- United States

- /

- Electrical

- /

- NYSE:SES

3 Growth Companies Insiders Own Up To 33%

Reviewed by Simply Wall St

As the U.S. stock market grapples with valuation concerns and tech sector pressures, investors are keenly observing insider ownership as a potential indicator of confidence in growth companies. In this environment, stocks with significant insider ownership may offer insights into management's belief in the company's long-term prospects and resilience amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 51% |

| Prairie Operating (PROP) | 31.2% | 115.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hyatt Hotels (H) | 11.3% | 52.3% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Duolingo (DUOL) | 14.2% | 30.1% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 11.9% | 25.9% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

Let's dive into some prime choices out of the screener.

Commerce.com (CMRC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Commerce.com, Inc. provides a software-as-a-service e-commerce platform for brands and retailers across multiple regions globally, with a market cap of $377.03 million.

Operations: Commerce.com generates revenue through its software-as-a-service e-commerce platform, serving brands and retailers across diverse global regions including the United States, Americas, Europe, Middle East, Africa, and Asia Pacific.

Insider Ownership: 17.2%

Commerce.com has demonstrated significant insider ownership, aligning management interests with shareholders. Recent earnings show a narrowed net loss and increased sales, indicating improved financial health. The company's strategic partnerships and technological advancements, such as the integration with PayPal for AI-driven commerce solutions, position it well in the evolving ecommerce landscape. Despite slower revenue growth forecasts compared to the market, Commerce.com's focus on innovative payment solutions and data optimization could drive future profitability and operational efficiency improvements.

- Delve into the full analysis future growth report here for a deeper understanding of Commerce.com.

- Our comprehensive valuation report raises the possibility that Commerce.com is priced lower than what may be justified by its financials.

Frontier Group Holdings (ULCC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of $881.46 million.

Operations: Frontier Group Holdings generates revenue primarily from providing low-cost airline services to leisure travelers across the United States and Latin America.

Insider Ownership: 33.1%

Frontier Group Holdings has shown significant insider ownership, aligning management interests with shareholders. Despite recent financial challenges, including a net loss of US$77 million in Q3 2025, the company is forecasted to achieve profitability within three years with expected earnings growth of over 114% annually. While revenue growth is projected at 11.7% per year, surpassing the broader US market's rate, substantial insider selling and share price volatility present potential concerns for investors.

- Take a closer look at Frontier Group Holdings' potential here in our earnings growth report.

- Our expertly prepared valuation report Frontier Group Holdings implies its share price may be lower than expected.

SES AI (SES)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SES AI Corporation develops and produces AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and robotics, with a market cap of approximately $813.45 million.

Operations: SES AI Corporation's revenue segments include the development and production of advanced battery technologies for electric vehicles, urban air mobility, drones, robotics, and battery energy storage systems.

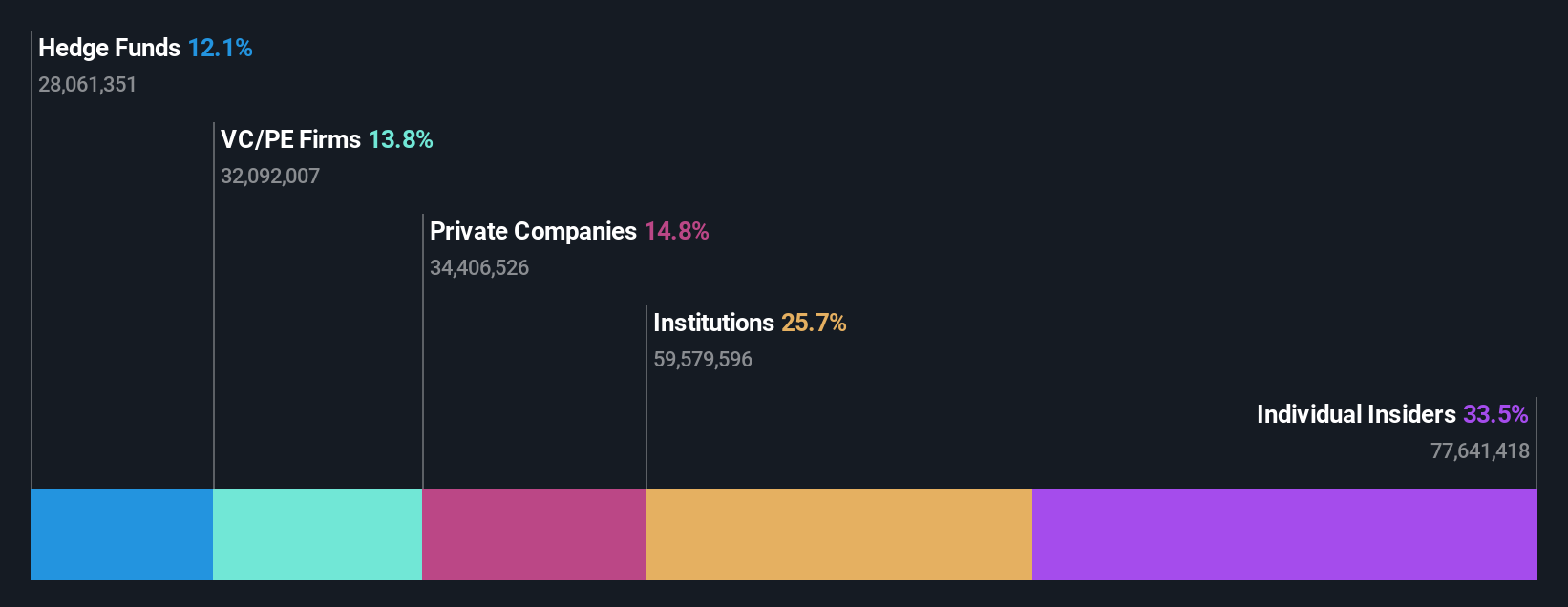

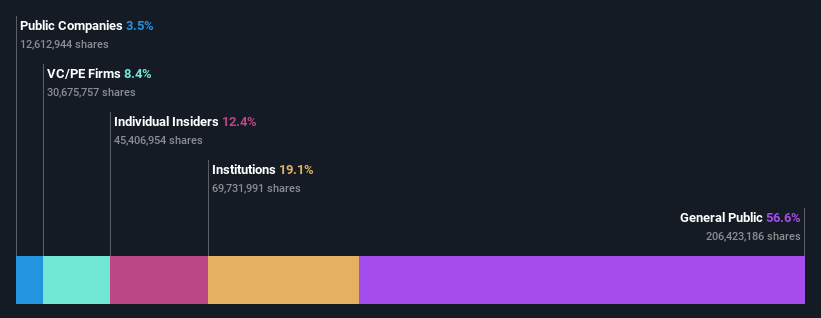

Insider Ownership: 12%

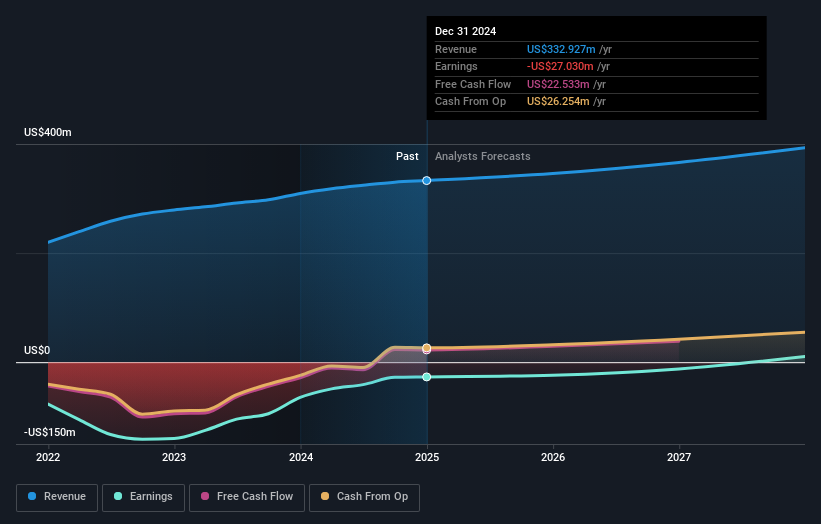

SES AI demonstrates strong insider ownership, aligning management interests with shareholders. The company is expected to achieve profitability within three years, with revenue growth forecasted at 53.1% annually, significantly outpacing the US market. Recent strategic initiatives include a joint venture to commercialize novel electrolytes and increased revenue guidance for 2025 to US$20-25 million. However, the share price has been highly volatile recently and SES's Return on Equity is projected to remain low in three years.

- Click to explore a detailed breakdown of our findings in SES AI's earnings growth report.

- Our comprehensive valuation report raises the possibility that SES AI is priced higher than what may be justified by its financials.

Next Steps

- Access the full spectrum of 197 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SES

SES AI

Develops and produces AI enhanced lithium metal and lithium ion rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, battery energy storage systems, and other applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives