- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG) Valuation: Assessing the Upside After a 13% Monthly Share Price Climb

Reviewed by Simply Wall St

See our latest analysis for Datadog.

Datadog’s share price has been on a steady upward trajectory, with a 13.3% jump over the past month helping the company recapture momentum after a more modest start to the year. Looking at a broader timeframe, the stock’s 12-month total shareholder return of nearly 25% and a massive 96% total shareholder return over three years highlight its ability to deliver sustained gains for patient investors, as optimism about cloud-driven growth continues to build.

If Datadog’s rally has you exploring what’s next for tech, it might be the perfect time to check out See the full list for free.

With robust gains in both the short and long term, investors are now asking whether Datadog shares remain attractively priced, or if the stock’s future growth is already fully reflected in its valuation. Could this be a fresh opportunity, or is everything already priced in?

Most Popular Narrative: 4.7% Undervalued

With Datadog recently closing at $157.62, the most popular narrative sets its fair value at $165.35, pointing to a modest potential upside. This narrative weighs ongoing momentum in cloud and AI adoption against Datadog’s ambitious growth forecasts and market expectations.

Accelerating enterprise cloud migration and broader adoption of AI workloads are driving increased demand for unified observability and security platforms. This positions Datadog as a mission-critical vendor and supports continued topline revenue growth as digital transformation deepens across industries.

Ever wondered what aggressive assumptions lie behind this valuation? The growth projection, the future margin profile, and just how high the implied future earnings multiple is might surprise you. See what’s fueling this bold price. Tap in to uncover the narrative’s key numbers and logic now.

Result: Fair Value of $165.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to large AI customers and mounting competition could disrupt Datadog’s steady growth trajectory and challenge its underlying narrative.

Find out about the key risks to this Datadog narrative.

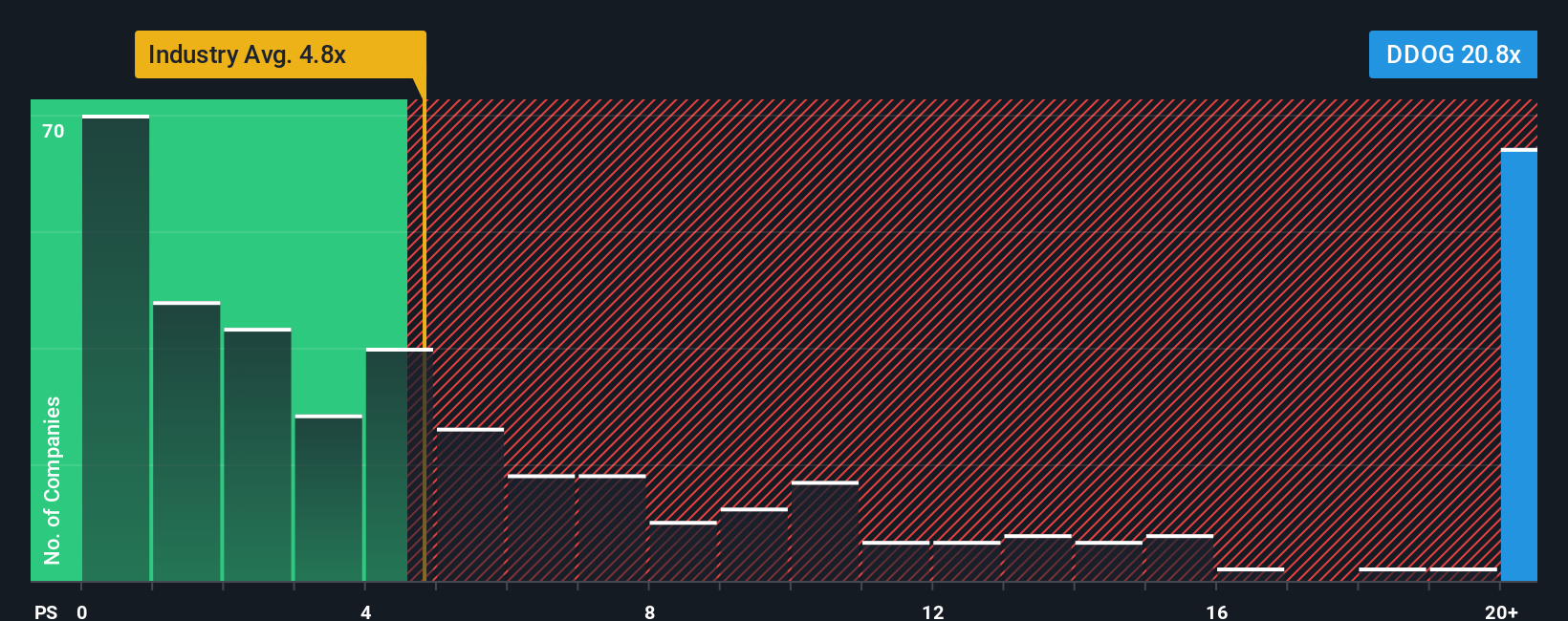

Another View: High Sales Multiple Signals Premium Pricing

Looking through a different lens, Datadog is trading at a price-to-sales multiple of 18.2x. That is much steeper than the US Software industry’s average of 5.5x and its peer average of 8x. It is also well above its fair ratio of 14.6x, hinting at valuation risks if growth stalls. Will Datadog continue to justify its premium as competition heats up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If you want to look past prevailing opinions or dig deeper into Datadog’s outlook, you can craft your own view with fresh insight in just a few minutes. Do it your way.

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to a single stock. Expand your horizons with smart, data-driven picks tailored to today’s hottest trends. Join thousands of investors already finding new opportunities, and make your next move with greater confidence.

- Tap into high potential and track these 870 undervalued stocks based on cash flows poised for upward momentum as they trade below their intrinsic value.

- Capture powerful income streams by evaluating these 19 dividend stocks with yields > 3% offering reliable yields above 3% for a strong portfolio foundation.

- Position yourself ahead of game-changing trends by backing these 27 AI penny stocks at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives