- United States

- /

- Software

- /

- NasdaqGS:HUT

Hut 8 (HUT): Earnings Growth Slows Sharply Despite 50% Revenue Surge, Challenging Bullish Sentiment

Reviewed by Simply Wall St

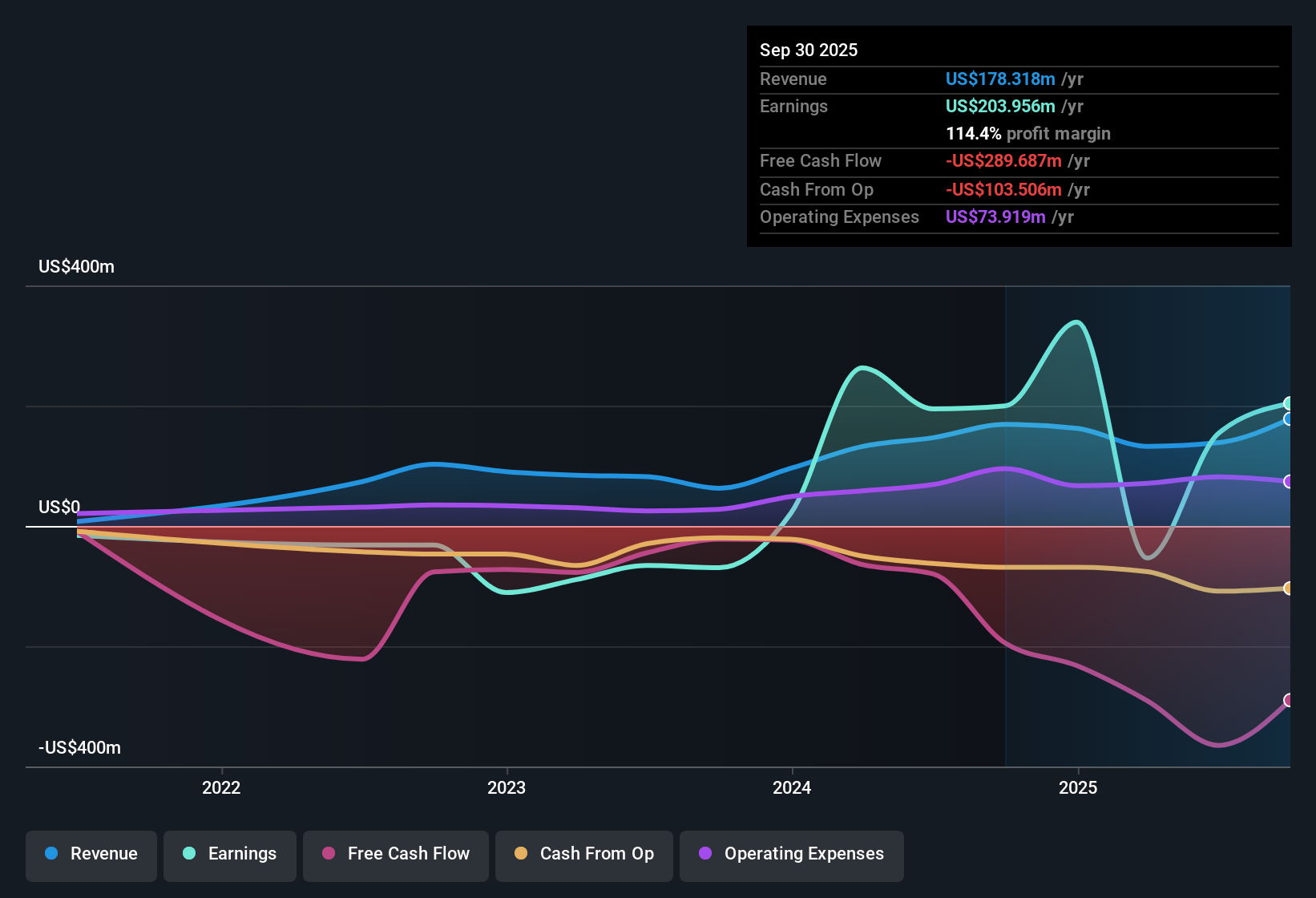

Hut 8 (NasdaqGS:HUT) is expected to grow revenue by an impressive 49.97% per year, far outpacing the broader US market’s 10.5% annual forecast. However, net profit margins are down from last year and earnings are forecast to decline steeply at 72.5% per year over the next three years, with the latest annual earnings growth slowing to just 2% compared to a five-year average of 61.9%. Investors are weighing strong revenue growth projections and a Price-to-Earnings ratio of 25x, which is lower than the US Software industry average of 35.2x, against risks like recent share dilution, share price volatility, and declining profitability.

See our full analysis for Hut 8.The next section compares these headline results against the key narratives and sentiment that have shaped expectations for Hut 8. Let’s see which stories hold up and which get challenged by the numbers.

See what the community is saying about Hut 8

Margins Compressed as Analysts See Profits Squeezed

- Profit margins are expected to shrink from a high 111.1% today down to 18.3% in three years, reflecting a dramatic shift in bottom-line efficiency despite strong top-line forecasts.

- Analysts' consensus view highlights that although Hut 8 is driving forecast annual revenue growth at nearly 77% over the next three years,

- The steep projected margin decline undercuts the bullish claims that growth will reliably translate to higher profits, since margins are set to compress to less than a fifth of current levels as production and expansion costs rise.

- What is surprising is that even with this margin pressure, consensus expects earnings to remain positive at $140.6 million, but well below today’s $154.0 million. This shows how much cost management and Bitcoin price volatility could impact performance.

- See how analysts balance Hut 8’s fast growth with falling margins in the full company narrative. 📊 Read the full Hut 8 Consensus Narrative.

Power Strategy Drives Revenue Predictability

- Nearly 90% of Hut 8’s energy capacity is now covered by long-term contracted agreements, up sharply from 30% a year ago, setting up a more stable foundation for cash flow generation across volatile cycles.

- Analysts' consensus view sees recurring energy contracts and diversified infrastructure efforts as crucial,

- Since these shifts mean management is no longer solely dependent on unpredictable Bitcoin prices and instead can rely more on stable, infrastructure-like revenues over time.

- However, consensus also warns that heavy reliance on natural gas-fired plants leaves Hut 8 exposed to future environmental regulation and could impact returns if markets pivot away from fossil fuels.

Valuation Still Attractive Versus Software Peers

- Hut 8 trades at a P/E ratio of 25x, below the US Software industry average of 35.2x, even as its peer group average stands at -8.2x, signaling investors are factoring in both growth potential and sector volatility.

- Analysts’ consensus narrative questions whether investors should pay up for Hut 8’s future,

- The current share price of $47.00 sits under the allowed analyst price target of $50.67, which is 7.8% higher, giving some upside but less than the margin suggested in headline forecasts.

- To justify consensus expectations, the company must not only maintain rapid top-line momentum but also return to much higher profitability. The narrative suggests debate remains around whether ongoing expansion can offset the drag from weaker earnings ahead.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hut 8 on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Does your take on the numbers offer a new angle? Shape your view and share a unique narrative in just a few minutes. Do it your way

A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Hut 8 faces sharply declining profit margins and volatile earnings. This makes future performance heavily dependent on managing rising costs and unpredictable markets.

If you want to focus on companies showing steadier results, use our stable growth stocks screener (2074 results) to find those delivering consistent revenue and earnings across different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives