- United States

- /

- IT

- /

- NasdaqGS:APLD

Why Applied Digital (APLD) Is Down 7.1% After Announcing Multi-Billion Dollar AI Data Center Deal

Reviewed by Sasha Jovanovic

- Earlier this month, Applied Digital Corporation reported first-quarter earnings ending August 31, 2025, highlighting year-over-year revenue growth to US$64.22 million and multi-billion dollar long-term data center lease agreements with CoreWeave.

- This marks a significant shift as the company pivots from crypto mining to AI infrastructure, rapidly expanding its data center footprint to support new AI-focused tenants and long-term demand.

- We'll explore how the company's transition to AI infrastructure, anchored by its 15-year CoreWeave deal, reshapes its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Applied Digital Investment Narrative Recap

To be a shareholder in Applied Digital today, you need confidence that the company’s bold shift from crypto mining to AI infrastructure will deliver sustained revenue growth, and that major hyperscaler contracts like CoreWeave’s 15-year lease can offset ongoing operational losses and customer concentration risks. The latest earnings news, marked by robust revenue growth and continued losses, keeps the spotlight firmly on new AI campus launches and the success of long-term leases; these factors remain the key short-term catalyst and risk, respectively.

Among recent company announcements, the new $11 billion lease with CoreWeave is especially relevant, cementing Applied Digital’s move into long-term, recurring revenue streams, an important validation for those tracking its data center expansion narrative. This agreement may help address some earlier concerns about reliance on volatile crypto segments, but the company’s financial leverage and capital demands continue to warrant attention.

But as ambitious as these expansion plans appear, investors should also be aware of the potential risks surrounding...

Read the full narrative on Applied Digital (it's free!)

Applied Digital's outlook projects $755.7 million in revenue and $102.2 million in earnings by 2028. This is based on a 73.7% annual revenue growth rate and a $263.2 million increase in earnings from the current -$161.0 million.

Uncover how Applied Digital's forecasts yield a $27.00 fair value, a 17% downside to its current price.

Exploring Other Perspectives

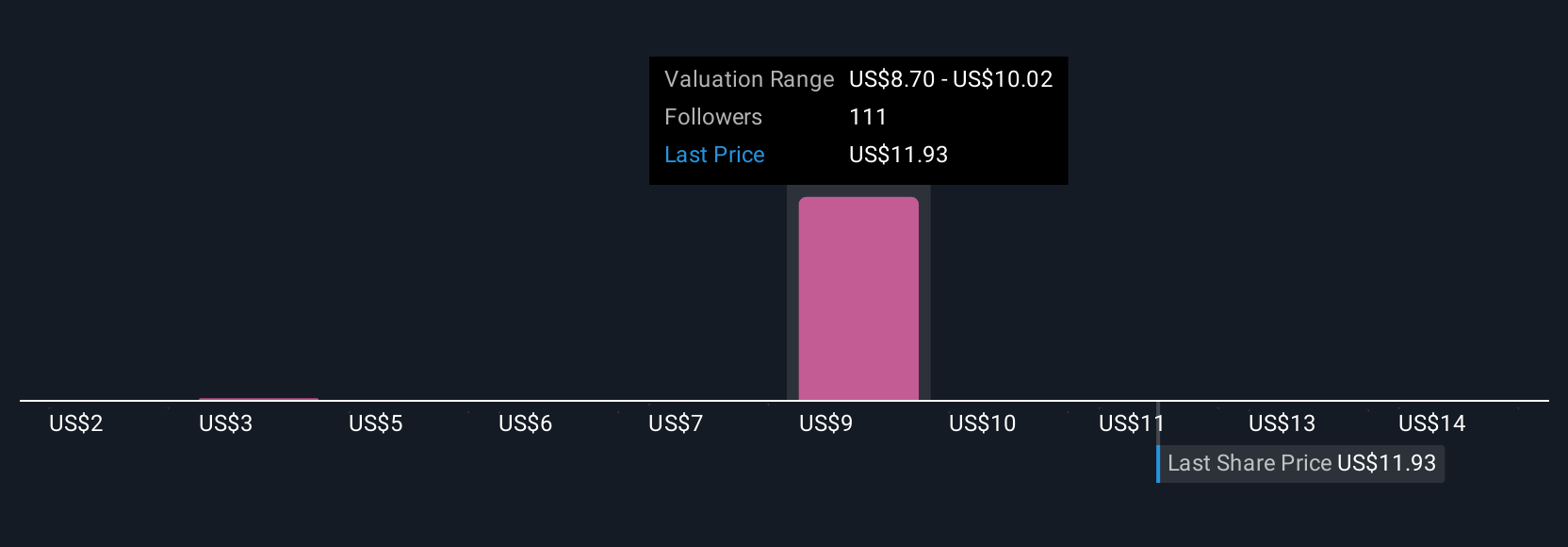

Fair value estimates from 28 Simply Wall St Community members for Applied Digital range from US$2.89 to US$27 per share. While expansion into AI data centers is fueling strong revenue growth, concentration risk with a few hyperscaler clients remains a major factor you should weigh as you consider the range of opinions.

Explore 28 other fair value estimates on Applied Digital - why the stock might be worth less than half the current price!

Build Your Own Applied Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Applied Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Digital's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion