- United States

- /

- Software

- /

- NasdaqCM:BLIN

Improved Revenues Required Before Bridgeline Digital, Inc. (NASDAQ:BLIN) Stock's 27% Jump Looks Justified

The Bridgeline Digital, Inc. (NASDAQ:BLIN) share price has done very well over the last month, posting an excellent gain of 27%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

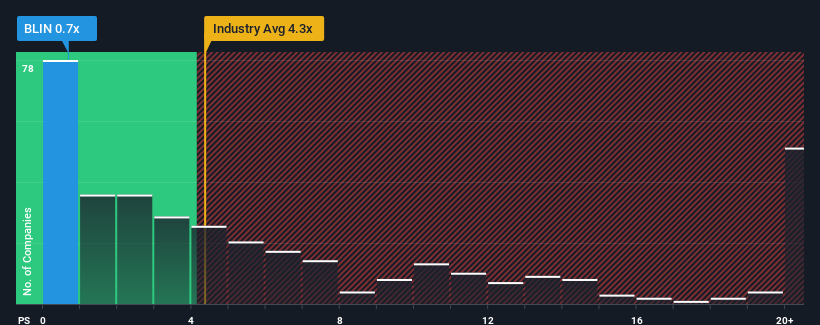

In spite of the firm bounce in price, Bridgeline Digital may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Bridgeline Digital

What Does Bridgeline Digital's P/S Mean For Shareholders?

Bridgeline Digital hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bridgeline Digital will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Bridgeline Digital's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 6.4% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 43% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 4.1% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

With this in consideration, its clear as to why Bridgeline Digital's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Bridgeline Digital's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bridgeline Digital maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for Bridgeline Digital (1 is a bit unpleasant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bridgeline Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BLIN

Bridgeline Digital

Operates as a marketing technology company in the United States, Canada, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives