- United States

- /

- IT

- /

- NasdaqGS:APLD

Will Applied Digital's (APLD) Aggressive Fundraising Redefine Its Long-Term AI Infrastructure Ambitions?

Reviewed by Sasha Jovanovic

- Applied Digital Corporation recently filed a US$342.6 million shelf registration for 15 million shares related to an ESOP offering and closed a previous US$196.83 million shelf registration, as part of its ongoing efforts to raise capital for data center development.

- This wave of capital raising, alongside significant debt financing and heightened options activity, underscores the company's accelerating push to support its AI infrastructure growth and signals strong investor engagement with its long-term ambitions.

- We’ll now explore how these expanded financing initiatives may shape Applied Digital’s investment narrative, especially as the company ramps up its AI data center buildout.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Applied Digital Investment Narrative Recap

The core case for Applied Digital hinges on belief in the multiyear, high-revenue potential of its AI data center buildout, enabled by long-term contracts with major hyperscalers like CoreWeave. The new US$342.6 million shelf registration and associated equity raises further fortify the company's cash position, but do not materially shift the key short-term catalyst: securing timely ramp-up of data center capacity tied to those large contracts. The biggest risk remains the company's elevated leverage and high capital needs, increasing pressure to meet utilization targets. Among recent developments, the US$2.35 billion senior secured note offering stands out for its significance. This influx of debt directly funds the rapid buildout at Polaris Forge, accelerating Applied Digital’s ability to deliver on its large leasing agreements while also increasing financial leverage and balance sheet risk, factors now sharpened by ongoing equity issuances to support capital needs. In contrast, investors should be especially mindful that even with new capital in hand, the concentration of revenue with a few hyperscaler clients leaves the company exposed to ...

Read the full narrative on Applied Digital (it's free!)

Applied Digital's narrative projects $755.7 million revenue and $102.2 million earnings by 2028. This requires 73.7% yearly revenue growth and a $263.2 million earnings increase from -$161.0 million.

Uncover how Applied Digital's forecasts yield a $43.70 fair value, a 89% upside to its current price.

Exploring Other Perspectives

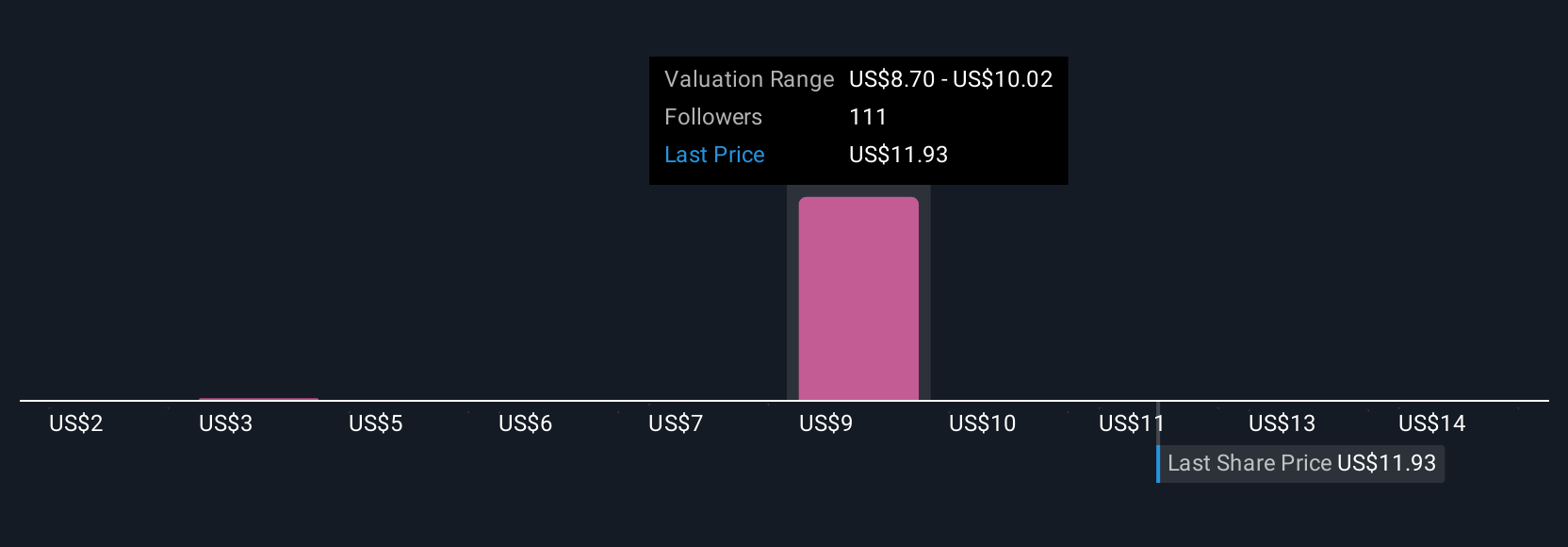

Fair value estimates from 32 Simply Wall St Community contributors run from as low as US$2.89 to as high as US$43.70. While you see this wide range, remember that recent capital raises have heightened balance sheet risk, sharpening the focus on the company's ability to deliver growth without missing utilization targets.

Explore 32 other fair value estimates on Applied Digital - why the stock might be worth as much as 89% more than the current price!

Build Your Own Applied Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Applied Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Digital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives