- United States

- /

- Software

- /

- NasdaqGS:DSP

Improved Revenues Required Before Viant Technology Inc. (NASDAQ:DSP) Stock's 29% Jump Looks Justified

Viant Technology Inc. (NASDAQ:DSP) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

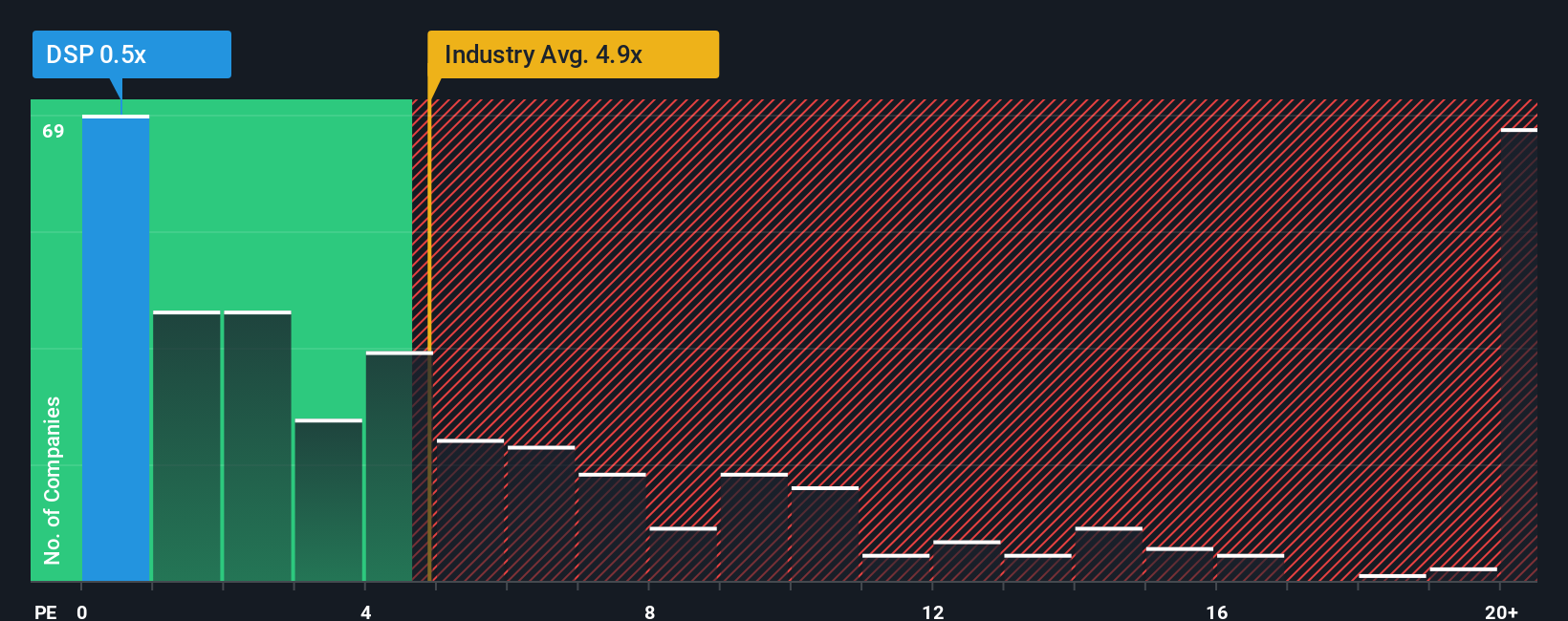

Although its price has surged higher, Viant Technology may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.9x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Viant Technology

What Does Viant Technology's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Viant Technology has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Viant Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Viant Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The latest three year period has also seen an excellent 44% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the nine analysts following the company. That's shaping up to be materially lower than the 30% per annum growth forecast for the broader industry.

In light of this, it's understandable that Viant Technology's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Viant Technology's P/S Mean For Investors?

Even after such a strong price move, Viant Technology's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Viant Technology maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - Viant Technology has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Viant Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DSP

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives