- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

If You Had Bought Euronet Worldwide (NASDAQ:EEFT) Shares Five Years Ago You'd Have Made 240%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. One great example is Euronet Worldwide, Inc. (NASDAQ:EEFT) which saw its share price drive 240% higher over five years. Also pleasing for shareholders was the 43% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 17% in 90 days).

View our latest analysis for Euronet Worldwide

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

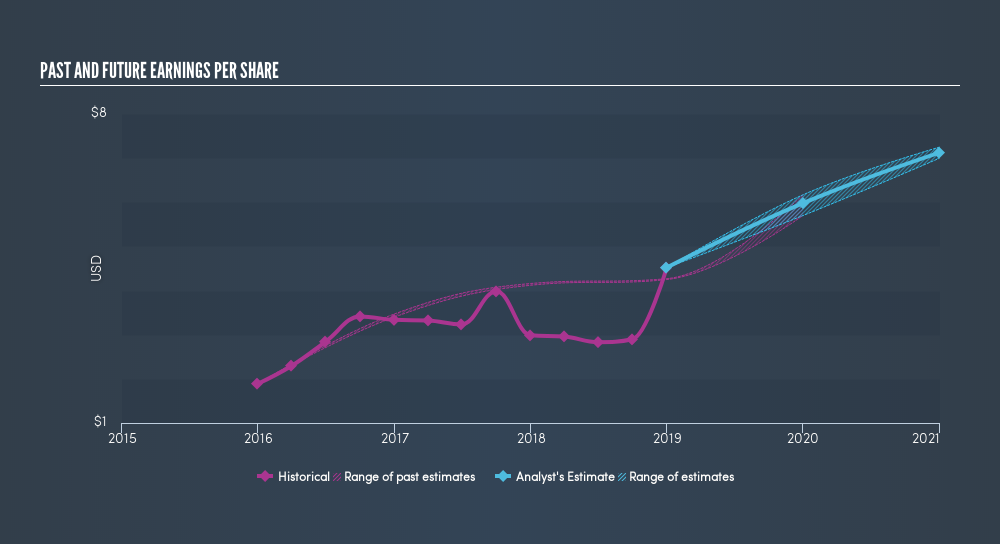

Over half a decade, Euronet Worldwide managed to grow its earnings per share at 21% a year. This EPS growth is lower than the 28% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Euronet Worldwide has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

It's nice to see that Euronet Worldwide shareholders have received a total shareholder return of 61% over the last year. That's better than the annualised return of 28% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Euronet Worldwide in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Excellent balance sheet and good value.