- United States

- /

- IT

- /

- NasdaqGS:CRWV

CoreWeave (CRWV): Assessing Valuation Opportunities After Recent Stock Volatility

Reviewed by Simply Wall St

CoreWeave (CRWV) has recently seen its stock performance fluctuate in the past month, drawing attention from investors curious about how the company’s growth prospects stack up in the evolving software sector.

See our latest analysis for CoreWeave.

While CoreWeave’s year-to-date share price return of 160% speaks to its rapidly building momentum, its 1-month share price return of -25.7% highlights just how volatile growth stories can be as sentiment shifts around risk and future potential. The stock’s performance has been supercharged this year. However, recent weeks prove that even high-flyers can hit turbulence as investors reassess valuations and near-term outlooks.

If you’re watching fast-changing trends in software, now could be the perfect moment to branch out and discover See the full list for free.

With analysts targeting a price nearly 40% higher than current levels and strong annual growth figures, the question for investors is clear: is CoreWeave’s recent selloff a buying opportunity, or has the market already accounted for all of its future gains?

Price-to-Sales of 15.3x: Is it justified?

CoreWeave’s shares are trading on a price-to-sales (P/S) ratio of 15.3x, which is well below the peer average of 22.3x. This suggests the market values its sales lower than direct rivals, despite its rapid business expansion and high profile in the sector.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of a company’s revenue. It is a popular yardstick for companies growing fast but not yet profitable, which fits CoreWeave’s current profile as it scales operations at speed.

Given CoreWeave’s 279% revenue growth over the past year and forecasts for even faster growth ahead, this multiple implies the market is pricing in impressive sales momentum but remains somewhat cautious versus the peer group. Notably, compared to the estimated “fair” P/S ratio of 48.2x, there appears to be considerable upside if the market shifts its view to match this level. Such a re-rating would be significant for shareholders.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 15.3x (UNDERVALUED)

However, substantial net losses and recent share price volatility could undermine confidence in CoreWeave’s trajectory if growth expectations are not met in the near future.

Find out about the key risks to this CoreWeave narrative.

Another View: What Does the SWS DCF Model Say?

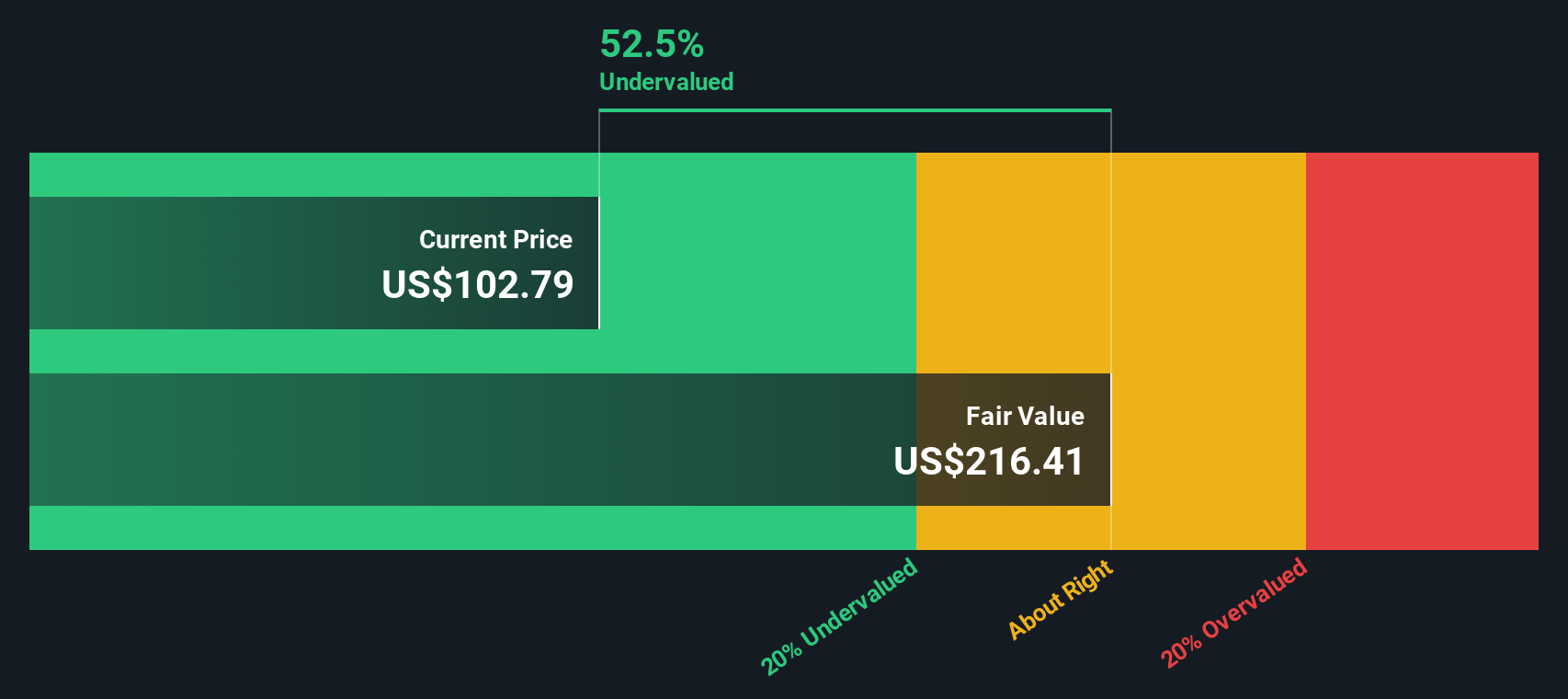

Taking a different approach, our DCF model values CoreWeave at $424.83, which is far above its current market price of $104.01. This suggests the stock may be heavily undervalued if its long-term cash flows play out as expected. Should investors take this as a sign that the market is missing something big, or is the discount deserved for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you see the story differently or want to take a hands-on approach, you can craft your own CoreWeave analysis in just a few minutes. Do it your way

A great starting point for your CoreWeave research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There is a world of opportunity waiting beyond just one stock. Maximize your portfolio’s potential by checking out strategies that investors are excited about right now.

- Tap into tomorrow’s growth by reviewing these 24 AI penny stocks, filled with innovative businesses driving the next wave in artificial intelligence.

- Lock in reliable income with these 16 dividend stocks with yields > 3%, which offers strong yields and stability for a steady financial future.

- Catch the next undervalued winners early when you scan these 870 undervalued stocks based on cash flows and spot stocks the market has not recognised yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives