- United States

- /

- IT

- /

- NasdaqCM:DTST

Data Storage Corporation (NASDAQ:DTST) Soars 25% But It's A Story Of Risk Vs Reward

Data Storage Corporation (NASDAQ:DTST) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The annual gain comes to 101% following the latest surge, making investors sit up and take notice.

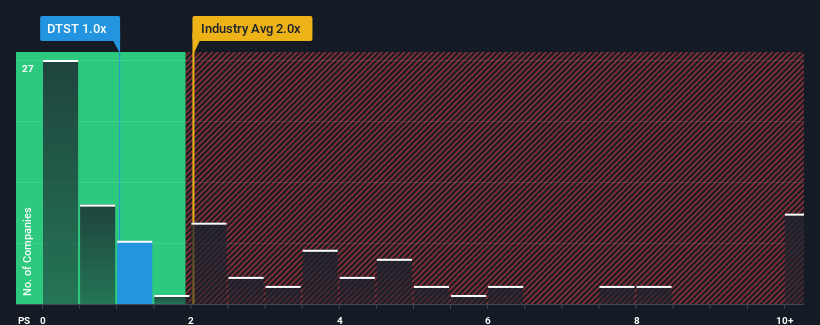

In spite of the firm bounce in price, it would still be understandable if you think Data Storage is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1x, considering almost half the companies in the United States' IT industry have P/S ratios above 2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Data Storage

How Data Storage Has Been Performing

Revenue has risen firmly for Data Storage recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Data Storage, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Data Storage?

The only time you'd be truly comfortable seeing a P/S as low as Data Storage's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.4%. The latest three year period has also seen an excellent 167% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

In light of this, it's peculiar that Data Storage's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Data Storage's P/S

Data Storage's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Data Storage revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Data Storage you should be aware of, and 1 of them shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DTST

Data Storage

Provides enterprise cloud and business continuity solutions in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives