- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (BSY): Valuation Insights Following Strong Q3 Results, AI Progress, and New Expansion Partnership

Reviewed by Simply Wall St

Bentley Systems (BSY) delivered third quarter results that beat expectations, highlighted by strong subscription gains and operational improvement. The company is also advancing AI-powered solutions and expanding its SMB reach with a major new partnership.

See our latest analysis for Bentley Systems.

Bentley Systems’ strong Q3 results and strategic partnership headlines come at a time when the share price has given up some ground in recent months, with a 1-year total shareholder return of -3.3%. Despite this, the impressive 3-year total shareholder return of 22.4% shows that longer-term momentum is still intact as the company invests in AI-driven solutions and broadens its SMB reach. This hints at potential for renewed growth ahead.

If you’re interested in discovering more innovative software names gaining traction through technology and strategic moves, there’s a full list of standout digital and AI-driven companies to explore. See the latest with See the full list for free.

With shares currently trading at a discount to analyst price targets and backed by robust growth and ambitious AI initiatives, the big question is whether Bentley Systems is undervalued or if the market is already pricing in its next phase of expansion.

Most Popular Narrative: 19.8% Undervalued

With Bentley Systems’ narrative fair value of $58.21 versus a recent close of $46.71, the consensus indicates considerable upward potential, driven by structural sector shifts and operational momentum. Several catalysts and critical assumptions underpin the backdrop for this outlook.

Large-scale productivity challenges (such as the shortage of skilled engineers) are forcing the sector to accelerate digital transformation, elevating demand for Bentley's AI-driven, cloud-based, and digital twin solutions, which should drive both revenue expansion and higher-margin product mix.

Curious about what’s accelerating this compelling valuation? There is a key shift in how the sector is adopting new revenue and earnings models, one that could challenge everything you expect from traditional software growth. Want to find out which strategic assumptions boost Bentley’s future prospects? Unlock the full narrative for the numbers and rationale driving this bold fair value.

Result: Fair Value of $58.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including intensifying SaaS competition and potential business model disruption from new AI adoption across engineering markets. These factors could challenge this outlook.

Find out about the key risks to this Bentley Systems narrative.

Another View: Growth at a Premium?

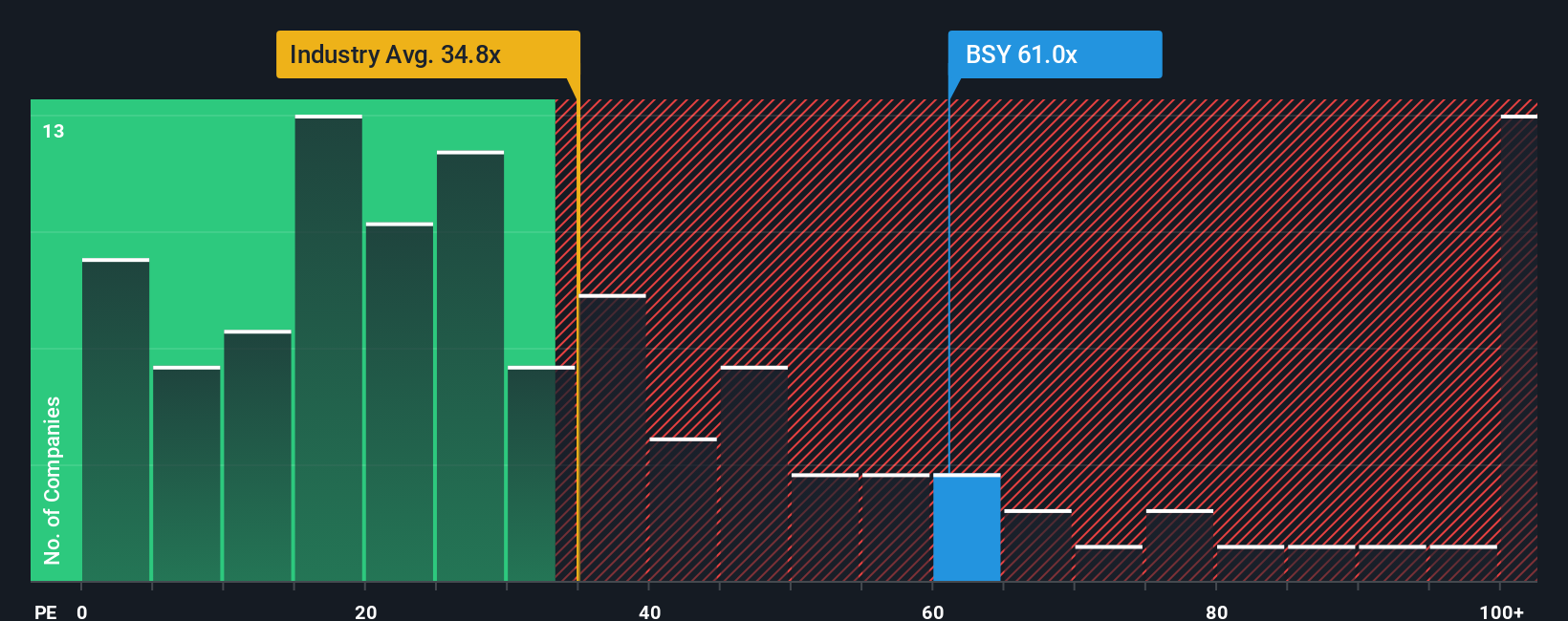

While the fair value narrative leans bullish, looking at Bentley Systems’ price-to-earnings ratio reveals a different angle. Trading at 54.5x, the company stands well above the US Software industry average of 33.5x and also above peers, with a fair ratio closer to 34.3x. This significant gap suggests investors are already paying a steep premium for future growth. Could this premium be justified if execution stalls, or does high conviction in Bentley's strategy warrant the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bentley Systems Narrative

If you prefer to dive deeper and shape your own perspective, you can analyze the numbers and craft your narrative in just minutes. Do it your way

A great starting point for your Bentley Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity slip by. Some of the market’s most exciting investments are just a step away with Simply Wall Street’s free screeners. Here are three standout ways to get ahead of the curve:

- Unlock greater growth potential by checking out these 25 AI penny stocks, which are redefining industries with cutting-edge artificial intelligence advancements.

- Boost your portfolio’s income by targeting these 16 dividend stocks with yields > 3% that offer reliable yields above 3% for steady, long-term returns.

- Seize undervalued opportunities now by scanning these 876 undervalued stocks based on cash flows and position yourself to benefit as the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives