- United States

- /

- IT

- /

- NasdaqGM:BLZE

Why Investors Shouldn't Be Surprised By Backblaze, Inc.'s (NASDAQ:BLZE) 28% Share Price Surge

Despite an already strong run, Backblaze, Inc. (NASDAQ:BLZE) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 43%.

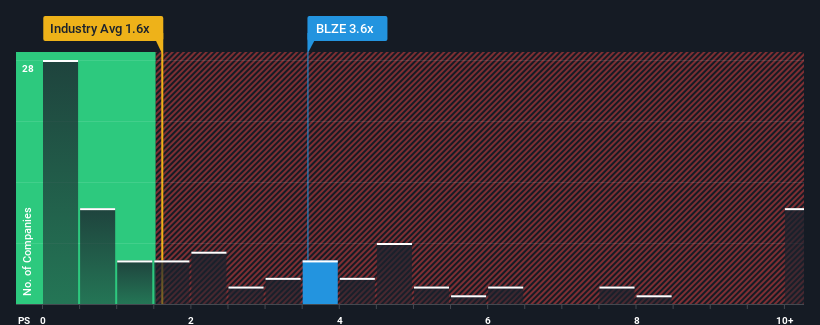

After such a large jump in price, given close to half the companies operating in the United States' IT industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Backblaze as a stock to potentially avoid with its 3.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Backblaze

What Does Backblaze's P/S Mean For Shareholders?

Backblaze certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Backblaze will help you uncover what's on the horizon.How Is Backblaze's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Backblaze's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen an excellent 79% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the eight analysts following the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this information, we can see why Backblaze is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Backblaze's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Backblaze shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Backblaze, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Backblaze might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:BLZE

Backblaze

A storage cloud platform, provides businesses and consumers cloud services to store, use, and protect data in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives