- United States

- /

- IT

- /

- NasdaqGS:HCKT

Hackett Group (HCKT) Net Profit Margin Declines to 5.5%, Challenging Bullish Narratives

Reviewed by Simply Wall St

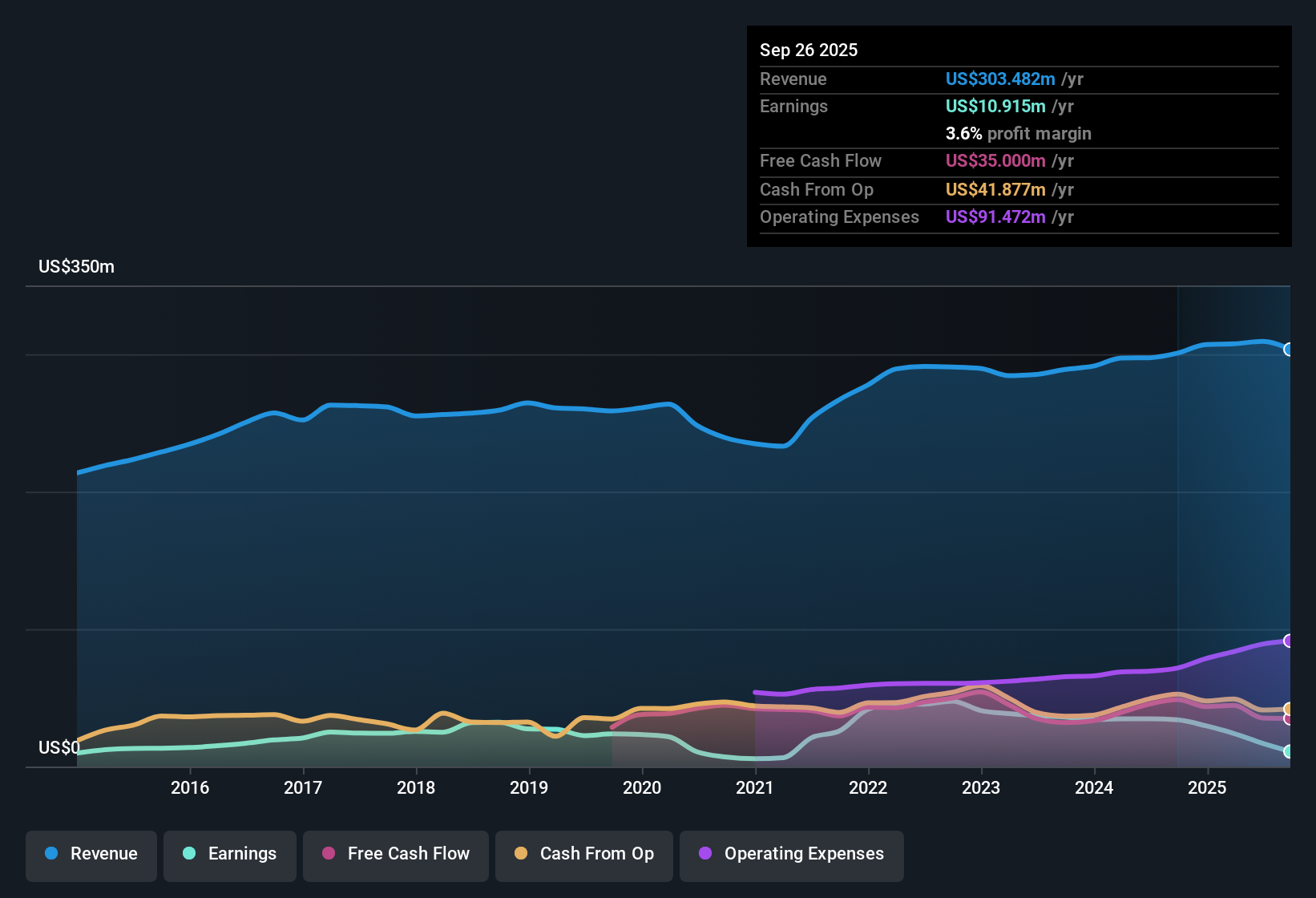

Hackett Group (HCKT) reported a net profit margin of 5.5%, a noticeable drop from last year’s 11.7%, reflecting a decline in profitability. While the company experienced negative earnings growth over the past year, its longer-term track record shows average annual earnings growth of 8.9% over five years. Investors will be watching closely as recent margin contractions are weighed against high-quality earnings and shares that currently trade below an estimated fair value. This situation raises questions about potential upside.

See our full analysis for Hackett Group.With the numbers on the table, the next step is to see how these results compare with the prevailing market narratives. Some expectations may hold up, while others could be put to the test.

See what the community is saying about Hackett Group

PE Ratio Still Above Industry Despite Discount to Peers

- Hackett Group trades at a Price-To-Earnings ratio of 30.7x, lower than the peer average of 70x but still above the broader US IT industry’s 28.9x benchmark. This signals the stock is not the cheapest option among sector giants.

- Analysts' consensus view notes that while the discount to direct competitors may tempt value-seeking investors, Hackett’s premium to the industry suggests its valuation includes expectations for new AI-driven growth, productivity gains, and a shift to recurring revenue streams.

- Consensus highlights that for today's price of $18.94 to reach the targeted $28.33, Hackett must deliver on planned expansion in AI solutions and a reversal of recent margin declines.

- The ongoing transition from legacy segments and successful roll-out of licensable AI platforms are seen as crucial catalysts that justify a valuation above the sector norm.

- To see what is driving the mainstream outlook and what must go right for the stock to close the valuation gap, analyst narratives set the stage for the debate. 📊 Read the full Hackett Group Consensus Narrative.

Margin Expansion Hopes Confront Execution Risks

- Analysts expect Hackett’s profit margins to rise from 5.5% today to 16.4% within three years, a turnaround that would more than triple current profitability if achieved.

- According to the consensus narrative, bullish investors point out that investments in Gen AI solutions and process automation could supercharge operating margins. This is contrasted by concern that delays in licensing and lagging legacy segments introduce real risk to this scenario.

- Growth in Gen AI consulting and partnerships like Celonis are anticipated to boost recurring revenues, fueling optimism for better margins.

- However, the ongoing 20%+ year-over-year contraction in Oracle Solutions and rising SG&A costs, as noted by management, create meaningful hurdles for the bullish thesis.

DCF Fair Value Points to Bigger Upside Potential

- With shares currently priced at $18.94 against a DCF fair value estimate of $40.65, Hackett trades at a sharp discount that suggests meaningful upside if long-term earnings assumptions hold.

- Consensus narrative acknowledges that the 26.1% gap between the current share price and the $28.33 analyst target reflects a blend of skepticism and optimism. Investors are waiting to see if near-term cost discipline and operational efficiency translate into sustainable margin expansion.

- If Hackett can achieve annual earnings growth of 2.6% and margin improvement by 2028, as forecasted, the market could move quickly to re-rate the stock closer to its fair value estimate.

- However, elevated client uncertainty and lumpy demand are cited as risks that could make the fair value difficult to realize unless major catalysts materialize soon.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hackett Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data from a new angle? Take a moment to share your insights and shape your narrative in just a few minutes with Do it your way.

A great starting point for your Hackett Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Hackett Group’s potential, recent profit margin declines, volatile earnings, and legacy headwinds point to execution risk and a lack of consistent financial performance.

If you prefer businesses that steadily grow through all cycles, take a look at stable growth stocks screener (2074 results) and quickly spot those with a proven record of consistent results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hackett Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCKT

Hackett Group

Operates as an intellectual property platform-based generative artificial intelligence strategic consulting and executive advisory digital transformation in the United States, Europe, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives