Fair Value

- Information Services Group trades at a 29.9x price-to-earnings ratio, which is below both its peer group at 66.3x and the broader US IT industry at 31.6x. The current share price of $6.07 also sits under the DCF fair value estimate of $6.34.

- Consensus narrative suggests that, although growth forecasts trail the US market, the stock’s modest valuation compared to sector peers and its discount to fair value could provide a potential cushion for investors.

- Consensus notes the market price is just below the DCF fair value, indicating the company may have limited downside if growth and margin expansion materialize as projected.

- However, with only a small difference between fair value and price, and relatively modest growth, outperformance may depend on ISG’s ability to capitalize on new digital transformation opportunities.

Earnings Growth Trails US Market Amid Recurring Growth Drivers

- While earnings are projected to rise at 13.26% per year, this is slower than the US market’s expected 16.1% rate. However, recurring revenue now makes up 45% of total revenue, supporting longer-term visibility even without outsized growth.

- Consensus narrative states that expanding adoption of AI advisory, recurring-service models, and new acquisitions are helping offset pressure from larger rivals and automation trends.

- Analysts expect profit margins to rise by more than 1.5 percentage points over three years, reflecting these recurring and digital drivers.

- The narrative also highlights that ongoing investment in mid-market platforms and expansion in Europe could help address the forecast lag behind the overall market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Information Services Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures in a different way? Take just a few moments to craft and share your own narrative: Do it your way

A great starting point for your Information Services Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Information Services Group’s inconsistent earnings growth and reliance on one-off gains make it difficult to find steady, predictable performance across cycles.

If you’re seeking companies that consistently grow revenue and earnings year after year, focus on dependable performers with our stable growth stocks screener (2094 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:III

Information Services Group

Operates as an artificial intelligence (AI) centered technology research and advisory company in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives