- United States

- /

- Software

- /

- NasdaqCM:ARQQ

Arqit Quantum (NASDAQ:ARQQ investor one-year losses grow to 81% as the stock sheds US$40m this past week

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So we hope that those who held Arqit Quantum Inc. (NASDAQ:ARQQ) during the last year don't lose the lesson, in addition to the 81% hit to the value of their shares. That'd be a striking reminder about the importance of diversification. Arqit Quantum hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On top of that, the share price is down 20% in the last week. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 20% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Arqit Quantum

SWOT Analysis for Arqit Quantum

- Currently debt free.

- Shareholders have been diluted in the past year.

- ARQQ's financial characteristics indicate limited near-term opportunities for shareholders.

- Has less than 3 years of cash runway based on current free cash flow.

Arqit Quantum isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Arqit Quantum's revenue didn't grow at all in the last year. In fact, it fell 64%. If you think that's a particularly bad result, you're statistically on the money The market didn't mess around, sending shares down the garbage shute. (Or down 81% to be specific). Our mindset doesn't have a lot of time for stocks like this. A healthy aversion to bagholding (holding potentially worthless stocks) sees many shareholders avoid buying shares like this, rightly or wrongly.

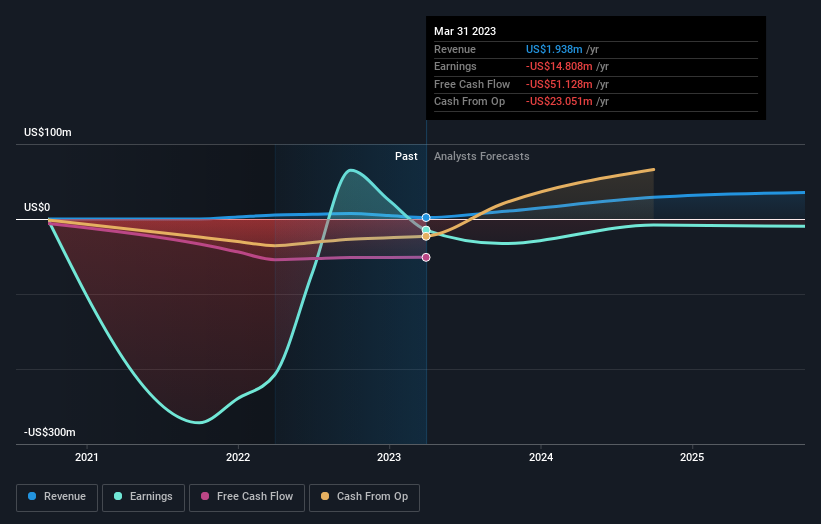

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Arqit Quantum stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 10% in the last year, Arqit Quantum shareholders might be miffed that they lost 81%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 1.7% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Arqit Quantum better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Arqit Quantum you should be aware of, and 2 of them are concerning.

But note: Arqit Quantum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ARQQ

Arqit Quantum

Provides cybersecurity services through satellite and terrestrial platforms in the United Kingdom.

Flawless balance sheet moderate.