- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG): Analyzing Valuation After Recent Share Price Gains

Datadog (DDOG) stock caught the attention of investors this week after its shares moved higher, edging up roughly 1% in the past day. The company’s recent performance adds to its steady gains over the past month and is fueling some new interest from those watching software stocks.

See our latest analysis for Datadog.

Datadog’s 1-month share price return has been especially strong, surging nearly 14% to outpace most peers and reflecting renewed investor confidence after a year of headline-making gains. With a current price of $152.87, its one-year total shareholder return stands at 19%. The momentum since the start of the year also hints at optimism building around its growth story for both the short and long haul.

If Datadog’s upward streak has you thinking about the next wave of opportunities in software and AI, it’s a great moment to check out the See the full list for free.

With shares already delivering handsome 12-month returns, investors are debating whether Datadog’s valuation still offers upside, or if the strong rally means much of the optimism is already priced in. Could there be more room to run?

Most Popular Narrative: 7.5% Undervalued

Datadog’s most widely followed narrative points to fair value at $165.35, compared with the last close price of $152.87. This indicates that, based on current forecasts and sector momentum, there may be notable room for the stock to move higher if these assumptions play out.

Ongoing product innovation (for example, autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance, providing cross-selling opportunities and driving higher average revenue per user and net retention rate. This in turn improves recurring revenue predictability and gross margins.

Curious how ambitious tech launches are expected to impact the bottom line? The fair value hinges on aggressive topline growth and surprisingly robust profitability projections. Want a peek at the bullish assumptions driving this target? Discover how much upside is built into that number.

Result: Fair Value of $165.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened revenue dependence on large AI customers or aggressive new competition could quickly challenge even the most optimistic long-term forecasts for Datadog.

Find out about the key risks to this Datadog narrative.

Another View: Price Ratios Tell a Different Story

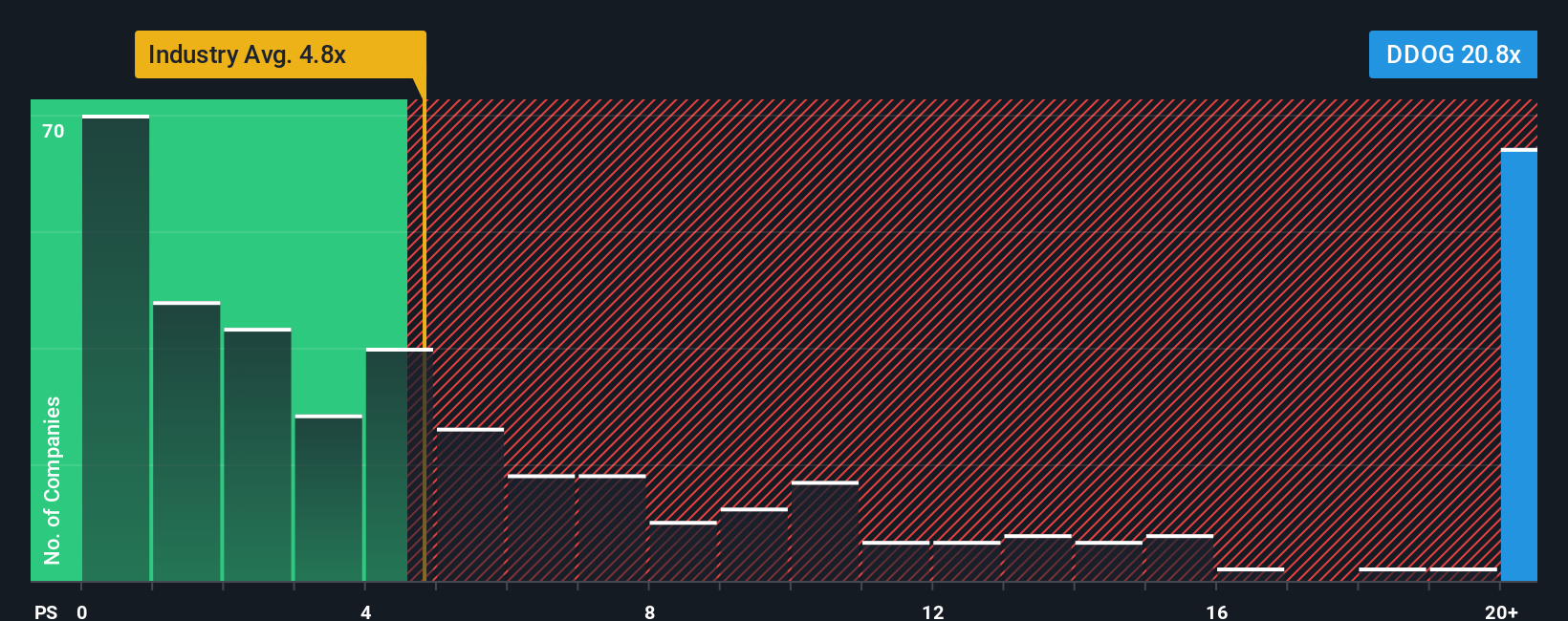

While the fair value narrative suggests Datadog is undervalued, looking at its price-to-sales ratio paints a starker picture. Datadog trades at 17.7x sales, much higher than the industry average of 5x and above its fair ratio of 14.4x. This signals premium pricing and potentially increased valuation risk. Is the high price justified by future growth, or could expectations be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

Prefer to see things from your own angle or want the data to tell its own story? You can craft a custom analysis and perspective in a matter of minutes, allowing you to shape the narrative your way. Do it your way

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t just stick to one winner. Put your portfolio ahead of the curve by checking out unique stock opportunities you might not have considered yet.

- Target powerful potential gains by scanning these 3596 penny stocks with strong financials, which feature emerging companies with strong financials that could be tomorrow’s standout performers.

- Boost your income stream and stability by reviewing these 18 dividend stocks with yields > 3%, offering high-yield opportunities to enhance your returns with consistent payouts.

- Take advantage of the latest technological breakthroughs and catch early leaders using these 24 AI penny stocks, which are shaping the future of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.