- United States

- /

- Software

- /

- NasdaqGS:BSY

Will Bentley Systems' (BSY) AI Push and Buybacks Redefine Its Long-Term Value Proposition?

Reviewed by Sasha Jovanovic

- Bentley Systems recently reported third-quarter results, posting revenue of US$375.55 million and net income of US$57.37 million, up from the previous year, and announced it completed a US$157.58 million share repurchase program begun in May 2022.

- Additionally, EARTHBRAIN Co. Ltd. announced a partnership with Bentley to integrate AI-powered digital twin technology into Smart Construction, enhancing construction site connectivity and digital transformation.

- We'll look at how Bentley's robust earnings growth and new AI-driven partnership with EARTHBRAIN shape its current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Bentley Systems Investment Narrative Recap

To be a Bentley Systems shareholder, you need confidence in long-term adoption of specialized infrastructure software and successful expansion into new digital and AI-enhanced workflows. The latest strong earnings, sizable buyback completion, and an AI-driven partnership reinforce this narrative, but do not materially alter the near-term catalyst of accelerating cloud-based and recurring revenues, nor do they fully resolve the risk of mounting competition from cloud-native SaaS providers and potential open standards.

Among the recent announcements, Bentley’s partnership with EARTHBRAIN stands out for integrating AI-powered digital twins into construction workflows. This move aligns closely with ongoing sector shifts toward digital transformation, a major catalyst driving demand for Bentley’s solutions and supporting its push for more predictable, higher-margin recurring revenue streams.

By contrast, investors should be aware that growing pressure from lower-cost, cloud-based alternatives means that even robust quarterly results may not fully insulate Bentley from ...

Read the full narrative on Bentley Systems (it's free!)

Bentley Systems is projected to reach $1.9 billion in revenue and $443.2 million in earnings by 2028. This outlook is based on analysts’ assumptions of 9.7% annual revenue growth and a $188.9 million increase in earnings from the current level of $254.3 million.

Uncover how Bentley Systems' forecasts yield a $58.21 fair value, a 26% upside to its current price.

Exploring Other Perspectives

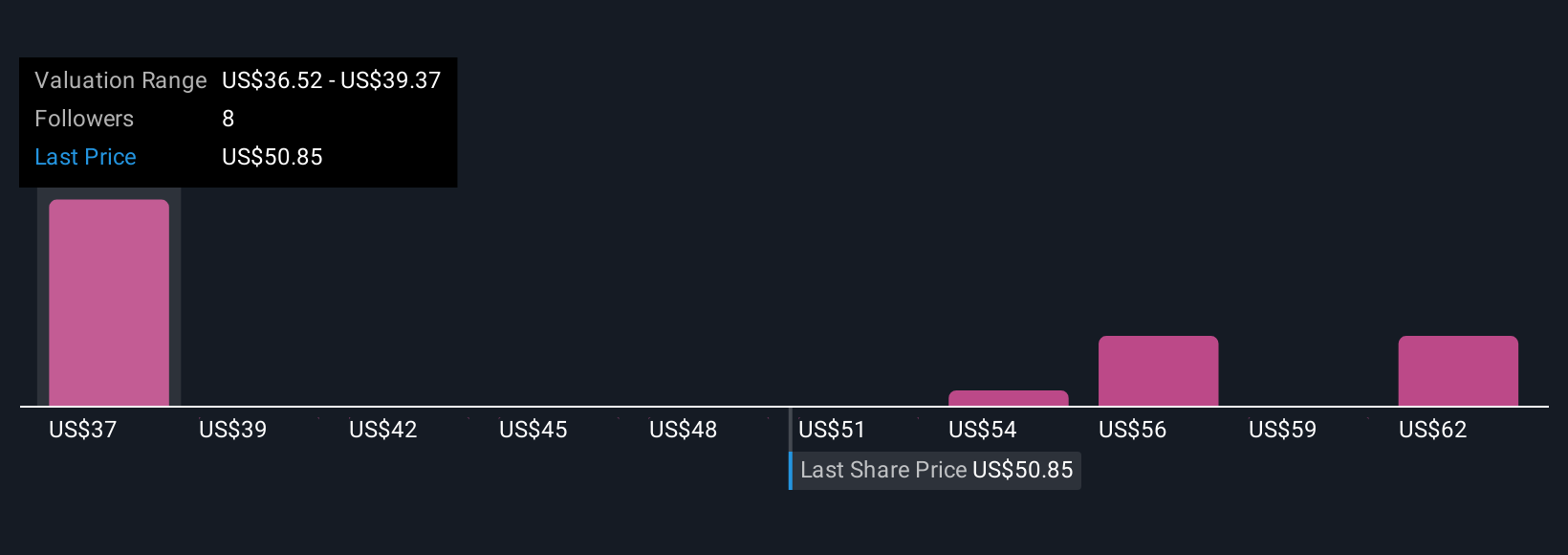

Simply Wall St Community members provided four fair value estimates for Bentley ranging from US$37.36 to US$65. While ongoing progress in digital transformation is a key catalyst, these varied appraisals show just how widely expectations can differ for the company’s future. Check out more investor perspectives and see how yours compares.

Explore 4 other fair value estimates on Bentley Systems - why the stock might be worth as much as 40% more than the current price!

Build Your Own Bentley Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bentley Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bentley Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bentley Systems' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives