- United States

- /

- Software

- /

- NasdaqCM:GRRR

Positive Sentiment Still Eludes Gorilla Technology Group Inc. (NASDAQ:GRRR) Following 30% Share Price Slump

Gorilla Technology Group Inc. (NASDAQ:GRRR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 224% in the last twelve months.

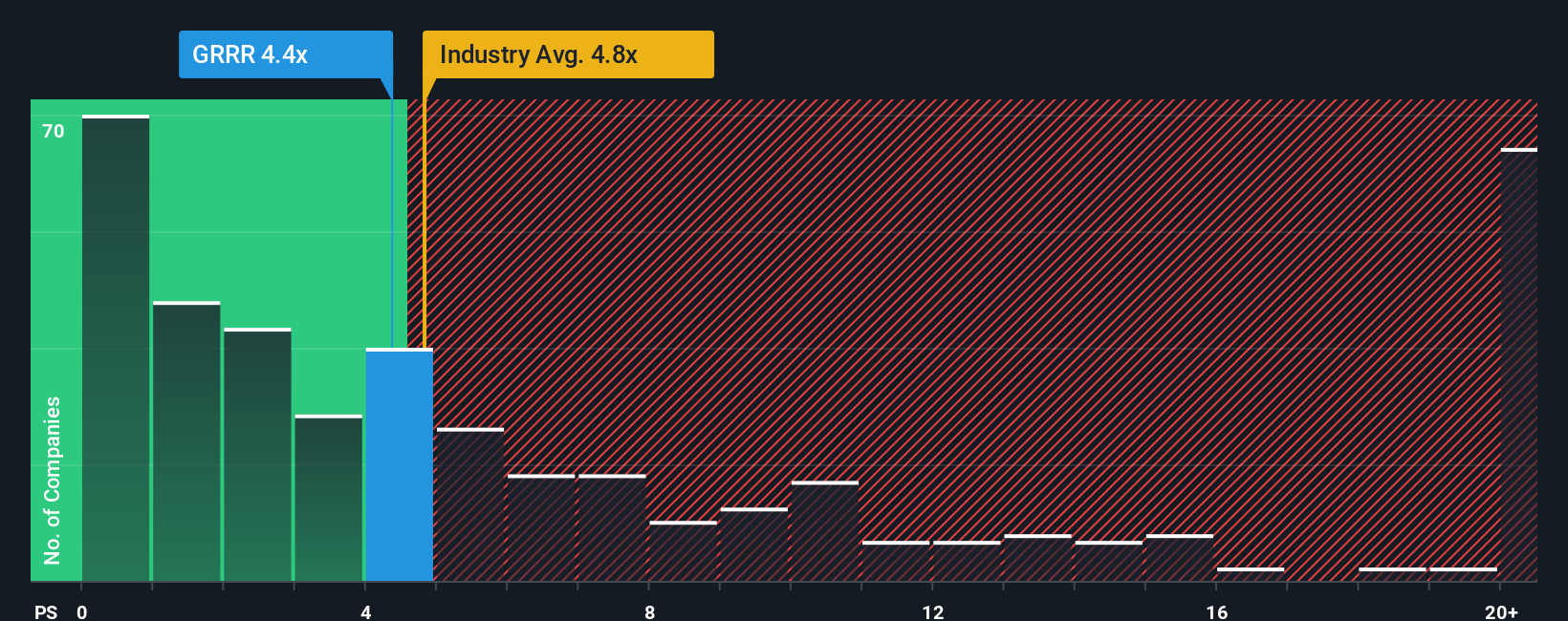

In spite of the heavy fall in price, it's still not a stretch to say that Gorilla Technology Group's price-to-sales (or "P/S") ratio of 4.4x right now seems quite "middle-of-the-road" compared to the Software industry in the United States, where the median P/S ratio is around 4.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Gorilla Technology Group

What Does Gorilla Technology Group's Recent Performance Look Like?

Gorilla Technology Group's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Gorilla Technology Group.How Is Gorilla Technology Group's Revenue Growth Trending?

In order to justify its P/S ratio, Gorilla Technology Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 128% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 47% over the next year. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we find it interesting that Gorilla Technology Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Gorilla Technology Group's P/S

Gorilla Technology Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Gorilla Technology Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Gorilla Technology Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives