- United States

- /

- Software

- /

- NasdaqCM:APPS

How Digital Turbine's (APPS) Raised Revenue Outlook and Board Changes May Shape Its Investment Story

Reviewed by Sasha Jovanovic

- Digital Turbine recently reported second quarter financial results, showing year-over-year revenue growth to US$140.38 million and a reduction in net loss to US$21.4 million, alongside raised revenue guidance for fiscal year 2026 to a range of US$540 million to US$550 million.

- This update also included the resignation of board member Mollie Spilman, who departed to pursue a senior executive role elsewhere, adding to the evolving leadership outlook at the company.

- To assess the implications of these developments, we'll examine how Digital Turbine's raised revenue guidance may influence its long-term investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Digital Turbine Investment Narrative Recap

To be a shareholder in Digital Turbine, you need confidence that its platform can keep expanding across global smartphones despite industry giants and regulatory hurdles. The recent earnings report, showing raised revenue guidance for fiscal 2026 and narrower losses, supports a constructive short-term catalyst of continued top-line improvement, while risks from heavy competition and data restrictions remain present. The news of a board member resignation does not materially impact the company’s execution or upcoming revenue drivers right now.

Among Digital Turbine's latest announcements, the raised revenue guidance to US$540 million–US$550 million stands out for its relevance, as it reinforces the key catalyst of growing device installations and broader advertiser appeal. This increased guidance reflects management’s confidence and may help frame investor expectations, even as sector competition intensifies and regulatory developments evolve.

But it's important investors are aware, in contrast, that continued dominance by larger tech ecosystems still threatens...

Read the full narrative on Digital Turbine (it's free!)

Digital Turbine's narrative projects $651.7 million in revenue and $85.3 million in earnings by 2028. This requires 9.0% yearly revenue growth and a $166.3 million increase in earnings from the current level of -$81.0 million.

Uncover how Digital Turbine's forecasts yield a $8.75 fair value, a 45% upside to its current price.

Exploring Other Perspectives

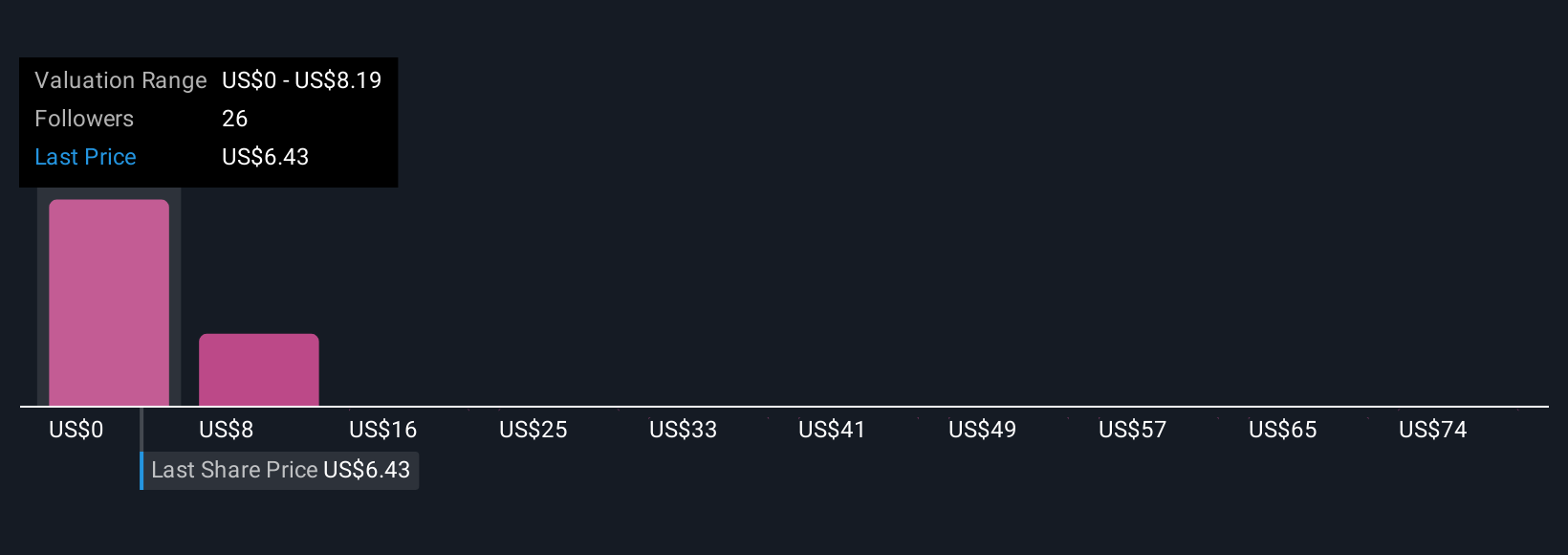

Sixteen members of the Simply Wall St Community estimate Digital Turbine’s fair value from as low as US$0.98 to as high as US$25 per share. Such varied opinions highlight sharply different expectations for growth, especially given current industry pressure from tech giants which could influence future relevance or market share.

Explore 16 other fair value estimates on Digital Turbine - why the stock might be worth over 4x more than the current price!

Build Your Own Digital Turbine Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digital Turbine research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Digital Turbine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digital Turbine's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:APPS

Digital Turbine

Through its subsidiaries, operates a mobile growth platform for advertisers, publishers, carriers, and device original equipment manufacturers (OEMs).

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives