- United States

- /

- IT

- /

- NasdaqCM:GDYN

The Market Doesn't Like What It Sees From Grid Dynamics Holdings, Inc.'s (NASDAQ:GDYN) Revenues Yet As Shares Tumble 25%

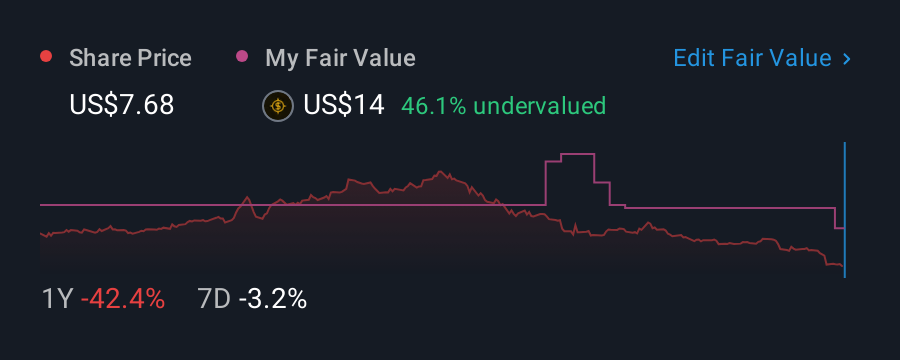

Unfortunately for some shareholders, the Grid Dynamics Holdings, Inc. (NASDAQ:GDYN) share price has dived 25% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

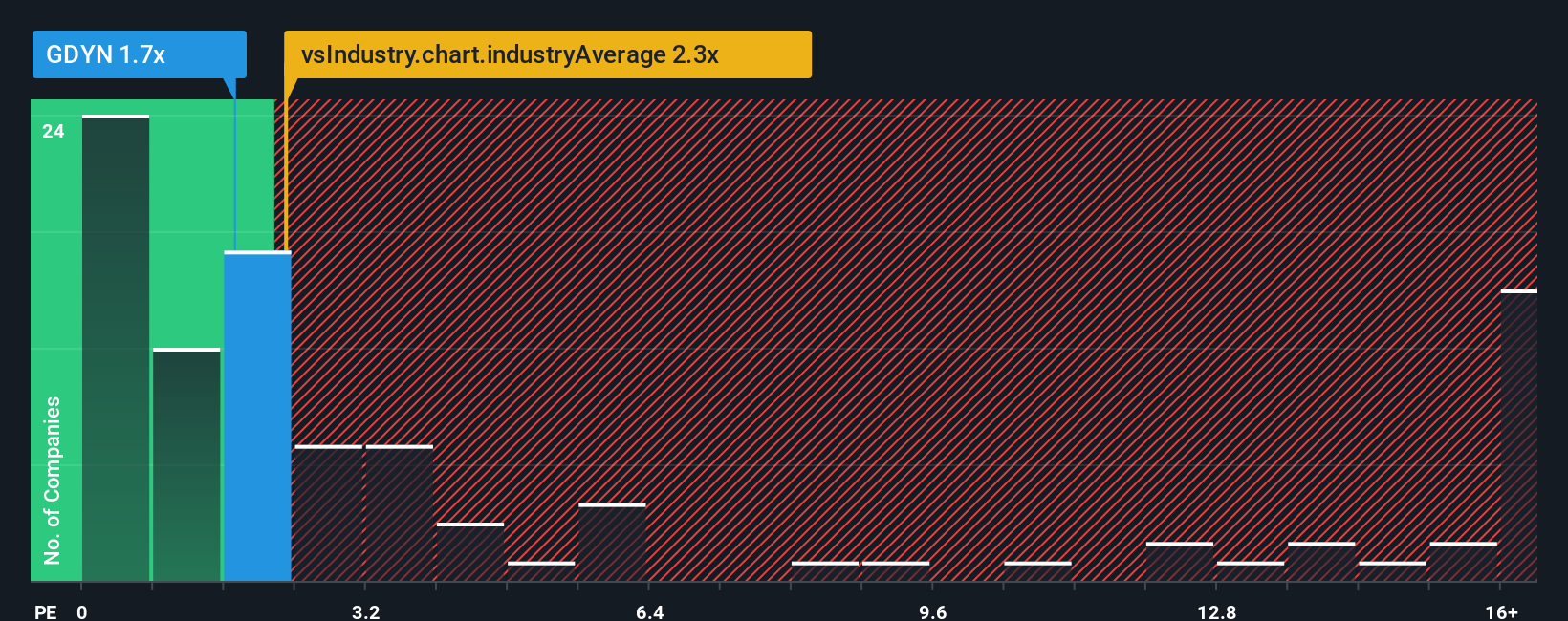

Even after such a large drop in price, Grid Dynamics Holdings' price-to-sales (or "P/S") ratio of 1.7x might still make it look like a buy right now compared to the IT industry in the United States, where around half of the companies have P/S ratios above 2.3x and even P/S above 10x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Grid Dynamics Holdings

How Has Grid Dynamics Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, Grid Dynamics Holdings has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Grid Dynamics Holdings.How Is Grid Dynamics Holdings' Revenue Growth Trending?

Grid Dynamics Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The latest three year period has also seen an excellent 42% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 12% over the next year. Meanwhile, the rest of the industry is forecast to expand by 20%, which is noticeably more attractive.

With this information, we can see why Grid Dynamics Holdings is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Grid Dynamics Holdings' P/S?

Grid Dynamics Holdings' recently weak share price has pulled its P/S back below other IT companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Grid Dynamics Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Grid Dynamics Holdings (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GDYN

Grid Dynamics Holdings

Provides technology consulting, platform and product engineering, and analytics services in North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives