Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:HALO

High Growth Tech Stocks To Watch In US March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.9%, yet it has risen by 14% over the past year, with earnings forecasted to grow by 14% annually. In this context of fluctuating short-term performance but promising long-term growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability in a rapidly evolving sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.26% | 29.10% | ★★★★★★ |

| TG Therapeutics | 26.19% | 37.78% | ★★★★★★ |

| Alkami Technology | 21.95% | 85.17% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| Applied Optoelectronics | 58.93% | 141.15% | ★★★★★★ |

| Zai Lab | 28.33% | 68.55% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 239 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

CleanSpark (NasdaqCM:CLSK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CleanSpark, Inc. is a bitcoin mining company operating in the Americas with a market capitalization of $2.18 billion.

Operations: The company generates revenue primarily through its bitcoin mining business, which accounted for $467.49 million. It operates in the Americas and focuses on leveraging its mining capabilities to enhance financial performance.

With a remarkable leap in net income from $25.91 million to $246.79 million in just one year, CleanSpark showcases its robust financial health and potential within the high-tech sector. This surge is complemented by a substantial increase in earnings per share, escalating from $0.14 to $0.85, underscoring efficient operational management and profitability enhancement. Furthermore, CleanSpark's strategic movements in the cryptocurrency mining space are evidenced by their recent production of 668 Bitcoins and sale of 12.65 Bitcoins at an average price of approximately $101,246 each, highlighting not only revenue generation capabilities but also adaptation to market demands and technological trends.

- Click here to discover the nuances of CleanSpark with our detailed analytical health report.

Examine CleanSpark's past performance report to understand how it has performed in the past.

Geron (NasdaqGS:GERN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geron Corporation is a late-stage clinical biopharmaceutical company dedicated to developing and commercializing therapeutics for myeloid hematologic malignancies, with a market cap of approximately $1.06 billion.

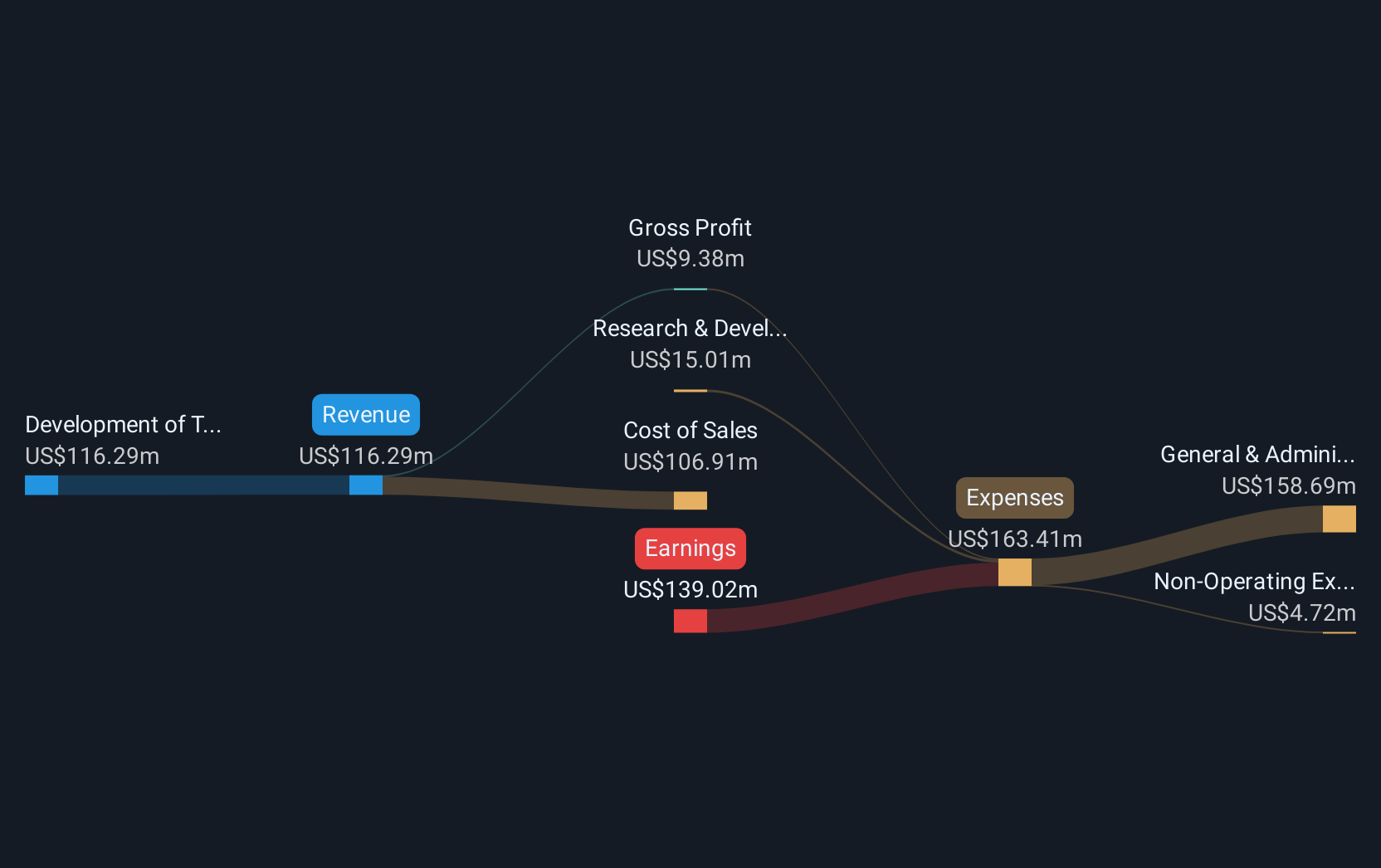

Operations: The company focuses on developing therapeutic products for oncology, generating revenue primarily from this segment with $76.99 million. As a biopharmaceutical entity, its operations are centered around advancing treatments for myeloid hematologic malignancies.

Geron, despite its unprofitability, shows promising growth with a projected revenue increase of 35.1% annually, outpacing the US market's 8.5%. This biotech firm is expected to turn profitable within three years, an optimistic forecast considering its substantial revenue leap from $0.237 million to $76.99 million in one year. The company's recent FDA approval for RYTELO as a treatment for certain types of myelodysplastic syndromes underscores its potential in niche markets, although it faces challenges like high volatility in share price and ongoing capital needs for extensive R&D efforts and commercialization strategies.

- Navigate through the intricacies of Geron with our comprehensive health report here.

Gain insights into Geron's historical performance by reviewing our past performance report.

Halozyme Therapeutics (NasdaqGS:HALO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Halozyme Therapeutics, Inc. is a biopharmaceutical company that focuses on the research, development, and commercialization of proprietary enzymes and devices both in the United States and internationally, with a market capitalization of approximately $7.16 billion.

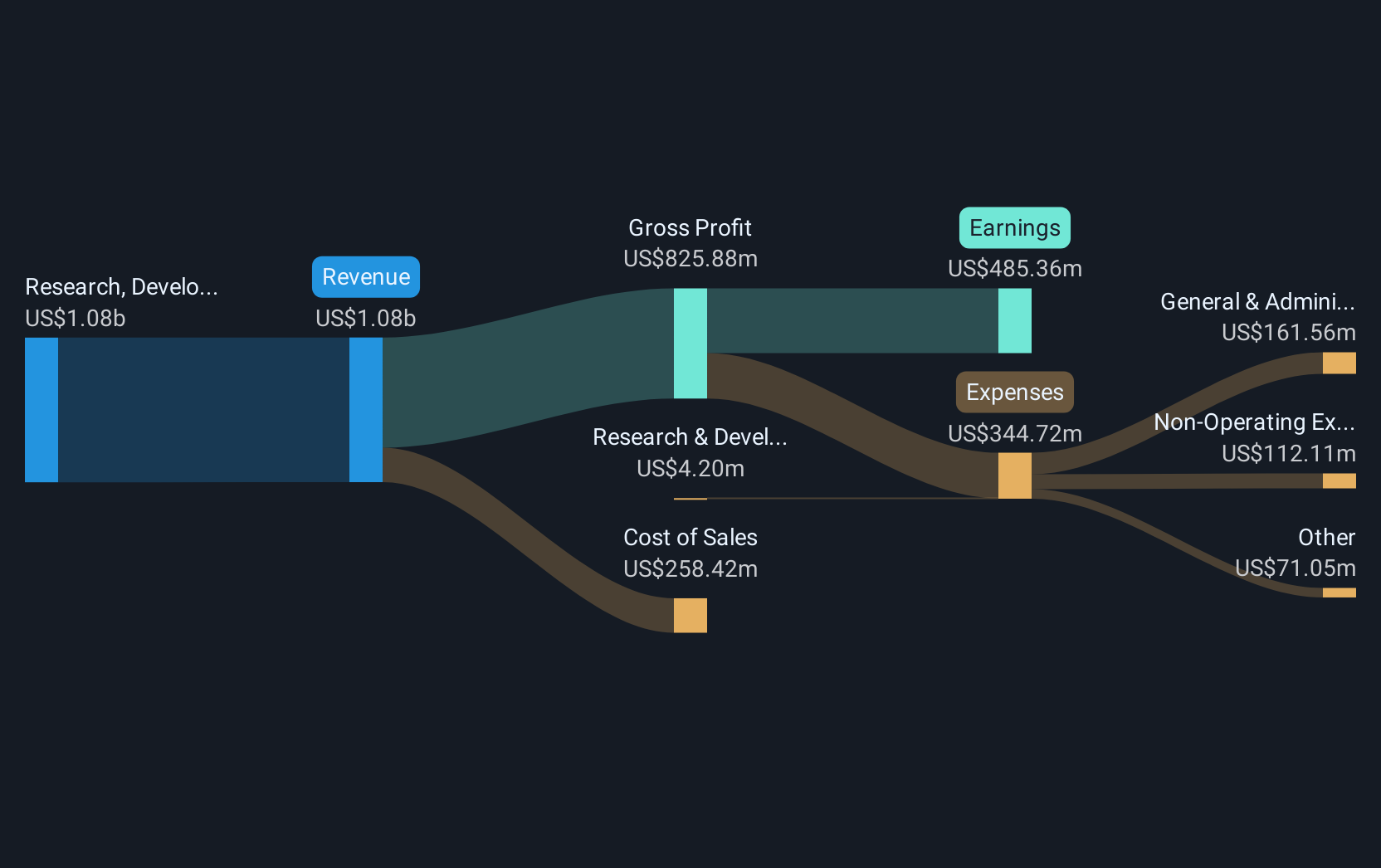

Operations: Halozyme Therapeutics generates revenue primarily from the research, development, and commercialization of its proprietary enzymes, totaling approximately $1.02 billion. The company's focus on innovative enzyme solutions supports its operations both domestically and internationally.

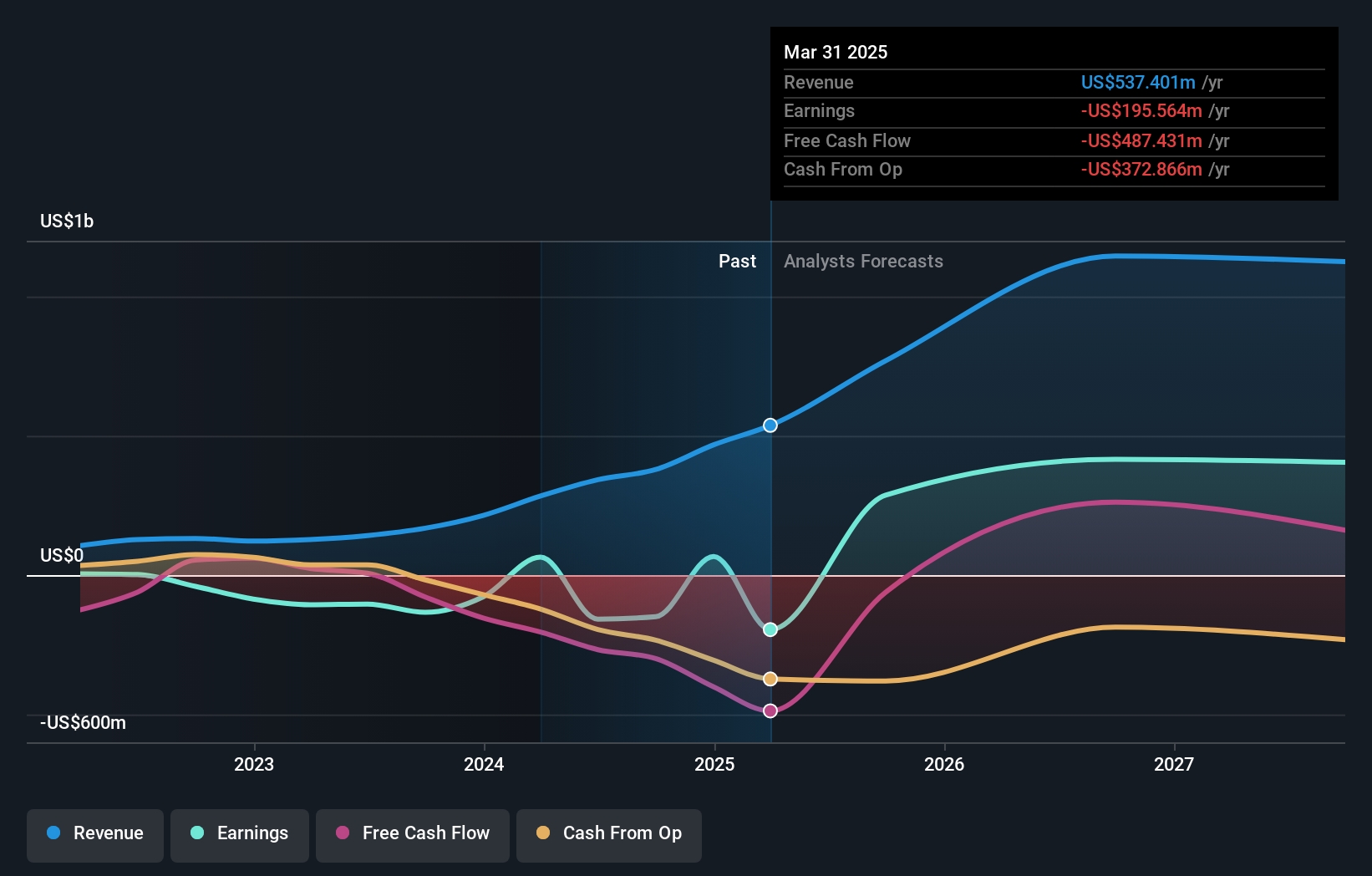

Halozyme Therapeutics has demonstrated a robust financial performance with a significant uptick in annual revenue, rising from $829.25 million to over $1 billion, reflecting an 11.8% growth rate. This surge is propelled by enhanced royalty streams and product sales, notably from XYOSTED®. The firm's strategic repurchase of shares underscores confidence in its trajectory, complementing a 15.4% forecasted annual earnings growth. Recent approvals for its ENHANZE® drug delivery technology in Japan further solidify its market position, promising continued innovation and expansion in therapeutic solutions.

- Delve into the full analysis health report here for a deeper understanding of Halozyme Therapeutics.

Evaluate Halozyme Therapeutics' historical performance by accessing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 239 US High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharmaceutical company, researches, develops, and commercializes of proprietary enzymes and devices in the United States and internationally.