- United States

- /

- Software

- /

- NasdaqGS:FROG

JFrog (FROG): Evaluating Valuation After Strong Third Quarter Revenue Growth and Improved Earnings

Reviewed by Simply Wall St

JFrog (FROG) just released its third quarter earnings report, highlighting a sizeable increase in revenue compared to the same period last year. The company also narrowed its net loss, which has sparked fresh interest among investors.

See our latest analysis for JFrog.

Following its upbeat earnings release, JFrog's share price has maintained strong momentum, climbing nearly 54% year-to-date. The 1-year total shareholder return stands at about 44%, which suggests investor optimism is rooted in sustained longer-term performance instead of short-term news flow.

If JFrog's results have you thinking about what's next in software, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership.

But with shares up sharply and revenue growth staying strong, investors now face a key question: is JFrog still undervalued, or is the company’s future growth already fully priced in?

Most Popular Narrative: 16% Undervalued

With JFrog’s most followed narrative placing fair value at $56.44, the stock’s last close of $47.26 suggests the market is currently pricing in less upside than these projections. The narrative’s bullish stance is drawn from key developments and future assumptions around growth, technology, and the company’s platform momentum.

The need for hybrid and multi-cloud deployment models is intensifying as organizations seek cost predictability, compliance, and flexibility when running AI workloads. JFrog's platform, architected from inception for both cloud and on-prem/hybrid, appeals to enterprises facing this complexity. This helps to secure large, multi-year enterprise contracts, boost retention, and expand average deal size.

Ever wondered what’s behind JFrog’s head-turning future price target? The full narrative teases a brave combination of growth rates and profit assumptions, all hinging on pivotal shifts in customer demand and technology adoption. The math and milestones creating this stretch valuation might surprise you.

Result: Fair Value of $56.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on large enterprise deals and intensifying competition in security could make JFrog’s projected growth much less certain than it appears.

Find out about the key risks to this JFrog narrative.

Another View: What If You Look Beyond the Narrative?

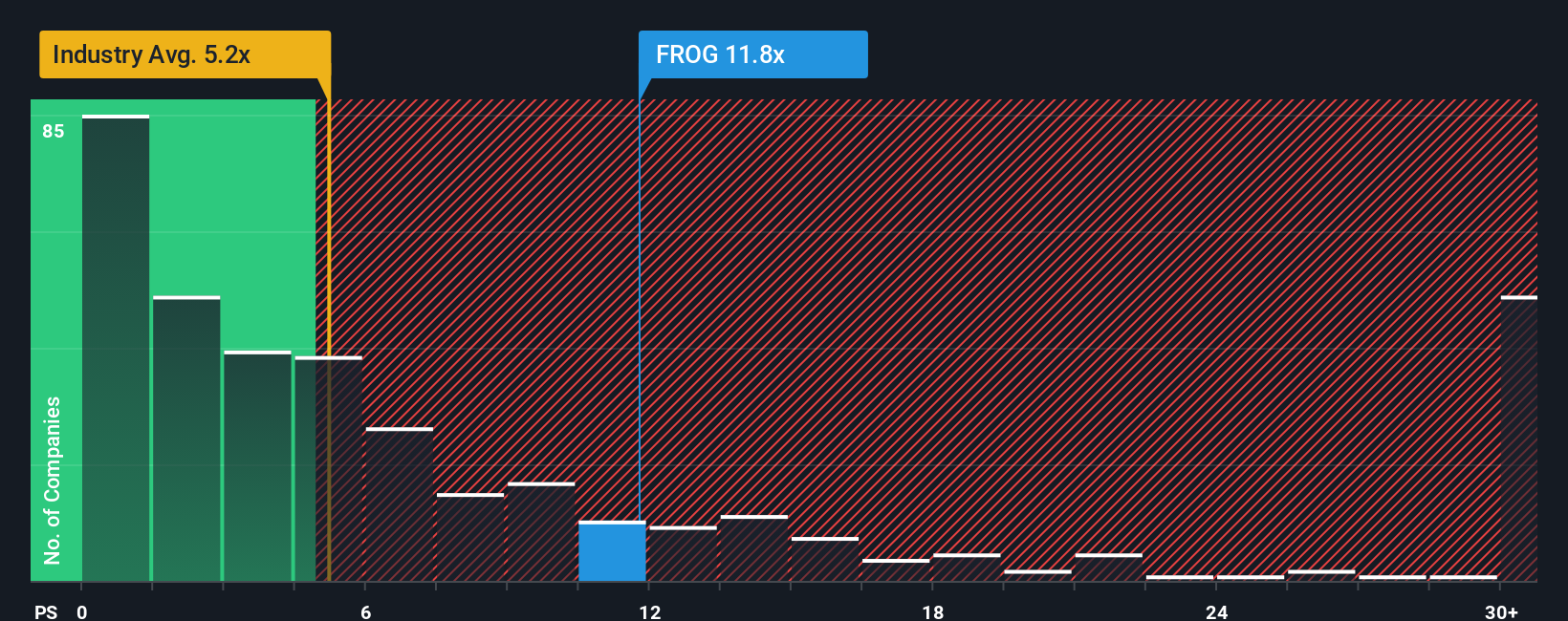

While the most popular narrative points to JFrog being 16% undervalued, a quick check on the sales multiple tells a different story. JFrog's price-to-sales ratio sits at 11.6x, which is much higher than both the industry average of 5.1x and the fair ratio of 6.5x. This indicates the market is paying a premium. Could this premium suggest heightened risks for investors, or is it pointing to a less obvious upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JFrog Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build your own JFrog story from the ground up. Do it your way.

A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the next big opportunities before the crowd does. Expand your portfolio horizons now with these handpicked stock ideas designed for forward-thinking investors.

- Accelerate your potential returns by targeting hidden gems. Start with these 848 undervalued stocks based on cash flows for a streamlined path to undervalued opportunities backed by solid financials and growth potential.

- Capture income that keeps on giving by tapping into these 17 dividend stocks with yields > 3% if you’re searching for reliable stocks with yields above 3% and compelling fundamentals.

- Explore rapid transformations in healthcare with these 32 healthcare AI stocks, where artificial intelligence is reshaping patient care, diagnostics, and medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FROG

JFrog

Provides software supply chain platform in the United States, Israel, India, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion