- United States

- /

- Software

- /

- NasdaqGS:BSY

How Geospatial Reality Modeling and Cloud Connect at Bentley Systems (BSY) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Bentley Systems recently announced major enhancements to its infrastructure software offerings, unveiling Bentley Infrastructure Cloud Connect for unified data collaboration and the integration of advanced reality modeling services through Cesium. These updates promise secure, scalable environments for infrastructure professionals to visualize, manage, and collaborate on projects throughout their lifecycle in full geospatial context.

- An interesting implication is that these innovations could drive greater user adoption of Bentley’s products by simplifying workflows and enabling more immersive digital twin experiences across engineering, construction, and asset operations.

- We'll examine how the addition of geospatial reality modeling via Cesium could reshape Bentley Systems' growth outlook and market positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Bentley Systems Investment Narrative Recap

To consider owning Bentley Systems shares, investors must believe the company can grow by driving digital transformation in global infrastructure, especially as clients demand cloud-based, AI-driven workflows. The recent launches of Bentley Infrastructure Cloud Connect and advanced geospatial modeling via Cesium align with this narrative, but these enhancements may not materially shift the most important near-term catalyst: sustained growth in recurring revenues. Key risks, such as intensifying competition from SaaS rivals, also remain largely unchanged despite the news.

Of all the recent announcements, the rollout of Bentley Infrastructure Cloud Connect stands out for its potential to enhance recurring revenue streams. By unifying data and workflows in a secure, scalable environment, Connect could support Bentley’s long-term shift toward higher-margin, subscription-based business models, helping address profitability pressures discussed by many investors.

Yet, in contrast, investors should be aware that rising competition from newer cloud-native SaaS rivals could still threaten retention rates and...

Read the full narrative on Bentley Systems (it's free!)

Bentley Systems is projected to reach $1.9 billion in revenue and $443.2 million in earnings by 2028. This outlook relies on an annual revenue growth rate of 9.7% and a $188.9 million increase in earnings from the current $254.3 million.

Uncover how Bentley Systems' forecasts yield a $59.08 fair value, a 14% upside to its current price.

Exploring Other Perspectives

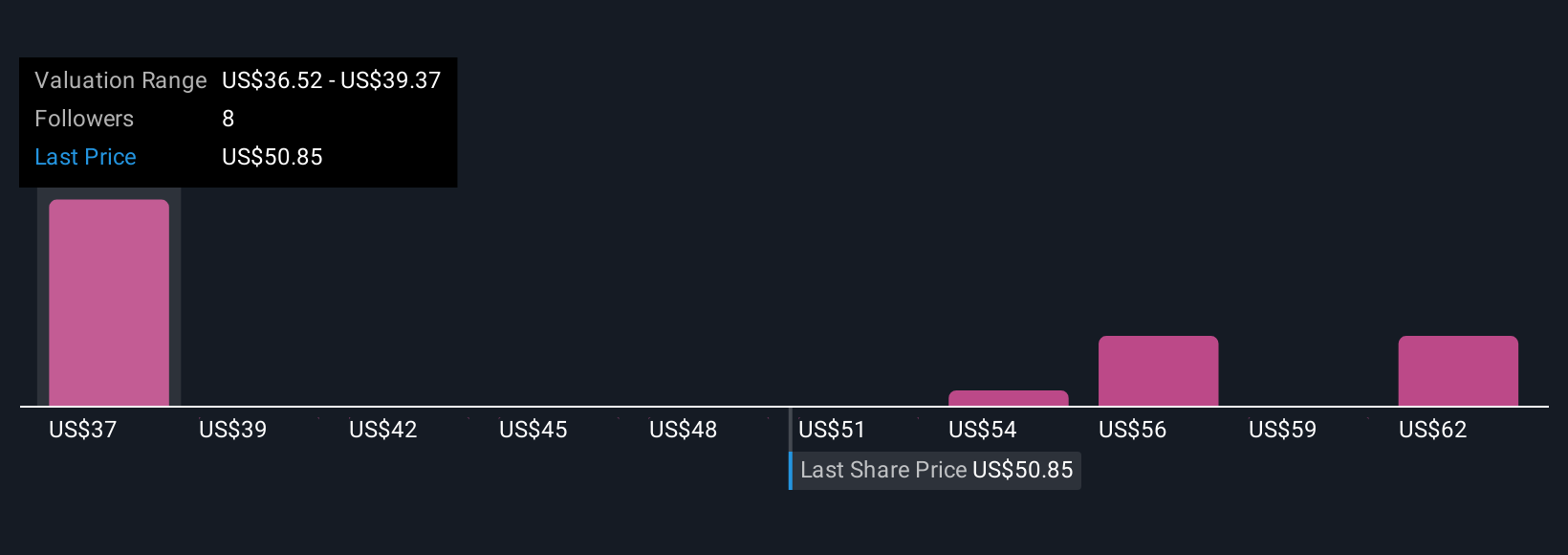

Fair value estimates for Bentley Systems from the Simply Wall St Community range from US$36.64 to US$65 across 4 perspectives. While some see upside tied to growth in recurring revenue, others caution about increasing SaaS competition threatening earnings quality and market share. Explore several viewpoints to inform your own thinking.

Explore 4 other fair value estimates on Bentley Systems - why the stock might be worth 29% less than the current price!

Build Your Own Bentley Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bentley Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bentley Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bentley Systems' overall financial health at a glance.

No Opportunity In Bentley Systems?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives