- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG) Is Up 17.5% After Q3 Beat and Upgraded Outlook Has the Long-Term Thesis Evolved?

Reviewed by Sasha Jovanovic

- Datadog, Inc. recently reported its third-quarter 2025 financial results, posting revenue of US$885.65 million and adjusted earnings per share of US$0.55, both surpassing analysts’ expectations and showing strong year-over-year growth.

- Driven by continued enterprise adoption and demand for AI-driven monitoring solutions, Datadog also raised its full-year 2025 guidance, now projecting annual revenue up to US$3.39 billion.

- We'll explore how Datadog's robust revenue growth and improved guidance update the company's investment narrative for long-term investors.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Datadog Investment Narrative Recap

To be a shareholder in Datadog, you need to believe that accelerating enterprise adoption of cloud-native and AI-driven monitoring will keep fueling demand for its observability and security platforms. The recent earnings beat and raised 2025 outlook support this narrative, reinforcing enterprise demand as a short-term catalyst, though risks around profit margin pressure remain material given continued investment in R&D.

Of the latest announcements, Datadog’s upward revision of its full-year 2025 revenue guidance to as much as US$3.39 billion is the most relevant to the past quarter’s results, directly aligning with strong topline momentum and increased adoption of its AI-enabled solutions.

However, despite growing revenue and a strong outlook, investors should be aware that operating margin remains...

Read the full narrative on Datadog (it's free!)

Datadog's narrative projects $5.2 billion in revenue and $406.8 million in earnings by 2028. This requires 19.9% yearly revenue growth and a $282 million earnings increase from $124.6 million today.

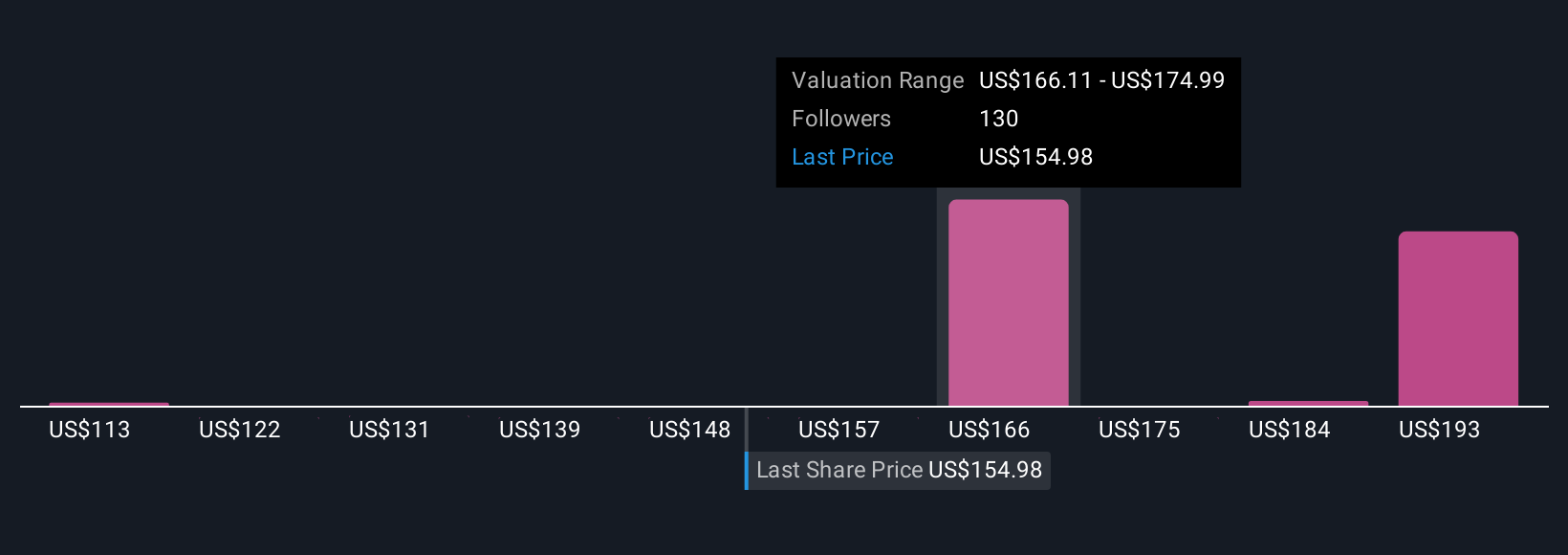

Uncover how Datadog's forecasts yield a $168.91 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Community fair value estimates for Datadog range from US$112.84 to US$190.35 across 11 perspectives from the Simply Wall St Community. While revenue growth expectations impress, concerns about sustained profit margin pressure could shape outcomes differently for each investor’s thesis.

Explore 11 other fair value estimates on Datadog - why the stock might be worth as much as $190.35!

Build Your Own Datadog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Datadog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Datadog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Datadog's overall financial health at a glance.

No Opportunity In Datadog?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives